The term unicorn was coined in 2013, by Aileen Lee, founder of Cowboy Ventures, to refer to technology start-ups with valuations over US $1 billion. At that time there were 39 unicorns in the US and none in India. India today has a total of 50 plus unicorns, the third largest number in the world after the US and China. However, firms like Ola, Flipkart, Lenskart, Nykaa, UrbanClap, Paytm and Zomoto make the journey look easy. There are a number of firms that have struggled to scale-up the founder’s visions or the market’s expectations.

Let’s study the journey of some of these companies, each of which have done many things right, but have taken a few marketing missteps that they have then had to pivot to recover. As we investigate these stories, perhaps there are learnings for other entrepreneurs to learn as they navigate their own passion projects.

‘‘

The legend goes that the inspiration for Paper Boat came from the flask of Aam Panna, Suhas Misra's mother would pack for him every day.

Hector Beverages

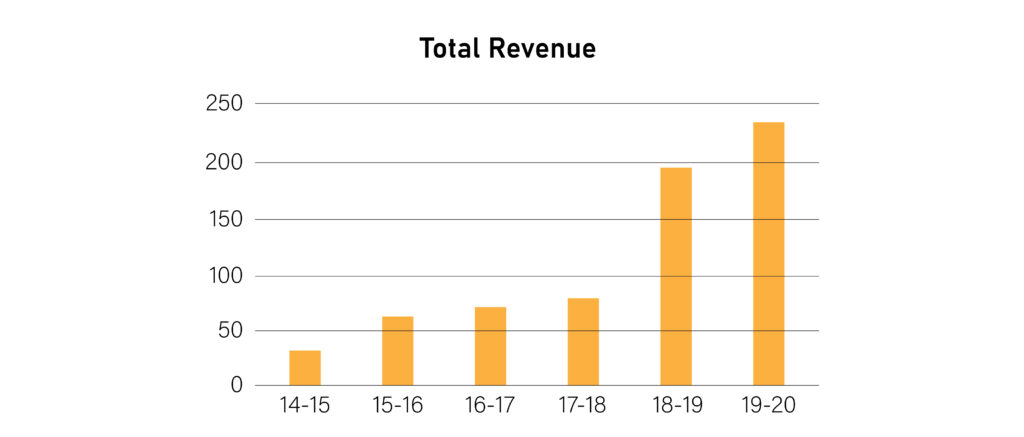

Paper boat is one of the companies that have caught the imagination of consumers and investors alike. They have had years that have been extremely successful and a few in which the market questioned if the growth story has come to an end.

Hector Beverages was founded in 2009 by Neeraj Kakkar, Suhas Misra, Neeraj Biyani and James Nuttall. Today Neeraj Kakkar and Neeraj Biyani run the show after Suhas and James decide to exit the company.

The company started operations with Frissia (protein water) and later Tzinga (energy drinks) but later smartly pivoted to their third venture Paper Boat. The legend goes that the inspiration for Paper Boat came from the flask of Aam Panna, Suhas Misra’s mother would pack for him every day.

The company started its operations through the Manesar Plant and subsequently roped in its first investors in 2011 including Catamaran and Foot print. The next reached out to Elephant Design that helped them both with the naming as well as pack design leading to the launch of ‘Paper Boat’ in 2013.

The Brand saw strong initial success and they quickly expanded to a second factory in 2014, which was their Mysore plant with a speed of 380 bottles/minute versus 80 bottles/minute in the Manesar Plant, along with the capabilities for coconut water and sugar cane juice.

From 15-16 to 17-18 the Brand kept its focus on three key levers of growth:

- Brand Building: They launched Paper Boat with a novel purpose of trying to preserve traditional recipes that go back thousands of years, and were handed down from one generation to another, in a modern form. On this Brand core they invested aggressively in digital engagement and also launched a TVC on main line television.

- Innovation: They launched a slew of products including more than 11 types of ethnic drinks and juices: Jal jeera, aam panna, aam ras, alphonso aam, jamun kala khatta, chilli guava, nimbu pani, kokum, neer more, kanji, sugarcane juice, lychee ras, apple and orange.

