An investor sometimes gets swayed with emotion and becomes passionate with the idea of earning money in the stock market but in the process forgets to calculate the possible returns that an investment can give.

As time passes, an investor will need to monitor the performance of investment to help move closer to financial goals. For assessing the performance of the investment made, there are certain metrics such as IRR (Internal Rate of Return) and ROI (Return On Investment). Let us understand more how these metrics can benefit an investor.

What is IRR (Internal Rate of Return)?

IRR (Internal Rate of Return) is a financial metric through which we can estimate the profitability of the project, business or investment. In other words, it is an annualised rate of return from an investment made.

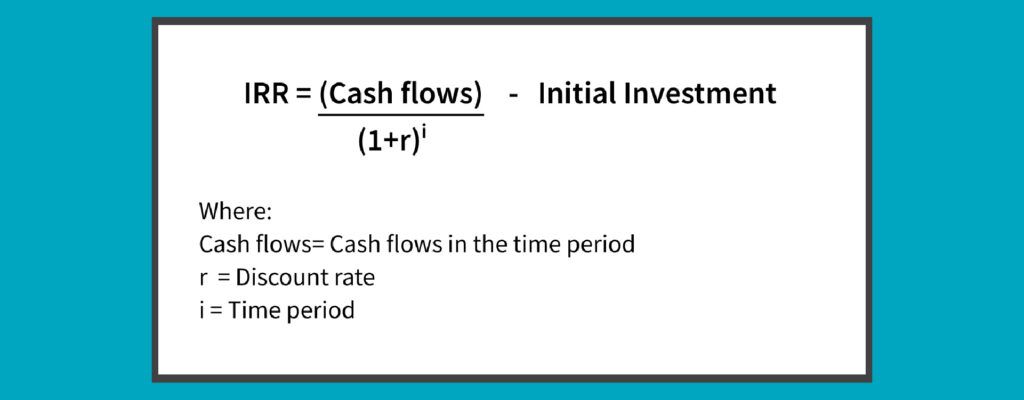

Mathematically, IRR’s definition is the discount rate in which the present value of cash flows from the investment made equals the initial investment making the net present value (NPV) zero. NPV here is the value of the sum of cash flow returns of an investment spanning over the investment cycle equalling the initial investment made.

How is IRR to be calculated?

The formula of IRR is based on NPV’s formula itself, which mathematically is denoted by:

‘‘

Metrics such as IRR (Internal Rate of Return) and ROI (Return On Investment) help assess the performance of the investment made.

Let us understand how it is calculated. Say, we have made an investment of Rs 10,000 in the first year and are supposed to get Rs 12000 as returns in the second year, now here we will calculate the IRR.

Initial investment = 10000

Cash flow in first year= 12000

As per the formula

NPV=0= -10000/ (1+IRR) ^0 + 12000 (1+IRR)^1

0 = -10000 + 12000 (1+ IRR)

10000 = 12000 (1+IRR)

So, here 1+IRR = 1.2

IRR= 20 %

If NPV is positive it means that the estimated future discounted cash flows are greater than the cost of the investment and the investment makes sense.

What is Return on Investment (ROI)?

ROI calculates the percentage increase or decrease of return of a particular investment over a set time frame.

ROI = Expected value-Original ValueOriginal value ×100

It is an accurate metric for calculating returns for a certain period of time and can be calculated for any type of activity for any investment.

Let us understand the ROI calculation, say we have invested Rs 30000 and the expected to give returns worth Rs 40000 then the ROI becomes,

ROI = 40000-30000/ 30000 * 100 = 33.33%

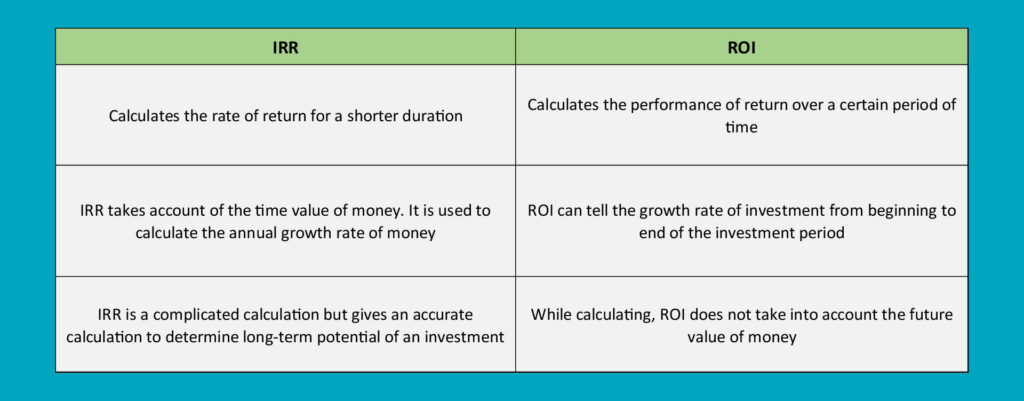

IRR vs ROI

Here are the key differences between ROI and IRR.

Which should be considered -IRR vs ROI?

Due to its simplified calculation, ROI is mostly used to calculate the total growth of investment from start to finish, while IRR calculates the annual growth rate. Investors generally consider the metric where the calculation of returns also includes the additional costs. However, companies generally use IRR to understand that for a new project or new development to know the estimated return on such investment.

The IRR helps companies to compare and rank projects based on the return, the investment with highest possibility of rate of return is usually preferred. IRR is widely used in analysing the returns in investment on private equity by venture capitalists, since it involves multiple cash investment over a period and a cash flow at the end through an IPO or sale of a business.