The origin of India’s derivative market dates back to 1875 when the Bombay Cotton Trading Association first began trading and by 1900, India became the world’s largest derivatives market.

But what is a derivative market?

A derivative is a financial contract between one or more sellers where the trading amount is dependent on the value of assets such as stocks, bonds, commodities, currencies, and market indices. Stocks, bonds, and market indices are known as financial derivatives, and gold, silver, food grains, and crude oil are commodities. The value of the financial contract or derivative is derived from the value of its underlying asset.

Let us understand this with an example.

Suppose a person named B, wants to book an IPL ticket for the front row. But on reaching the booking counter, he finds that all the front row tickets are sold. Moreover, other tickets were expensive now. His friend who works with the Cricket Board, on learning the situation, assures him of the availability of a middle row ticket for which booking will begin after four days. B’s friend hands him a letter that promises B to purchase the ticket at Rs 2000 irrespective of the ticket’s price at that time which may increase due to high demand.

As expected, the demand causes the ticket value to rise to the price of Rs 4000, but due to the letter, B can purchase the ticket at Rs 2000, giving him 50 percent profit. This also means that the value of the letter is Rs 2000, which is the profit.

Now, due to some reason B met with a small fracture due to which he cannot collect the ticket at the said date. The catch here is that since the said date has passed, he will not get the ticket priced at Rs 2000, and the letter provided by his friend holds no value now.

In this case, the letter was the derivative or in simpler terms a contract whose value was dependent on the ticket. So, the ticket is the underlying asset and the derivative is the ticket.

Similarly, in real life, petrol and diesel are derived from crude oil. Crude oil is the underlying asset and petrol and diesel are derivatives. A price change in crude oil will simultaneously impact the price of petrol and diesel.

‘‘

A derivative is a financial contract between one or more sellers where the trading amount is dependent on the value of assets such as stocks, bonds, commodities, currencies, and market indices.

What are the types of derivatives?

Derivatives can be classified into four types :

Option: It is a financial contract that allows the buyer to buy or sell an asset at a specific price during a specific period. However, in an option contract, the advantage lies in its flexibility that allows the trader to decide whether to purchase the asset or not at the said time. For instance, in the above example – Had B signed an option contract with his friend, then he could have avoided purchasing the IPL ticket at that date since he met with a fracture.

Future: Future is a financial contract that allows the trader to buy or sell an underlying asset at the agreed price mentioned in the contract at the said time. Here, the only difference that lies between future and option is that the trader cannot step down to purchase the assets. He has to purchase, irrespective of favourable market prices. Taking the same example, had B signed a futures contract with his friend then he would have to purchase the ticket for Rs 2000, even if he is not able to attend the IPL finale due to his broken leg. He is obliged to carry out the contract as agreed. Sadly, B in this has made a loss of Rs 2000.

Forwards: Similar to future derivatives, the trader is obliged to perform the contract with the only difference being that forwards are not standardised and not traded on stock or derivative exchanges. In this type, the chances of sellers or traders turning down the contract become high when the market price does not favour them. Had this been a future contract, and by chance, the seller or trader does not perform the contract then the risk is borne by the derivative exchange. As the contracts are not bound by a regulatory body’s rules and regulations, they are customisable to suit the requirements of both parties involved.

Swaps: Involves two parties where the exchange of cash flows or liabilities takes place from two different financial instruments. Most swaps involve cash flows based on a principal amount such as a loan or bond. Interest rate swaps are the common swaps contract that takes place. They are not traded on stock exchanges and are over-the-counter contracts between businesses or financial institutions.

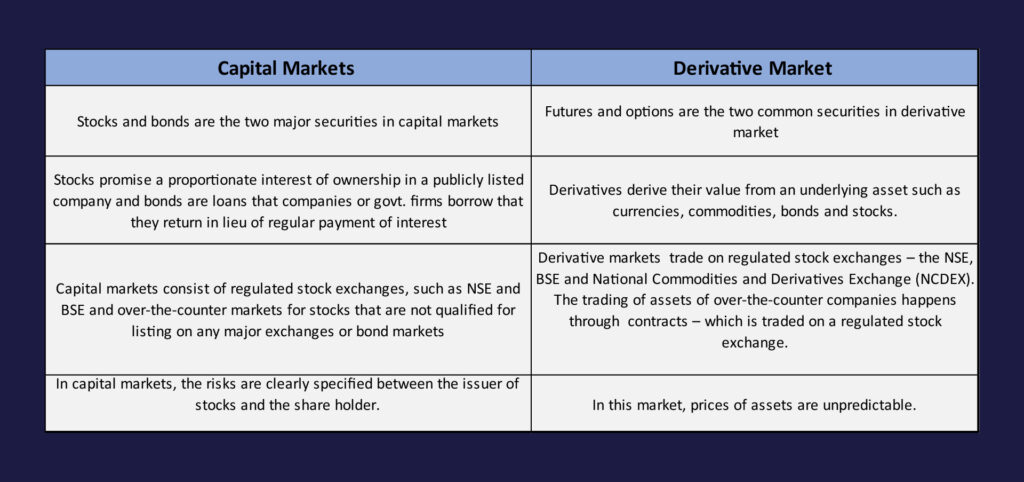

What is the difference between capital and derivatives markets?

Though in both capital and derivative markets both small and big businesses intend to raise capital, few know about the difference between the two.

Which body regulates the derivatives market?

In India different derivative instruments are regulated by various bodies such as commodity derivative market in India is regulated by Securities and Exchange Board of India (SEBI), and RBI regulates the interest rate derivatives, foreign currency derivatives and credit derivatives.