Holding on to your salary till the end of the month is tough. Taking a personal loan from the bank to pay for your monthly Netflix subscription or some dinner takeouts, seems too far-fetched, right? Not to forget the never-ending paperwork that accompanies a personal loan. Therefore, a paperless, hassle-free, access to free-flowing credit, available at the tap of your fingers would feel like a godsend. That’s exactly what MoneyTap did; it made personal loans available as easily as a few taps on the smartphone.

What is MoneyTap and How Did it Come about?

Founded by IIT and ISB alumni Anuj Kacker, Bala Parthasarathy and Kunal Varma, MoneyTap caters to the credit needs of the middle class. Personal loans and credit cards are not very popular among the salaried and middle class of India because of the incessant hassles of paperwork and the high-interest rates on credit card loans. Therefore, founding a company that provides a credit line up to 5 lakhs to its consumers was an ambitious feat.

In 2014, Bala Parthasarathy, Sanjay Swamy and Shripati Acharya, started a Seed stage investment firm called Prime Ventures Partners which invested in startups like HackerEarth, Nimble Wireless, Ezetap and Happay.

After two years with Prime Ventures, Bala was once again allured by the idea of entrepreneurship and this time it was the enticing world of fintech. TapStart founders Kunal Verma and Anuj Kacker followed Bala into founding this fintech startup. The duo sold off their stakes in TapStart in 2015, to venture into MoneyTap.

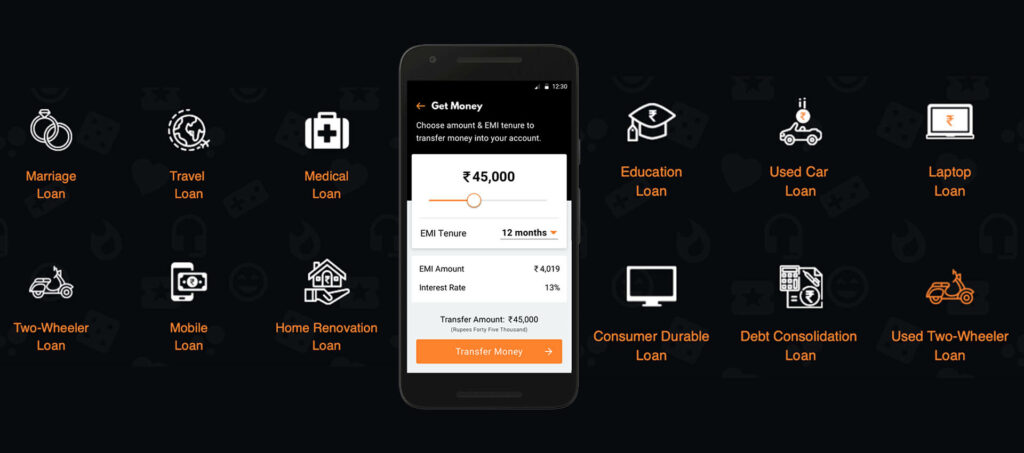

The founders noticed that the monetary needs of the middle class can be easily solved with a small credit line. So, in 2015, they launched an app, in partnership with RBL Bank and several NBFCs, which became India’s first app-based personal line of credit financing. Going with the ‘cashless India’ culture, MoneyTap brings a flow of personal credit lines to your fingertips.

The app leads a 100 per cent paperless process. Anyone, between the age of 23 to 55 with a minimum salary of 15,000, a smartphone and a PAN can check for their eligible credit limit in less than 15 minutes through the app. The credit limit approved can go up to 5 lakhs but the consumer only has to pay the interest on the amount that they choose to borrow. Once the credit line is approved and set up, the customer can transfer money to their bank account or even spend it directly with the credit card that comes with the MoneyTap account. One can also check their spendings, repayments and credit limits on the app.

Personal loans and credit cards are a rare thing in India owing to the fact that the interest rates are very high. Staying true to their word of providing affordable and easy access to credit, MoneyTap offers loans at an interest rate as low as 1.08 per cent per month, and 13 per cent to 18 per cent per annum, and flexible loan tenures of 2 to 36 months. The loan can be repaid in monthly installments within the duration of 36 months and once all the EMIs are paid back, the credit limit gets replenished making it viable for borrowing again.

One of the initial challenges that the company faced was the conservative nature of banks. It has been very difficult to raise money and also comply with the rules and regulations of the banks and NBFC. Another challenge has been the difficulty in catering to demanding customers. With the banks being conservative, consumers expect flexibility and good customer service from the app. The two rounds of funding has seemed to bring a balance and has bridged the gap between the conservative banks and demanding customers.

‘‘

The app owes its quick success to the tech-savvy millennial of the country who despise tedium, and what screams ‘tedium’ more than the long application process for a personal loan at the bank.

MoneyTap’s Sure-Footed Business and Revenue Model

The business of money lending is a very risky one and is prone to fraud. The increasing number of fraudulent cases is the reason that the banks increased the interest rates on credit cards. Therefore, MoneyTap is very conservative about who it gives credit to. When signing up for the service, the customer goes through a chatbot interface that connects to the banking system and the credit bureau to investigate the customer’s credit history. The approval depends on this. The app happens to reject about 60-70 per cent of the application.

Every credit line comes with an initial processing fee of Rs.500, which is another way to ensure the genuineness of the customers. Despite its high rejection rate, the company was successful in making a customer base of 300,000 registered users from 14 cities in India, within eight months of its inception. In 5 years, the company has expanded to 60 Indian cities, and the plan is to expand to 200 soon. The app has been downloaded over 10 million times and disburses more than Rs. 2500 crore annually.

