It’s great that you want to grow your business. But how do you ensure you are on the right path? Probably you have heard the phrase “If you don’t know where you’re going, you might not get there.” Well, it holds true for businesses too. And hence you need to know and learn from your competitor’s financial statements for your own financial benchmarking. As a business, you need to understand where you stand in terms of finances with respect to your competitors. Financial benchmarking can help you set internal goals, find new market opportunities, identify your strength and your competitor’s weakness to shine through. Financial benchmarking has many other benefits too.

Where do you find the financial statements of your competitors?

If you were a large enterprise, it would have been easy and fairly simple. You would hire a consulting firm, subscribe to a huge database, and ask the consulting firm to find the problem, analyse them, and send you a solution.

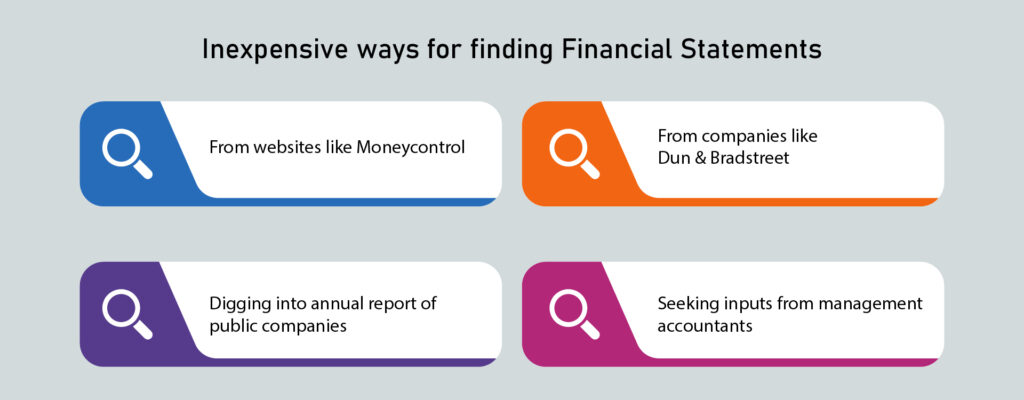

But as a new business or as a start-up, this is out of the question. It is expensive and most likely out of your budget. So how can you go about digging in such information? Thankfully, there are few inexpensive ways to find this information.

- Identify your competitions and gather data. Try to identify companies that are of your size and preferably in your geography.

- Choose the right industry that closely represents your business.

- Choose the source carefully so that there is a lot of data and not a skew done by a handful of companies.

- For sources, check out your industry association. They are the best source for the information you are looking for.

- The annual report is another source to dig in information for public companies.

- If you have an established banking relationship, your banker can be an invaluable resource to gather inputs about your competitors. A banker looks at ratio analysis data all the time, so they can always share some noteworthy inputs with you.

- You may also gather financial statements from companies like Dun & Bradstreet. This company offers individual company data on sales, nature of financing, creditworthiness, balance sheet, income statement, public filings, lawsuits, etc.

- You may also seek inputs from your management accountant. They are specialised in this area and are professionally equipped to guide you on improving your ratios and how you can make your business more profitable.

‘‘

If you don’t know where you’re going, you might not get there.

Become familiar with reading financial statements

Now that you have gathered the information about your competitors’ financial statements, it is important to learn how to read them. Only when you can make meaningful interpretations and analyse the balance sheets can you significantly learn from it.

However, financial reporting is a complex matter and diverse too. So, here are some tips to get started.

- Financial statements are filled with financial jargon. It can be overwhelming to understand everything, but an excellent financial dictionary can help you a lot.

- Read the accompanying notes. Every financial statement is provided with some accompanying notes. Pay attention to them to understand the financial statement properly.

- The financial statement of a company reflects the company’s financial stability. However, these numbers become easier to understand and more meaningful when you can understand the underlying realities and fundamentals. For example, it is important to understand what the company does, its products, and its business model before you delve into the numbers.

- Know that no financial statements are made in a single mold. There are different reporting patterns that each company follows. Also, know that the diverse nature of business activities leads to a diverse set of financial statements. So don’t feel overwhelmed with a diverse reporting structure. Instead, take your time to get familiarized with it.

- A financial statement also has several nonfinancial information. For example, you may find information on the state of the economy, competitive considerations, market forces, introduction of new technologies, workforce, etc. Although these are not directly reflected in a company’s financial statements, they play a larger role in how those financial statements look. How do you compare the competitor’s data with yours?

- You may come across something called a consolidated statement while studying the financial statements of your competitors. A consolidated statement of a parent company and its subsidiaries means it represents its separate legal entities. You may consider a consolidated statement as one entity rather than considering separate statements for different entities.

