Options and Futures are the tools used by investors when trading in the derivatives market. Derivative here refers to a financial contract whose value is dependent on underlying assets or stocks.

In both these tools, a financial contract between the buyers and the seller is involved that allows the buyers to derive profits from an underlying asset such as shares, stock market indices, electronic trading funds (ETFs), etc. Here are some of the key differences between the tools.

What is Future?

A Future is a financial contract that allows the buyer to bet on the future price of an underlying stock or commodity. Traders, after betting, have to buy that stock at the time of delivery. There are many types of futures contracts available, on assets such as oil, stock market indices, currencies, and agricultural products.

Let us understand this with an example.

Say a trader wants to speculate in the price of crude oil by entering into a futures contract in January with the anticipation that its value will surge in December. Currently, the December crude oil futures contract is trading at $40 a barrel. Oil is traded in the quantity of 1000 barrels which means the total amount traded will become $40000 ( 1000 X $40), but first, the trader will only pay the initial margin. Suppose the oil prices at the end of the year increase and now the new price per barrel is $ 50 and the trader sells the future contract to exit. Now, the difference between the previous and current oil barrel price is $10 ( $50-$40) where the trader earns $10000 ( 1000 X $10) as profit. Had the price of an oil barrel fallen to $20, then the loss would have been – $20000 ( 1000 X $20 {$20-$40}) in which the trader has no other option to buy the oil, thus giving losses.

‘‘

IOptions and Futures are the tools used by investors when trading in the derivatives market. Derivative here refers to a financial contract whose value is dependent on underlying assets or stocks.

What is Option?

An option is a financial contract that offers buyers the opportunity to buy or sell an underlying asset at a specific price on or before a certain date. Here, the buyer is not obligated to buy or sell the asset if they decide against it. Within option, there are two alternatives:

Call: It gives the holder the right to buy a stock

Put: It gives the holder the right to sell a stock

Let us understand option with an example-

Suppose we are interested to invest in stocks whose price is Rs 2000, and after a month we bet the stock’s price to be Rs 2150, for that, the company asks to pay a margin of 10% i.e. Rs 200. But, let us say after a month when stocks are issued, the price becomes Rs 2500. So, the buyer who earlier paid the margin amount of Rs 200 and bet the stock price to be Rs 2150 will now buy it at Rs 2350 (2150+200). Therefore, a stock priced at Rs 2500 will be available at Rs 2350. But, in case if price falls the buyer can choose not to purchase the stocks as it will attract losses but will have to bear a small loss of Rs 200 which is the margin amount paid.

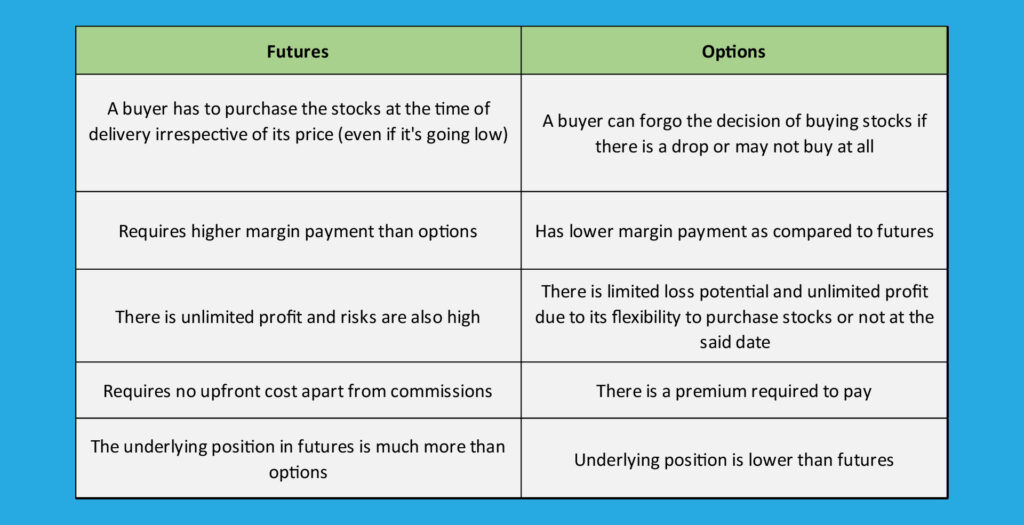

The Difference – Options vs Futures

Things to keep in mind for investors before investing in options and futures

Here are some of the tips to keep in mind for investors, as trading in options and futures (or in the derivatives market) is similar to trading in the stock market.

Maintain a margin amount

The margin amount while trading in options and futures markets should always be kept in store. As per the stock market rules, investors need to continuously maintain a margin amount i.e. one cannot withdraw this amount from trading account at any point in time till the trade gets settled.

Tab on budgets

While trading in options and futures market, a trader must pick stock and their contracts based on four things:

- Amount in hand

- Margin requirement

- Price of underlying assets or stocks

- Price of contracts