Being the first of its kind, MoneyTap has made a strong customer base with 90 percent of active customers, drawing credit multiple times from the app. The initial processing fee and the interest on the borrowed amount of credit line bring about a strong revenue for the company. The app owes its quick success to the tech-savvy millennials of the country who despise tedium, and what screams ‘tedium’ more than the long application process for a personal loan at the bank.

With two rounds of funding, MoneyTap has raised an amount of $82.3 Million. The latest round of funding took place in January 2020 and raised a funding of $70 Million. Its prime investors are Sequoia Capital India and Bala Parthasarathy’s own firm Prime Venture Partners. The second round of funding brought in new investors such as RTP Global, Aquiline Technology Growth & MegaDelta Capital.

MoneyTap: A Forerunner for Major Credit Lending Businesses

Since the inception of MoneyTap, a number of credit line financing startups have cropped up. Startups like PaySense and ZestMoney are MoneyTap’s biggest competitors, having been founded in the same year and offering similar services. MoneyTap not only has the upper hand in the competition being the first of its kind but it also offers lower interest rates.

In 2019, MoneyTap was awarded a Non-Banking Finance Company licence by the RBI. Their aim was to use the licence to enter into co-lending with their lending partners and offer better interest rates to their customers. The NBFC licence bolstered their market position. Shortly after getting the licence, MoneyTap raised its second round of funding of $70 Million. The acquisition of these fundings affirmed MoneyTap’s leading position in the fintech sector. The funding would be used to scale their business as they plan to 200 Indian cities in 2021. It will also be used to innovate their data backed lending models. MoneyTap’s surefooted steps have helped it create a loan book of Rs. 1000 Crore. The company has been on a 4 fold growth trajectory since 2019 and with the NBFC licence plans and the fundings raised, plans to accelerate it further.

‘‘

Their plan was to grow slowly and ensure the reliability of their customer base before expanding into new horizons.

Keeping the Competition at Bay

Finomena was one of MoneyTap’s biggest competitors till its untimely fall in 2017. It was a fintech company that helped students and young professionals in buying electronic devices and appliances by providing them small-ticket loans. The concept was quite like MoneyTap, except that it was focused on a particular segment of the community and very specific on how the loan is used.

The odd specifics of the customer base put it at a disadvantage in the market where it was competing with major fintech lending startups like MoneyTap and ZestMoney. In two years’ time, the reserves dried up due to high cash burn. What caused the reserves to dry up? Again, the oddly specific demographic. As mentioned earlier, the money lending business needs a keen eye. What MoneyTap does when signing up a customer for their service, is check if they have a regular source of income and its reliability. A customer base of students and young professionals is hardly expected to have a regular source of income.

What MoneyTap did differently was to keep the rejection rates high. Their plan was to grow slowly and ensure the reliability of their customer base before expanding into new horizons. While offering an easy and affordable credit line to their customers, MoneyTap ensures increasing their revenue through low-cost and tech-friendly solutions.

The Post-Pandemic Cashless Culture

Since the onset of the pandemic last year, there has been a rise in fintech companies. Paytm and UPI have restored trust in the fintech businesses and the pandemic has made people wary of stepping out and doing their transactions through cash. Therefore, the cashless culture will see a new trend in the post-pandemic scenario, a trend that will work in the favor of MoneyTap.

Bala Parthasarthy, Anuj Kacker, and Kunal Verma started this company with the vision to provide the middle class of India with easy and affordable access to credit lines without the hassle of several bank visits and tons of paperwork. The company expanded to 14 cities in the first eight months of its inception. In a matter of five years, it grew up to 60 with the majority of its users coming from the top metros like Delhi-NCR, Bengaluru Mumbai, and Chennai.

What the Future Holds

The founders plan to expand to 200 Indian cities in 2021. The post-pandemic cashless scenario might help them push forward with the plan as people from smaller cities of India take advantage of the app. The app has grown more user-friendly over the years. New features have been added that support Indian languages. It has attracted customers from Tier I and Tier II cities.

The app caters to the credit needs of the middle class. There is a dense concentration of the middle class in Tier I and Tier II cities. The app has seen a trend during the pandemic. Now that digital transactions are being favored, people are using their credit line for essentials, and Health and Education loans have seen an uprise.

The overly simplified process of the app attracts the tech-savvy millennials with the average age of the customer base of the app being 28-30. Judging by today’s scenario, the app might be successful in catering to an even older demographic. The company currently targets customers with average incomes of Rs. 30,000 to Rs. 40,000 per month, but it is planning to delve into the prospect of reaching out to groups having income as low as Rs. 10,000 to Rs. 15,000.

In September 2020, Renaud Laplanche who is considered the Godfather of Fintech joined the advisory board of MoneyTap. This means that MoneyTap is ready to test global waters. For now, they are looking to expand into Tier I and Tier II cities and the global expansion would start with SouthEast Asia and Middle East markets.

MoneyTap launched MoneyTap Labs at the beginning of this year with the vision to educate people on how to use financial products. They have been actively hiring engineers since last year. MoneyTap Labs have launched the SuperSplit app which would help users to track shared expenses and settle payments. More new products are in the pipeline.

The story of MoneyTap is the story of authenticity in innovation. It was found with the thought of catering a product to the middle class, despite knowing that the middle class seldom uses it. It nevertheless succeeds by keeping authenticity, reliability, and a sharp eye for detail at the core of its platform, making it a truly innovative product.

For more inspiring stories check out our Inspire section!