So, you have the data, and you have learned how to read them. The next step is to determine how you can compare the competitors’ data with yours? For example, if you have a 15 percent net profit, is that good or bad? How would you determine that? It depends on a lot of things like the history of your business and the industry you are in, and how your competitors are doing. To evaluate your business against your competitors, you would need data like gross profit ratio, current ratio, net profit ratio, etc. Although there is much other data to consider, it is always good to begin it simple and not make it too overwhelming.

Here are some of the key ones

Net profit ratio: You need to calculate this by taking your gross profit less your overhead expenses to arrive at the net profit value. Now divide this amount by your sales income to give you your net profit ratio.

Current ratio: Take your current assets and divide them with your current debt. This will help you determine if your business is liquid. For example, are your liquid assets enough to pay your short-term obligations?

Gross profit ratio: You calculate your gross profit ratio by taking your income less your direct materials and costs of goods sold. You then need to divide it by your total sales to get your gross profit ratio.

Three important financial ratios that every founder should know

A financial ratio is an important marker for qualitative analysis of your business. It also helps you to do an accurate comparative analysis with your competitors. Here are three important financial ratios that you should know.

Profitability

Profitability is another ratio that calculates how much profit the competitors are making by selling their services or products. The most common profitability ratio is the gross profit margin calculation. So, what is the gross profit margin? You can calculate gross profit margin by subtracting the cost of goods sold from sales and dividing by sales. The profitability ratio is a good indicator for businesses to understand their income on aggregated sales of a particular product line. While a high percentage ratio indicates that companies are making good money, a low percentage means they are not making enough.

Liquidity

If you are keen to learn your competitor’s ability to meet their short-term financial obligations, liquidity ratios would be the ones that you need to check out. This is a great indicator to determine how well a company is performing under its short-term economic conditions. Liquidity ratio analysis includes the current and quick ratios.

To get the current ratio, you need to divide current assets by current liabilities. If you find the ratio high, you need to understand that the business finances with its cash. It also indicates that the company can withstand short-term economic downturns.

On the other hand, to determine the quick ratio, you need to subtract between the current assets and inventory divided by current liabilities. This ratio is an indicator of how a competitor is doing to pay current liabilities without selling its inventory. A high quick ratio is always preferable by businesses, just like the current ratio.

Financial leverage

This ratio can help you calculate the company’s long-term solvency. This ratio can help you gauge and understand how well your competitors are using debt and equity financing for business operations. Know that the debt ratio and debt to equity ratio are the two most popular financial leverage ratios that you should be knowing.

‘‘

While checking the financial statements of your competition, pay special attention to essential numbers like gross margins, operating and net profit margins, etc.

Debt ratio

When you divide the total debt by your total assets, you get your debt ratio. A debt ratio empowers you with vital information like how much debt your competitors are investing in acquiring business assets. It is usually calculated as a percentage where a low percentage means the company is financing its business operations with cash rather than debt. A higher debt ratio means it’s the other way.

On the other hand, a debt-to-equity ratio is the value of total debt divided by total equity. This ratio helps you determine how much money your competitors are receiving from private investors or the founder’s investment. It is usually expressed in a percentage.

Price Strategy Matters

You may be tempted to compare your price strategy with your competitor’s while doing a financial statement analysis. But know that competitor-based pricing works well only when the market is saturated, and it is a well-researched market. Often competitors overstate their pricing abilities. Thus only 8-15% of all businesses can do value-based pricing based on customer’s ability and willingness to pay. If you are doing strategic pricing (pricing based on a competitor’s pricing model), know that you can risk a price war that can lead to a huge loss for everyone. Ultimately a business has to be profitable, and you should not compromise on that.

What to learn from the competitor’s finances?

Understanding your competition is the first step that every business should take to strengthen its foothold in the market. While there are several benefits of understanding the competitors, checking up on the financial statement of the competition is probably the best way to benchmark your strategy. While checking the financial statements of your competition, pay special attention to essential numbers like gross margins, operating and net profit margins, etc. Also, check the salaries and compensations the competitor is offering to its employees. This is another important parameter to keep a tab on. Don’t miss to check out their sales and profitability trends too. This is a significant indicator to help you understand how your competitors are doing. Check on their marketing trends and marketing budgets too. It is essential to check their marketing expenses as a percentage of their revenue and note the differences in your financials. Try to understand what are the factors that are causing this discrepancy. Do the discrepancies need your attention? Is there anything you can do about it?

Another aspect that you need to check is how your competition is using the money. Are they using it more effectively than yours? What can you do to turn the tables?

The key takeaways

There is a lot to learn from the financial statements of your competitors. And when you implement the positives of the findings in your business, you are better positioned to turn the table and set a stronger foothold in the market.