We have several long-term investment options but there is a dearth of short-term investment. On top of that, options are narrowed if we want a short-term investment with good returns.

Owing to Central Bank’s lower projected growth and uncertainties over future policy, the conservative mutual fund investors are developing an interest in investing in short-duration mutual funds such as overnight funds, floater funds, and liquid funds, etc. Such investments have increased due to their ability to deliver good returns in a short time. But, our article would like to draw the investor’s attention to SEBI’s new category of mutual funds – overnight funds introduced in 2018.

According to the data released by the Association of Mutual Funds in India (AMFI), the net inflow of overnight funds was Rs 5932 crores. Moreover, this newly launched overnight fund’s overall market value or capital stands at Rs 89,293 crores as of 31st July 2021. The market value includes the returns a mutual fund has made on its investment.

What are overnight funds?

Overnight Funds are a new category of mutual funds that have a maturity period of one day. A fund manager invests the overnight funds in CBLOs (collateralized borrowing and lending obligation), overnight reverse repos, and other debt or money market securities that give returns within a day.

In the meantime, if RBI brings any change in the interest rates, the prices will not be affected.

The returns received within a single day of maturity will be reinvested by the fund managers to purchase more such new bonds or securities at new prices overnight, and this cycle repeats.

Since these funds mature overnight, there are fewer chances of making capital gains or losses and remain unaffected by interest rate changes. It is therefore touted as the safest investment option in the mutual funds category.

‘‘

According to the data released by the Association of Mutual Funds in India (AMFI), the net inflow of overnight funds was Rs 5932 crores.

The purpose of overnight funds

The reason behind the growing popularity of overnight funds is that investors are able to use their funds in a better and profitable manner with low risk. Here are the purposes of investing in overnight stocks.

It is a short investment

The overnight mutual funds mature in just one day. This short period of investment allows investors to make better use of the extra cash they have at their hand.

Low-risk

As the prices remain unaffected to varying interest rates with maturity being for a day, it limits the funds’ exposure to risk and keeps it to a minimum.

High-liquidity

Overnight funds are regarded as the most liquid investment securities. It strives to give better returns than a savings bank account.

Who should invest in overnight funds?

Investors looking for greater liquidity and expecting returns more than a savings bank account.

Risk-averse investors who want to park their money overnight.

Also, ideal for institutional investors such as banks, insurers, and corporates seeking overnight returns by investing their surplus funds.

Investors who require quick money during financial emergencies.

How are these funds taxed?

Investors receive dividends and capital gains from overnight funds. Receiving dividends does not attract taxes but capital gains do. Capital gains are the difference between the purchase price and the selling price of the fund. The tax rate on capital gains depends on the time an investor holds the units of an overnight fund. Capital gains tax is of two types- short and long term.

Short-term capital gains tax:

If the investor holds the funds for a period of up to 3 years and taxes are charged as per the income tax slab rate applicable to the investor.

Long-term capital gains tax:

When an investor holds the funds for more than 3 years, he/she gets the benefit of indexation. Indexation means the purchase price is adjusted with the inflation that causes tax amount to reduce. Investors in the long term are taxed at 20% after indexation.

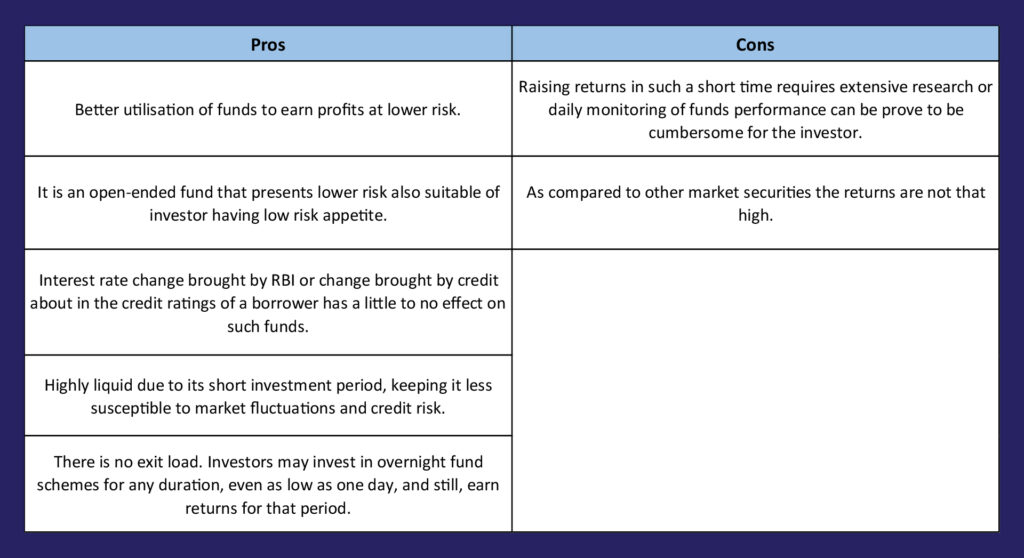

Pros and cons of investing in overnight funds

Word of advice for the investors

There is no doubt regarding overnight funds being the safest category of mutual fund investment since returns can be easily withdrawn. But, here are a few pointers that investors should keep in mind before investing in them.

- It is true that returns in short term investment are somewhat more than saving account but it should not be considered for the long term since it is not designed to optimise returns. They tend to offer relatively lower returns.

- Investment in overnight funds should be aligned with investor’s financial goals and strategy. Under the protective umbrella of safety and high liquidity, investors should not compromise on their returns by thinking of investing in it as the only option of generating returns. To get high-quality returns or profits they can invest in other short-term mutual funds like liquid funds or ultra-short duration funds.

- Before investing in any overnight funds, investors should measure the performance of a particular fund based on a week or one-month performance as they mature overnight. In addition to this, the returns and expense ratio is also to be considered as a higher expense ratio that will reduce the final returns. An expense ratio is an amount that is charged by the fund annually for managing the investment portfolio.