Indians across generations and geographies whether salaried or self-employed, young or old, rich or poor share a dream of owning a home. Ownership of a home remains a part and parcel of our national identity, social standing, personal achievement and security. It is, arguably, the single topmost dream of an average adult in India. At the same time, we cannot overlook the new fad of the new generation considering ownership of a house as an unwanted and avoidable burden and instead opting to live in a rented house.

Home, an average Indian’s topmost dream!

Till a few years back, say before 1990, people used to plan to own a house only post retirement using their savings, provident fund, gratuity, and other retirement benefits and corpus. Those were the days when home loans were unheard of in India. The financial market and banking products have undergone a lot of changes particularly post the economic liberalisation of the ‘90s.

Home loans have become easily available at low-interest rates, and in easy instalments and people have started opting for EMI in place of rent thereby owning houses at their early age. Almost all the commercial banks, both public and private sector, NFBCs and financial institutions like LIC have exclusive home loan arms or subsidiary companies under them.

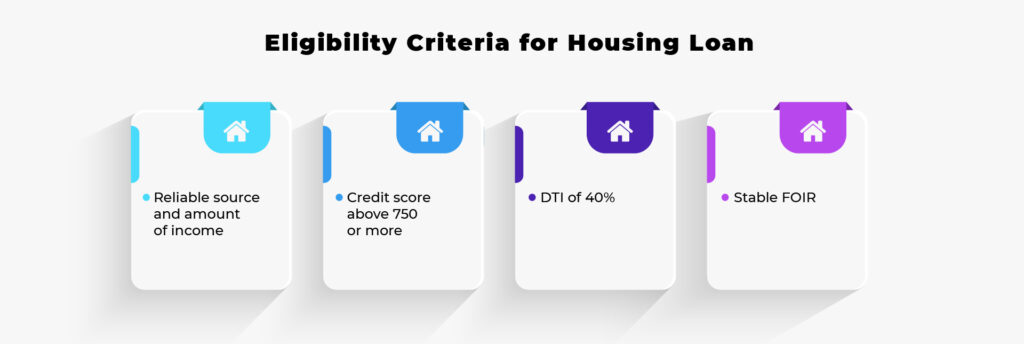

The dream for houses and home loans have become an integral part of most of India’s adult population. However, home loans do not come that easily. Banks do proper due diligence before approving loans to ensure that their loans do not become NPAs and unrecoverable. The basic criteria that home loan companies evaluate are whether the applicant has recurring disposable income and will be able to pay EMI without default.

From the applicant’s perspective, factors such as interest rates and the loan amount will influence your choice between different loan products in the market. At the same time, multiple factors determine your eligibility for the loan. The importance of paying attention to these factors cannot be stressed enough, for they determine whether your loan application will be approved, how fast your loan application will be processed, and the amount, terms and tenure of the loan.

‘‘

Home loans have become easily available at low-interest rates, and in easy instalments and people have started opting for EMI in place of rent thereby owning houses at their early age.

How to plan a home loan?

Here’s looking at some of the top things that you must keep in mind when applying for a home loan to get the best deal and its smooth processing.

Type of employment

You can avail of a loan of up to 80 per cent of home value with most home loan companies. If you are a salaried individual, lender institutions review your net salary to evaluate your loan application for its eligibility, tenure and loan amount. A good rule of thumb that can give an indicator is to compare your EMI-to-net income ratio. If your salary falls under the INR 25,000-40,000 per month bracket, your EMI should not cross 50 per cent of your income. If it is more than INR 40,000, then the EMI should not exceed 65% of your income.

Housing finance companies calculate your loan repayment capacity by relying on your salary slip for the last six months. They also take into account your credit history, details of existing debt and EMIs, and your bank statements. The evaluation also factors in your Form 16 filing ( for the authenticity of income) for the last two years and 26AS (as a counter check from TDS) statement for two years. The number of family members who are dependent on you is also considered during the evaluation of your eligibility for the loan.

If you are self-employed, it would get a bit tougher for you. The risk perception regarding self-employed professionals is greater because lenders usually look for financial stability, the repaying capacity of the borrower irrespective of which profession is being done or carried out by you before approving the loan. Being an entrepreneur, particularly of an early-stage startup, your ability to generate income is a crucial factor in becoming eligible for a home loan. However, there are a host of options available today when it comes to availing loans, especially with the rise of new-age financial institutions that are keen to tap into this underserved market.

Now, with the technology available to evaluate loan applicants’ profile, things are improving for the self-employed. Lenders are looking to tap an under-served market like that of self-employed. The demand for home loans from the self-employed segment is growing across cities. So, now we have several housing finance companies offering home loans specifically designed for the self-employed. The loan tenure is also enhanced for those with their own business.

A good credit score is crucial

The importance and need of good credit score history cannot be overstated for anyone applying for a loan, whether salaried and self-employed professionals. Financial companies evaluate your entire credit report to establish your creditworthiness, which determines the loan amount, duration and interest rate. Your credit score, also known as the CIBIL score helps the lender to review aspects such as your previous loan repayment behaviour and history of credit card dues or delay or defaults in payment, etc. Your CIBIL score gets better if you clear your dues (such as postpaid telephone bills and existing EMIs) in time. A credit score of 750 or above is mostly a prerequisite to avail of a home loan.

