The Fintech or the finance industry as a whole is going through a technological revolution and surprisingly Covid-19 has contributed to it. Survival does not look too bleak for Fintech even amidst the dangerous second wave currently ensuing. The adoption of Digital Banking has exploded since the outbreak last year and it’s been a blessing for the Fintech sector.

‘‘

Digital lending has been on the rise which will be the single biggest hope for recovery for the entire fintech sector.

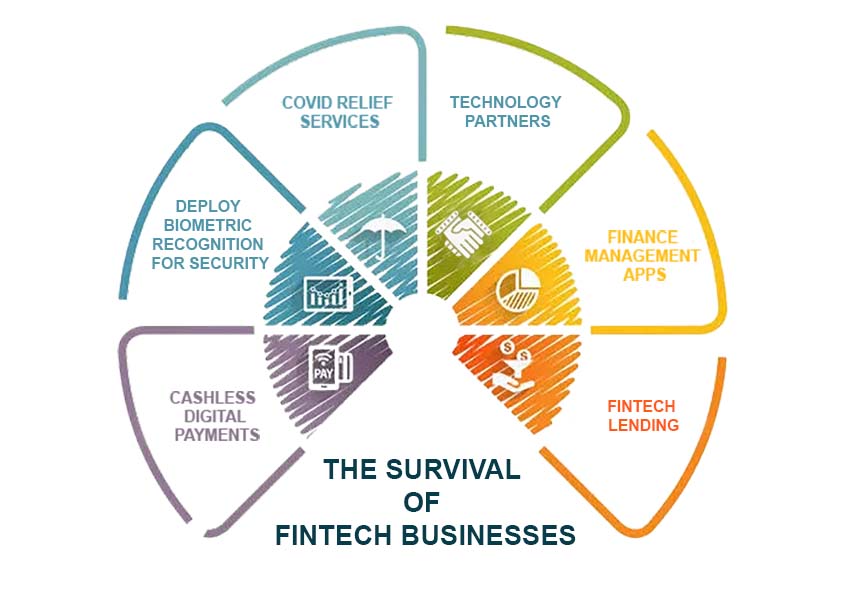

How fintech can survive the second wave

Deploy biometric recognition for security

Money laundering has been on the rise and malicious entities have increased their activity. As a financial business, get your hands on advanced security technologies and deploy biometric recognition to secure payments. Consumers are ready to pay additional monthly fees if the financial institution is offering biometric security.

Capitalise on demand for cashless, convenient digital payments

There is high demand for cashless and convenient digital payments, mainly owing to the hygiene factor. To survive and survive well during these times, fintech firms need to capitalise on this demand.

Team up with technology partners

During the pandemic, you need to drive operational efficiencies. Team up with partners for resources that you can use to align new systems with your business goals. Obtain key technology solutions like Integrated CRMs, cloud-based storage solutions, business management platforms from technology partners.

Deviate your services for Covid relief

Follow in the footsteps of a number of Indian fintech start-ups, as a survival strategy. Facilitate vaccine search and registration, assist in volunteering efforts, and organise vaccination drives specially for your field service executives.

Become a Fintech lender

Consumers need quick borrowing to overcome unprecedented pandemic-induced circumstances. Become a fintech lender and offer instant financing solutions to meet this demand.

Financial management apps are trending

Consumers are becoming increasingly aware about the importance of financial management. Apps providing finance management are trending, have become popular and are seeing increased usage during the many lockdowns. Come up with app ideas for finance management as a survival strategy.

