Investors use various metrics to determine if purchasing stocks of a company will fulfill their investment objectives. One such metric is P/B (Price-to-book) ratio which is largely used by an investor to determine the right stocks.

What is P/B (Price-to-Book) ratio and how is it calculated?

P/B ratio is a widely used parameter by an investor to determine if a company’s stock price is overvalued or undervalued or fairly priced as compared to the company’s book value. The ratio is a relationship between the market capitalisation of an organisation and the value of assets it possesses.

The ratio is calculated by dividing a company’s market price of the share by a company’s book value.

But before calculating the ratio directly, let us understand how we are arriving at the formula. First, the investors need to calculate market capitalisation which is the product of the total number of shares held by shareholders and the current market price of a company’s stocks.

Market capitalisation= Market value of a stock x Number of shares held by shareholders.

Second, investors need to determine the net value of an organisation by adding the book values of the assets present in a company’s balance sheet and deducting liabilities and debts. Book value is the worth of the company left when it closes its operations after paying its debts, creditors and liquidates itself.

Book value = Total assets – total liabilities – debts

After determining the above values, we now calculate the ratio as –

P/B ratio = Market capitalisation / Book value of assets

Or

P/B ratio = Market price per share / Book value of assets per share

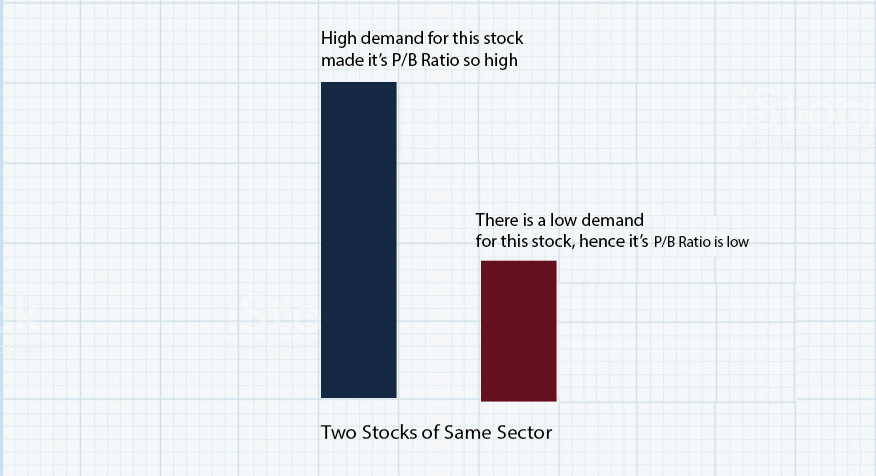

So, a P/B ratio of 2 means that we will pay Rs 2 for every Rs. 1 of book value. The higher the ratio, the more expensive the stock and so is its demand.

‘‘

P/B ratio is a widely used parameter by an investor to determine if a company’s stock price is overvalued or undervalued or fairly priced as compared to the company’s book value.

What is a good P/B ratio?

A P/B ratio of less than 1 is good, meaning that the stock is undervalued, and stock price is trading at a lower price as compared to the value of the company’s assets that is neglected by the market. This can be a potential buying opportunity, but it must be researched carefully.

A P/B ratio higher than one means it is an expensive stock. This can happen due to two reasons :

First: The investors believe that the market conditions will turn favourable to the business which can give better returns. This anticipation makes investors pay more than the book value and thus drives the market value more than the book value.

Second: The book value of the company might not be updated. For instance, a company’s balance sheet might reflect the amount paid for an asset, but that does not mean the worth of the asset. However, in the case of assets like land whose value increases over time, the true book value becomes higher.

Comparison of P/B ratio with others

Usually, investors while valuing a company consider the P/E ratio, as there is a tendency of investors to gauge the returns while estimating a company’s long-term earning potential. Earnings are what is left for shareholders once all expenses are paid. The P/E ratio compares a company’s share price with its future earnings potential, while the P/B ratio is computed by comparing a company’s stock price with its assets and liabilities. A P/B ratio should be looked at from the context of the return of equity. Return on Equity is the ratio between an organisation’s equity and net income. Therefore, a company with higher RoE (return of equity) will always command a higher P/B ratio and vice versa. However, the stock is overvalued if it gives low RoE and has a high P/B ratio.

Limitations of the ratio

Investors should keep in mind that the P/B ratio differs from industry to industry. Here are some of the limitations to it:

- The ratio does not take into account intangible assets such as goodwill, brand name, and intellectual property and considers only appreciating hard assets like cash, land, gold, plant, machinery, etc. Therefore, for service-oriented companies like IT and enterprise tech, their book value of assets will be low as they lack physical capital to generate revenues.

- It is not useful in understanding companies that have high debt.