In a credit report, home loan lenders also check if any previous loan is settled with write-offs or settlement by the institution. Write-offs occur when you settle a loan with a lender in case you’re unable to repay a loan. Applicants must do everything they can to improve their credit score before applying for a new loan. And repaying the written-off amount mentioned in the credit report is one such step they can take. Other steps include not defaulting on existing EMIs, avoiding borrowing too much at a time, diversifying your credit among others.

DTI (Debt-to-Income) and FOIR (Fixed Obligations to Income Ratio)

Whether salaried or self-employed, net monthly income is given prime importance by home loan lenders when considering a home loan application. They also ensure that the applicant has good repayment capacity with a low debt-to-income (DTI) ratio. Doing so underlines that you have robust financial health and can take new debt without unduly stressing available capital or income.

A DTI of 40 per cent is typically the threshold limit for sanctioning loans for most lenders. Your loans can get rejected outright if the DTI is higher than 40%, even if the credit score and net income meets the requirements, due to low financial liquidity.

Home loan lenders also use FOIR (Fixed Obligations to Income Ratio), a popular parameter, to determine loan eligibility. All the fixed obligations that a borrower is supposed to meet regularly every month form the FOIR. The fixed obligations do not include statutory deductions from the salary such as Provident Fund, professional tax and deductions for investments such as insurance or a recurring deposit.

As per the home loan bank’s eligibility criteria, the borrowers should restrict all their fixed obligations including the currently applying loan EMI to 50% of their monthly income. Or in other words, considering that 50% of your income is required for your living expenses, the lender would see that all your monthly loan obligations/liabilities should be only 50% of your monthly income.

Age of loan applicant

Age mainly impacts the duration or tenure of the loan, irrespective of whether you are a salaried or self-employed professional. The maximum tenure given by housing finance companies is 30 years for a salaried employee, which affects the EMI amount and the overall interest paid. The maximum age limit is extended by 3-5 years for self-employed applicants than salaried applicants.

Young applicants are often preferred, as they have lesser liabilities and are more likely to earn higher income over time. They also have more time to repay the loan. The risk appetite of most lenders decreases as the age of the borrower goes up since they have relatively lower FOIR and additional liabilities. If you are a home loan applicant between 41 to 60 years, you will need to close outstanding loans and include the income of your spouse before applying for new long-term credit.

Borrowers above 60 years of age are usually offered step-down repayment options and may require a younger, employed individual—typically an offspring or a close relative—to be a co-applicant. These options are generally exercised in cases when one of the co-applicants income is likely to decline after a certain period.

The event of moving into one’s home may be the culmination of a long-held aspiration but the journey typically consists of various steps taken and decisions made along the way. A home loan is one such step. By keeping the aforementioned factors in mind, applicants can ensure that this single step can become a giant leap towards owning their dream home.

‘‘

The Self-employed need to establish their business for a minimum of three years with at least two years of ascending profits lately before applying for a home loan.

- Sukanya Kumar, Founder & Director, RetailLending.com

Professionals have an edge

Home loan lenders prefer lending to self-employed professional categories such as doctors, chartered accountants, company secretaries, lawyers, and engineers. This is because they have specialized skills, domain knowledge and, most importantly, a steady income source.

Other categories of self-employed non-professionals find it difficult to get a home loan. Gaurav Gupta, the co-founder and CEO of the online aggregator of financial products and services MyLoanCare.in explains, “Self-employed non-professionals working in cyclical sectors have fluctuating monthly incomes from their professions. The probability of default on loan repayments is high. So, lending institutions reject home loan applications or offer loans at higher interest rates.”

Company stability and financials critical

The lender checks for the stability of the company by examining the financials when you apply for a home loan. Sukanya Kumar, Founder & Director of home loan advisory firm, RetailLending.com says, “The Self-employed need to establish their business for a minimum of three years with at least two years of ascending profits lately before applying for a home loan.” Otherwise, the loan assessor at the financial institution will reject the home loan application at the initial stage itself.

The start-ups with no profits to show will find it difficult to get home loan approval despite funding from investors in the business. Banks don’t consider sources of funding to operate the business while accessing the loan application nor do they consider future profits and cash flow from the business. Your business must show growth in cash profits, revenues and tangible net worth in the past three to five years at the time of applying for a home loan.

Basic requirements

In addition to the standard documents like bank statements of current and savings account for the last 6 months,, PAN, KYC, residential proof, the entrepreneurs must have the following things to get a home loan from any bank.

Your business profile

Proof of business existence

Educational qualification

Income tax returns of last 3 years with computation of income

Last 3 years CA certified/audited balance sheet and profit & loss account

The above documents are important to be submitted for all the entrepreneurs to get a home loan, in addition to meeting various criteria explained above.

A piece of advice

Though it looks to be a bit difficult for entrepreneurs, particularly those in the early stages, to get home loan approved, it is very much achievable if you do your homework properly and efficiently. First of all. you must be realistic about the amount you are looking for as a home loan. Your chances of getting a home loan approved is very high if you are willing to make a higher down payment while purchasing a home, show substantial savings and good business growth prospects, select a good property, and have a good credit score. It is important to build an income profile in a manner that can make you eligible for a home loan. This includes proper statutory compliance including payment and filing of ITR, GST, where applicable, showcasing a stable and adequate income stream, and proof of integrity in business and non-business transactions.