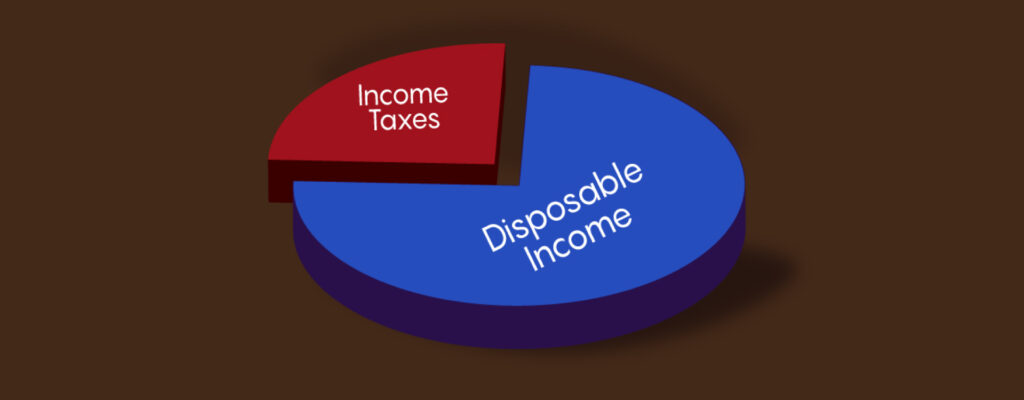

Whether you are an established entrepreneur, small scale businessman, a recent start-up founder or a consumer in the market, what you earn and what you spend is defined by your disposable income. But most of us aren’t aware of the term ‘Disposable Income’ and often confuse it with personal income. Personal and Disposable income are different and are not interchangeable. Disposable income is very simple language is the amount of money that an individual or household has with them to spend or save after income taxes have been deducted. In other words, it is the income you have in hand that can be disposed off (spent or saved) after paying your taxes.

For instance, let’s assume that a household has an income of Rs 3,00,000, and it pays a 35% tax rate. The disposable income of the household will be Rs 1,05,000—that is, Rs 3,00,000 – (Rs 3,00,000 x 0.35). Thus, the household has Rs 1,05,000 to spend on investments, savings, luxuries and necessities.

Though it seems like a simple concept, disposable income is one of the key economic indicators when it comes to analysing a country’s overall economy. Economists use disposable income as the foundational base to calculate other indicators like discretionary income, personal income, marginal propensity to consume or save, savings rates, etc. Disposable income is one amongst the three metrics of income, the other two being National Income and Personal Income, measured and recorded by the National Income and Product Accounts which is maintained by the Bureau of Economic Analysis.

As an entrepreneur, learning about disposable income helps you understand the consumer market better as it determines the aggregate demand and corresponding consumption spending patterns. Following DI statistics helps you decide portfolios, investments and supply chain of production that lead to profit-maximisation. Let’s dig a little deeper into the relationship between Disposable Income and other economic indicators.

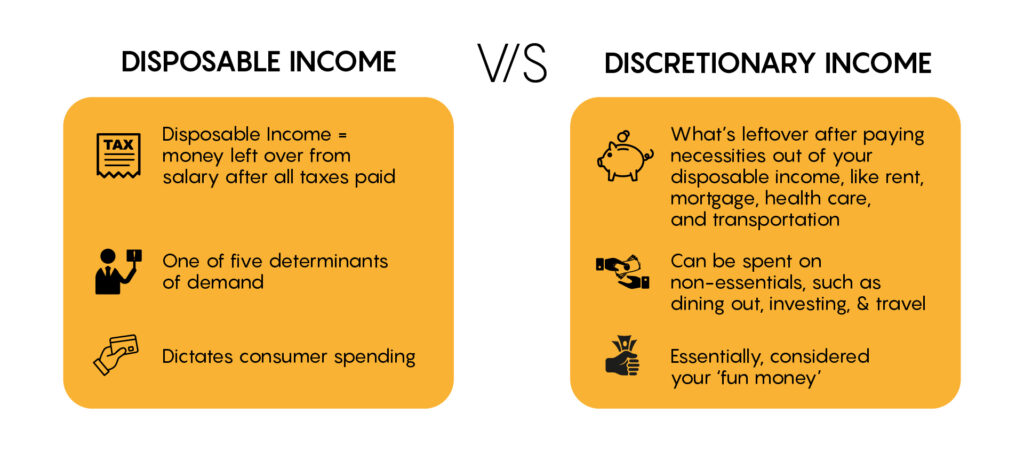

Difference between Disposable Income and Discretionary Income

Discretionary income is the measure of income a household has to spend, invest, and save after paying for taxes and necessities. Necessities include student loans, mortgage payments, credit card debts, etc. Discretionary income is obtained from disposable income which is also why the two-income types are very similar and often confused.

