It might seem puzzling for a new investor when he/she tunes in to Zee business to see the anchor and industry experts emphasising a particular stock’s market value and future. Questions regarding determining a profitable stock, the best stocks to invest in, or in what sector stocks to invest, are common in an investor’s mind. To help our new investors in determining the best stocks, we shall discuss one of the popular tools used in the stock market i.e. P/E ratio.

What is P/E (Price/Earnings) ratio?

P/E Ratio is one of the most widely used metrics for investors and analysts to determine stock valuation. It is the ratio of the current price of a company’s share to the earnings per share (EPS). EPS is calculated by taking the earnings of the past 12 months divided by weighted average shares outstanding.

The formula for the ratio is :

P/E ratio = (Current market price of a share) / (Earnings per share)

For instance, if a company’s stock is trading at Rs 60 per share and the company generates Rs 4 per share in its annual earnings, then the P/E ratio will be 15 (60/4). It means that given the company’s earnings, it would take 15 years of accumulated earnings to equal the cost of investment.

The market price of a stock is an indication of an investor’s willingness to pay for owning shares, whereas this ratio signifies how much the market is willing to pay for a stock based on the company’s past and future earnings.

Types of P/E ratio

Investors take into consideration two types of P/E ratio. Both these ratio depend on the earnings.

Forward P/E Ratio: This ratio is used to determine how a company is expected to perform in the future and its estimated growth rate. It is calculated by dividing the stock price of a single unit by the estimated future earnings of a company.

Backward P/E ratio: This ratio considers the past earnings of a company over a period. It provides a more accurate view of the company’s performance to the investors.

‘‘

P/E Ratio is one of the most widely used metrics for investors and analysts to determine stock valuation

Relationship between the P/E ratio and stocks

The P/E ratio differs from industry to industry and should be compared with companies that have similar business activity.

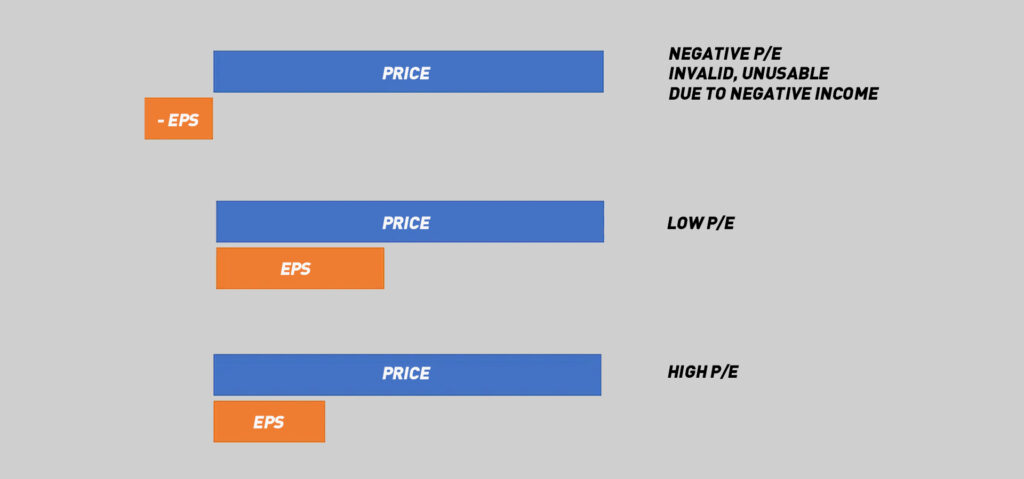

High P/E ratio: A higher P/E ratio indicates that the share prices of a company are higher than its earnings. It also reveals that investors have high expectations for the company’s earnings growth in the future and are willing to pay more for them. In such cases, investors should refrain from trading in such expensive stocks as it involves speculation making the company prone to risks. The high value in the ratio puts pressure on the company to justify its higher valuation, which might fail due to inefficient fund management.

Low P/E ratio: A lower ratio signifies that a company’s stock prices are undervalued against the company’s future earnings. It also indicates that the current and future performance of a company is weak. Under detailed research of a company’s fundamentals, investors can consider investing in such companies as they can purchase the stocks at a lower price, hold for the time, and later on selling it at a high price later when stock prices surge.

Negative P/E ratio: Sometimes a company might experience low cash flows that are reflected on the ratio to show negative. In such cases, the investors must not invest in companies with consistent negative P/E ratios as they may go bankrupt. Companies to avoid a negative reputation might not report the EPS numbers for a few quarters to hide their negative P/E, hence investors should be cautious.

Which is the ideal ratio to consider buying stocks of a company?

Let us compare the P/E ratio of two companies A and B belonging to the same industry. Company A has a ratio of 50 and company B’s ratio is 25. It clearly shows that the shareholders of company A have to pay Rs 50 for Re 1 of the company’s earnings, whereas in B the investors need to pay only Rs 25 against Re 1. In this case, investing in B might be more profitable. Companies having higher ratios are indeed risky to invest however, a low ratio might also indicate the low performance of a company due to its internal issues.

Limitations of the ratio

Depending solely on the P/E ratio for investment decisions might not be accurate as the earnings of a company are released every quarter, whereas stock prices fluctuate daily, which does not show a company’s performance for a long time. A company’s earnings are dependent on multiple factors and can be volatile.

Looking at the ratio, an investor cannot anticipate if a company’s cash flow will increase or decrease in the future. As a result, this leaves enough room for ambiguity in the direction of a company’s growth.