- Distribution Expansion: They also partnered with the Japanese food giant Indo Nissan Foods to strengthen its distribution and brand presence in tier II cities and rural markets.

However, while all three strategies are based on sound business fundamentals, their premium pricing of Rs 30 for 200 ml proved to be an impediment to scale growth and their turnover appeared to stagnate at under 100 Cr.

As a result, the analysis, started to question if the product and packaging novelty has worn off and has the impact of competition in the form of Daburs Hajmola Yoodley, B Naturals Zero Concentrate Promise and the entry of Coke and Pepsi into healthier beverages started to make its impact on the major.

The company pivoted smartly again and has launched a mega push in the last couple of years into several mainstream categories:

- Paper Boat Swing at much affordable prices of Rs 10 for 150 ml

- Juices in Tetra Pack at Rs 130 for 1 Ltr

- Dairy Beverages like Lassi, Thandai etc

Their largest gamble to date is the entry into traditional Indian snack-based products like Peanut Chikki, Banana chips, Aam papad, Bakarwadi, Namak para, Gur para and Shakar para.

The key challenge that the expansion of such a wide portfolio would be Brand stretch. However, what appears to be helping the majority is the fact that the Brand has been based on an emotional promise of ‘nostalgia’, rather than a functional promise and that appears to be assisting them, despite sharp reduction in advertising investments every subsequent year. And the second is distribution expansion where the partnership with Indo Nissan foods only took them to 100,000 outlets. They have now started investing in their own field force to expand to 250,000 outlets and are now targeting 350,000 outlets.

The key thing on the mind of the founders now appears to be an IPO to continue to fund their expansion as they make steady steps towards profitability.

‘‘

Mounting losses, restless investors and the pandemic eventually led to the firm being acquired by Wingreens Farms. Raw Pressery business has picked up substantially post the acquisition by Wingreens Farms.

Raw Pressery

Raw Pressery and Wingreens Farms are two Sequoia Capital backed food start-ups which have boasted of innovative food products capturing the imagination of the growing millennial audience. Interestingly the learnings that we take from the challenges these firms have faced very closely mirror what Paper Boat taught us. Let’s now investigate their journey.

Raw Pressery was founded by Anuj Rakyan in 2013-14, with the dream of preparing cold pressed juices at a shared kitchen in Mumbai. He wanted to deliver these juices directly to the customer daily, by utilizing spare time of Mumbai’s daddawalas.

The original insight for the Brand emerged when Anuj Rakyan suffered a back injury playing football. He wanted to heal himself naturally without surgery through rest and nutrition. He made juices at home, but realised that something equally good was not available on shelves. He realised that there was an opportunity for a clean label product with only goodness inside and nothing else.

It was indeed an inspiring vision, and enabled him to take the brand across 15 cities in the country.