Discretionary income subtracts all payments for necessities from DI like rent payment, health insurance, food, and transportation. It is that portion of disposable income that can be spent the way you want to spend it. It is usually the first thing that reduces when you lose a job, face a loss or pay reduction. During recessions, discretionary income becomes tight and ventures that sell discretionary goods, such as jewellery or vacation packages, suffer the most during recessions like the recent COVID-19 pandemic. Economists observe the sales of discretionary goods to analyse recessions and recoveries. Disposable income includes both necessity spending and luxury spending post taxes. Often people with low discretionary income have lower standards of living than people with higher ones even if they have the same disposable income.

To calculate discretionary income, let’s assume a household has an income of Rs 2,00,000 and pays an income tax rate of 25%. The household will have transportation, rent, insurance, food and other necessities adding up to 40,000 a year. Their discretionary income is 19,00,000 or the amount left after subtracting taxes and necessities. This is calculated as Rs 2,00,000 – (Rs 2,00,000 x 0.25) – Rs 40,000 for the year.

When we calculate discretionary income, we initially calculate our disposable income by subtracting taxes from personal income. Then we tally up our necessity expenditures like rent, utilities, mortgages, food, clothing, etc.

Disposable versus Personal Income

By definition, disposable income is calculated as the difference between personal income and personal tax and nontax payments. Usually, in numerical terms, personal tax and non-tax payments form around 15 per cent of personal income. Thus, DI comes to be about 85 per cent of your personal income. The equation below shows how we derive DI from PI by subtracting personal tax (PT) –

DI = PI – PT

Often people question the logic behind using disposable income in place of personal income when it comes to studying Macroeconomics. However, as mentioned before, it is not only about earning and receiving wages and payments. A key portion of your earnings is directly and indirectly paid to the government via taxes. This amount is not available for spending or saving, so your consumption patterns depend solely on your disposable income.

Consequently, your savings patterns also depend on DI. The main two purposes of studying DI are consumption expenditure (C) and saving (S)

DI = C + S

The consumption expenditure mentioned here put together with investments, government expenditure and net exports sums up to the Gross Domestic Product. The savings enter financial markets where they are borrowed by entrepreneurs and governments for investment purposes. Thus, disposable income is an indispensable component of Macro-economic studies.

Most of the time, consumption expenditure forms around 97 to 98 per cent DI while savings form around 2 to 3 per cent of DI. This division often fluctuates but remains more or less the same.

How Disposable Income affects Consumer Spending

John Maynard Keynes developed the theory of consumption which was based mainly on DI or income after paying taxes. To understand this, we need to define MPC or Marginal Propensity to Consume which is the change in the amount a consumer spends due to a change in their DI. For instance, let’s say your disposable income increases by Rs. 5000, you choose to spend Rs. 4000 of this on certain goods or services, then your MPC will be 4000/5000 = 0.8.

Similarly Marginal Propensity to save will be 1000/5000 = 0.2. The sum of MPC and MPS is always equal to 1. People with lower incomes usually have a higher propensity to spend with a change in their DI. If the government changes taxation, it directly affects disposable income and hence spending and levels of welfare. As an entrepreneur, you must be aware of how changes in DI affect consumer spending as the amount consumers spend will affect your earnings. An increase in DI increases spending which will in turn create more demand in the market and vice versa. Keep track of changes in taxes, MPC levels and demand to predict decisions for your ventures.

Effect of DI on the stock market

A surge in disposable income theoretically leads to a rise in stock valuations which correspondingly increases the overall stock market value. As we saw earlier, the increase in DI leads to households having more money to save or spend. This results in consumption growth. Consumer spending then creates the demand which is what helps keep companies profitable and pushes them to hire more workers as manufacturers raise their production to meet increased demand. This leads to a rise in wages which again creates more spending. Thus, a rise in consumption increases corporate sales and earnings, which raises the value of individual stocks. This turns into a market-wide rise in value with the potential to create an economic boom or inflation.

Disposable Income and Recession

Continuing from the above-mentioned points, the opposite also holds true. Assuming that disposable income decreases, households will have less amounts of money to spend and save. This forces them to consume less than what they did before. The decrease in consumption then reduces corporate sales and earnings, reducing the value of individual stocks. This in turn leads to a market-wide reduction in value with the potential to create a depression or recession.

However, increases in disposable income don’t always create a rise in the value of the stock market, and vice versa. For instance, during the wake of a recession or recovery period, even though DI increases, most consumers tend to not utilise their increased DI to raise consumption. In such situations, even an increase in disposable income results in a recession. So a rise in DI doesn’t necessarily lead to economic expansion.

Disposable income and Aggregate Demand

Aggregate demand is the total quantity of goods and services demanded in an economy at a given price level. An important component of the AD equation is C(Y-T) which shows consumption as a function of DI. The function of consumption is aggregated across all consumers. Therefore it can be applied for all incomes and tax brackets. As consumption forms a very necessary metric for calculating AD, disposable income is also an important metric for AD, an increase in DI increases consumption which increases AD. Aggregate Demand is an important metric for any venture to operate in a market as it decides how much to produce, how often to produce and most importantly how to produce.

Now that you know everything there is to know about disposable income, make sure you observe the trends and apply them in your ventures whilst making key decisions. To learn about Exchange Rate, check out Dutch Uncles Article on All you need to know about Exchange Rate.