Technical analysis remains an integral part of the stock market as it is a pictorial representation of price movements that helps investors understand the market reactions. Today, we will find a market analyst using the Japanese candlesticks as a tool to analyse the market, but few know that the foundation of technical analysis was initially laid by Charles Dow.

The Dow theory

The Dow theory was founded by Charles Dow, the creator of the world’s first-ever market index – the Dow Jones Industrial Average (DJIA) – and the father of modern technical analysis. The index was developed with the intent of measuring the movement of the US stocks. Charles Dow was the founder of Dow Jones and Company, and the first editor of the Wall Street Journal.

The theory explains how the stock market can be used by investors to determine the health of the business environment. Dow’s theory was the first to state that the market functions in trends. Though many new market theories and tools have emerged now, the six basic tenets of his theory are still relevant.

How does the Dow theory work?

There are a total of six tenets that form the core of Dow theory’s modern technical analysis

- The market discounts all news

The first tenet explains that any external condition such as a new political move, new policies, consumer sentiment, earning announcement by companies, variation in inflation, etc. already is reflected in the price of stocks and indices except for the information on natural calamities. Therefore, investors should not take impulse decisions based on the news and rumours.

‘‘

The Dow theory was founded by Charles Dow, the creator of the world’s first-ever market index - the Dow Jones Industrial Average (DJIA) - and the father of modern technical analysis.

The market has three trends namely

Primary trend: It is the major trend that shows how the market progresses in the long term. A primary trend can span many years.

Secondary trend: These are trends that work opposite to the primary trend and are said to be corrections. For example, if the primary trend is moving upward, the secondary trend is downward which can last for a few weeks or months.

3. Minor trends: These are variations to the market movement daily, which last less than 3 weeks and go against the secondary trend. Dow has suggested to not consider minor trends since the fluctuations are a result of market news and rumours.

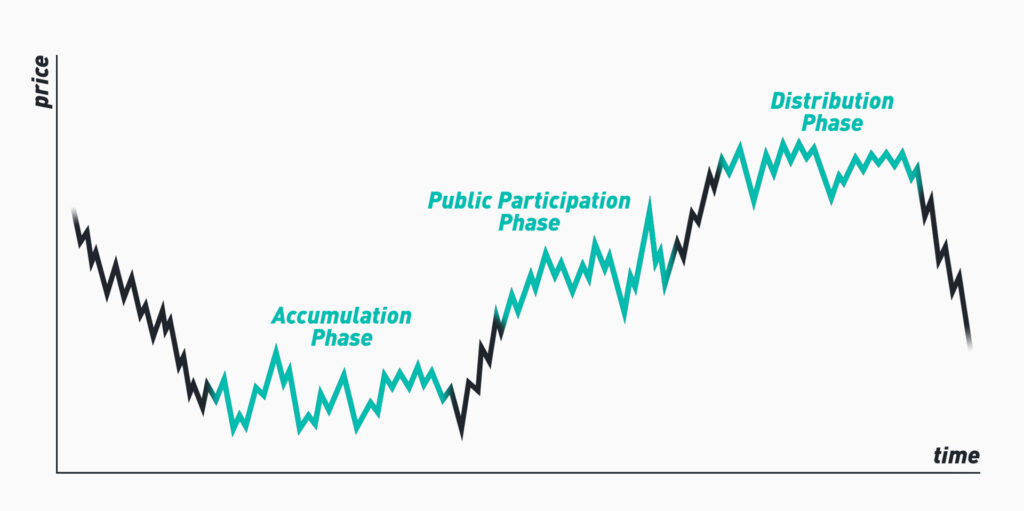

A trend has three phases

This tenet of Dow theory states that there are three phases to a primary trend that is self-repeating.

- Accumulation phase:

This phase occurs after a steep fall in the market over the past 6 months. Investors might be losing hope of any uplift in prices. The accumulation phase occurs when there is a beginning of primary upward or downward trend in a bullish or bearish market. In this phase, institutional investors such as mutual funds, pension funds, and large banks – buy up substantial shares of a given stock. Here, the price forms a base as the shares of stock are accumulated.

- Public Participation phase:

In this, the improvement in market conditions and positive sentiments drives more investors to purchase more stocks. It is the longest phase with large price movements.

- Distribution phase:

In this phase, the investors sell their stocks anticipating the market decline. In this stage, investors book profits and exit.

Indices should confirm each other

The market behaving bearish and bullish should not be verified by a single index. All the indices should indicate the same. For instance, in the case of bearish trend, Nifty large-cap, Nifty mid-cap, and Nifty small-cap should move in the downward direction. Any deviation in the indices can happen due to speculative or corrective moves.

Trends should be confirmed by volume

An ongoing trend will be confirmed with its trading volume. If the trend is upward, the trading volume rises with a price increase and falls with a price decrease. In a downward trend, the volume of trading should go down with a price decrease. If the trend is downward, the volume increases with a fall in price and decreases with a price rise.

Until there are clear signs of reversals, the trend should continue

One should keep on trading in the ongoing trend unless there are signs of reversals given by technical tools and indicators. Here, the reversal is when the direction of a price trend has changed, from going up to going down, or vice-versa.

Determining trends using Dow theory

Dow always believed that the closing price of stock sets the pace for the trend and not the minor intraday movement. When the trend moves horizontally or sideways, the price varies within a range. Once the range is broken, it can result in greater movements. Till then, the traders should wait for the price movement to break the trend line and should not jump to the conclusion of the trend going upward or downward.

The peak and trough analysis in Dow theory helps to identify trend deviation or reversals. A peak occurs when there is the highest price in the market movement and a trough is the lowest price of a market movement. An upward trend is a series of successively higher peaks and higher troughs. A downward trend is a series of successively lower peaks and lower troughs.

Lastly, every investor must understand the Dow theory to identify the hidden trends and make informed decisions before selling or buying stocks.