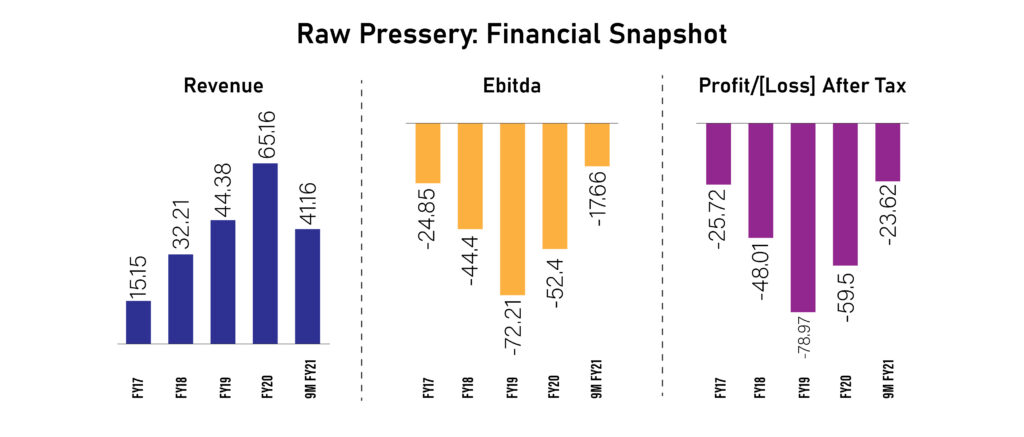

This allowed the brand to scale-up to a business of 65 Cr 2020 however they retained very high operational expenses and hence a loss of almost 60 Cr. In chasing their vision, the company made several logical pivots. The first was the realisation that while a few core consumers may take subscriptions, a large part of the business is going to remain offline. So, despite a very premium product, the online share of the business in 19-20 was only 10%, however the bulk of their business came from airports (30-35%) and organized modern trade stores like Food Hall and Reliance (50%).

Next, the group believed that the product should do the talking for them and they kept their advertising expenses persistently low at 30% in the initial years and under 10-15% by 2020. Their biggest challenge with the low shelf life of the products and the very expensive cost of refrigerated logistics. Though investments in technology were able to expand their shelf life quite substantially, logistics remained a persistent challenge. The softer challenge that the organization was not able to solve was the high cost of employees which accounted for as much as 40% of their top line. The equivalent numbers in scale firms are between 4-5%. These challenges could only be solved by expanding their range into products with a more affordable entry price and a range which holds its core promise of goodness but can move into the non-refrigerated aisle. And hence in Oct’18 the company expanded into Almond Milk at a pricing of Rs 80 – Rs 200. By Nov’19 they launched Coconut water with a pricing of Rs 50- Rs 60 and by Dec’20 into High Protein Smoothie.

By 2020, the contribution of these businesses was 40% for Cold Pressed Juice, 10% for Dairy, 35% for Coconut Water & 15% for Almond Milk. However, these initiatives only increased the dependence of the company towards offline channels and as the pandemic hit the company could only increase their business contribution from D2C to 15% and modern retail then accounted for 80% of their business. The lucrative Airport channel which was the backbone of their business could only account for 5% of their business. Mounting losses, restless investors and the pandemic eventually led to the firm being acquired by Wingreens Farms. Raw Pressery business has picked up substantially post the acquisition by Wingreens Farms. Let’s understand Wingreens business model a bit more to understand the synergies that have kicked in for both the companies.

Wingreen Farms

Wingreens Farms was incorporated in 2011 by Anju Srivastava and Arjun Srivastava. The products of the firm include dips, spreads, sauces and bakery products. The couple was working in the US for several years advertising and marketing and decided to return to India. They were taken aback by the condition of farmers in the country and the company was originally christened as WIN (Women Initiative Network) in Gurugram in 2008 with a capital of Rs 10 Lakh.

The initial idea was to work with farmers who had land but no money. The business model was to rent out land and pay the farmers the same both for renting the land and also as salaries for the women working in the company. In 2008, Anju started growing potted herbs in a half acre of farmland that she rented from the farmers in Tauru village, Haryana. She grew varieties of basil, thyme, oregano, peppermint, and other herbs for sale. However, she struggled in the initial years due to the extreme weather conditions in northern India.

She finally tasted some success in 2011, when Anju made pesto out of the basil she grew, and approached Spencer’s in MGF Megacity Mall, in Gurugram. The plan was to allow customers to taste the pesto, however they didn’t have any pasta and hence used chips. To their surprise customers showed good acceptance for the product as a dip. Following the successful launch of pesto as a dip, WIN was rebranded as Wingreens Farms, and the company then went on to launch 150 variants in 50 SKUs including, chipotle sauce, fiery desert mustard dip, dill tzatziki, peri peri hummus, rosemary hummus, peppermint with green tea leaves dip, etc.