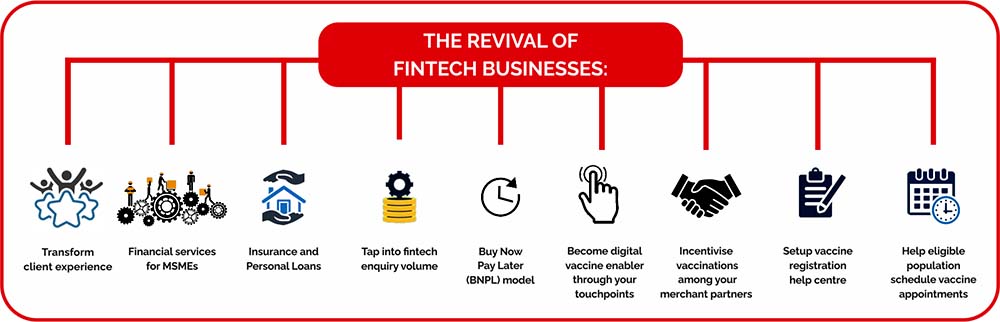

How fintech can revive post the second wave

Transform the client experience

A personal finance revolution is underway which completely transformed digital banking post pandemic. Habits and behaviours around finance usage and management have changed. To align with this revolution, focus on transforming the client experience.

Provide financial services for MSME’s

Disburse loans for MSMEs who will be very much in need of working capital and financing. Small merchants will need quick, convenient, small loans post the second wave and lockdowns. Business uncertainty is looming large among small businesses who were abruptly forced to halt production and recovery efforts following the first wave. However, you need to keep in mind that MSMEs will also be the worst impacted borrowers.

Provide Insurances and Personal Loans

Once the recovery phase starts for the second wave, consumer demand will be high for insurance and personal loans. The healthcare sector will show high demand for credit post lockdowns. Come up with health insurance products to cater to this demand.

Volume for Fintech enquiries won’t be impacted – Tap into the demand.

Even though the credit demand across various industries will see a significant dip, the enquiry volume for fintech products and services will remain unchanged. Tap into the demand and come up with sales and marketing strategies to convert enquiries into customers.

Buy Now Pay Later (BNPL) Model

The demand for BNPL financial services is high and will continue to increase post the lockdown. This is mainly because consumers are suffering from financial instability and disruptions in income continuity. Adopt the popular BNPL model in your financial services since it’s a golden opportunity to revive and recover from disruptions faster.

Vaccinations and the Fintech industry

Become a digital vaccination enabler through your touchpoints

If your fintech platform has physical touchpoints like local retail outlets and small ‘kirana’ shops, leverage these touchpoints as well as your platform to facilitate vaccination registrations. This is especially important if your touchpoints are in remote, densely populated areas with less tech savvy people. Leverage your distribution network and the people trained in your platform at the touchpoints to get people registered and scheduled for vaccinations.

Incentivize vaccination among your merchant-partners

Similar to a corporate social responsibility (CSR) initiative, offer incentives to your retail merchants to entice them to get vaccinated. Increase awareness regarding the need for vaccinations by offering special cashback programs, discounts and scratch cards when merchants submit proof of successful vaccinations.

Dispel vaccine related myths.

Create a registration help centre for rural communities to remove hurdles in vaccine registration among impoverished citizens. Create awareness among citizens who fall prey to myths and vaccine related fears by answering FAQs and thus helping increase registration counts in small towns and villages.

Assist vaccination schedules for the eligible population

A majority of the vaccine eligible population is unable to schedule appointments either due to technical glitches, lack of transparency, or due to vaccine shortages. You can help improve the number of vaccine appointments being scheduled and thus avoid vaccine wastage by becoming a digital bridge. Open appointment scheduling on your platform or instant alerts when slots open for consumers in their vicinity.

Conclusion

The Fintech industry has seen tremendous growth during the pandemic. The industry is seeing decent demand throughout the first and second waves. Digital lending has been on the rise which will be the single biggest hope for recovery for the entire fintech sector. Revival does not look bleak in the remotest and avenues for survival are many in fintech.

SMEs are most impacted in business due to the second wave, and Fintech can become a saving grace for the small business community to survive. Fintech companies can help the start-up community with customized financial products which they cannot get from traditional financial institutions. And this will create a win-win situation for both of them post covid.