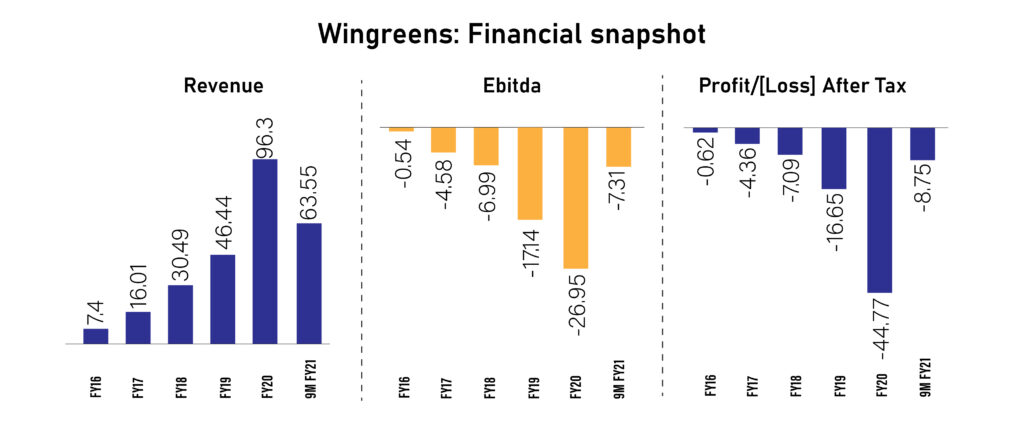

Within a span of 8 years, the brand has built a presence in 1300 Modern trade stores and 9,000 general trade stores across 140 cities across India. The company has plans to expand its distribution network to over 200 cities, over 2000 modern trade stores and over 1 lakh general trade stores over the next year. They also plan to extend their portfolio to 220 products across the range of dips, spreads, sauces and bakery products.

Despite accessing good funding from the market Wingreens has managed to deliver a far more sustainable business model. The pandemic has been an issue and an opportunity for the company. At one end the cost of business escalated, on the other the consumer was actually drawn to better cooking because of the rise of in-home dining.

However, all in all the acquisition of Raw Pressery has been a big opportunity towards the sustainability of both companies due to the following reasons:

- Raw Pressery and Wingreens Farms have a complimentary set of products with little overlaps giving the combined entity the right to build a Holistic Food and Beverage company that is structured as a House of Brands.

- Both company portfolios have a presence in the refrigerated isle and the sampling and activation infrastructure of both companies can be synergized.

- Further promoters believe that combining both portfolios should help them reduce their logistics and transportation costs by half.

- Also, with the enviable portfolios of both companies there is an opportunity to negotiate better with retailers when it comes to shelf space and commissions.

- And finally, most importantly, a strong portfolio combined with significant distribution heft is the magic formula for success in the Indian landscape.

There is a lot to learn from the three Brands that we have investigated, Paper Boat, Raw Pressery and Wingreens Farms. However, the key learnings can be gleaned in the form of the following steps and missteps that entrepreneurs should factor in their plans.

First, as entrepreneurs seek to launch innovative offerings in the Indian market, there remains a large role for storytelling and Brand building. This is something Paper Boat did very well. A large part of the allure of their 3rd product after Frissia (protein water) and Tzinga (energy drinks) was Paper Boat. And the platform of Drinks and Memories allowed them an opportunity to charge a premium and hence build a product that can be fuelled with advertising to command a premium. Perhaps this is where Raw Pressery missed a trick. While a clean label positioning is strong. It would have taken a while to catch up with the consumer.

Secondly, entrepreneurship is not for the faint hearted and business pivots are a part and parcel of the game. Hector beverages showed their resilience in reinventing themselves time and time again. This was perhaps something Raw Pressery took a little longer to do.

Thirdly, distribution expansion alone doesn’t ensure top line growth as Hector Beverages learnt the hard way in the period between 15-16 and 17-18. It has to be complimented with an accessible portfolio and the right branding strategy.

Fourthly, it’s critical to marry your business opportunity with consumer expectations, as Wingreens Farms learnt to their delight, almost by accident when they uncovered the opportunity for a dips market.

Fifth, as one discovers a significant business opportunity, it’s critical to make infrastructure investments to improve technology and set up factories; however it’s critical to keep a keen eye on cash burn and operational profitability. Solving for the right supply and logistics costs, employment costs and marketing spends is critical to build confidence with investors as Raw Pressery learnt to their peril.

Lastly, it’s important to start one’s business through a pilot mode across limited markets or channels, however the final path towards profitability in a market such as India, depends on building a robust distribution infrastructure for expansion.