What does it mean by Turnover and Profit?

As the saying goes: turnover is vanity, profit is sanity and cash flow is reality. This is a meaningful statement through not wanting to conclude so at the outset itself.

At the most basic level, turnover is the total sales revenue that a business generates over a specific period. Profit is the amount of money remaining or leftover after deducting its costs for the same period. In simple terms, the turnover is the top-line, and the profit is the bottom-line of a profit and loss or income statement.

Of course, the picture is not quite so straightforward. We come across various types of profit in financial reports and related articles, each of which you calculate by deducting certain categories or groups of costs. The analogy above describes net profit which, generally speaking, removes all costs.

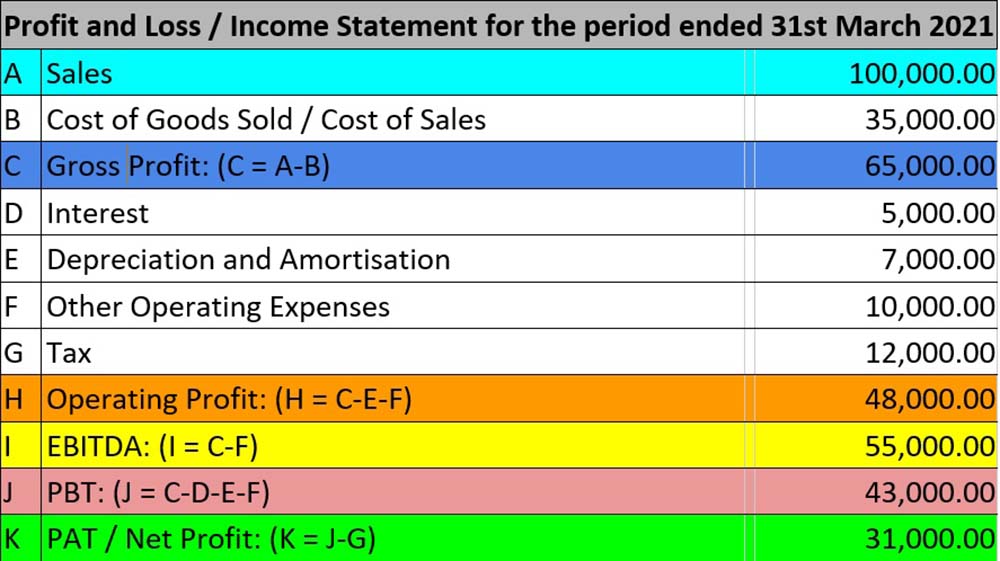

Here again, we see PBT which is profit before tax and PAT which is profit after tax. A business will also measure its gross profit, an important measurement by deducting the cost of goods sold (cogs) or cost of sales from the sales revenue, and sometimes exotic metrics such as the EBITDA which is earnings before interest, tax, depreciation and amortisation. Operating profit, also known as EBIT – earnings before interest and tax- is the business’s profit, excluding any deductions you’d normally make for interest and taxes but after deducting depreciation and amortisation.

‘‘

Turnover is vanity, profit is sanity and cash flow is reality.

Think of the profit and loss statement as a map, with turnover at the top, net profit at the bottom, and other profit metrics as destinations enroute to it.

Revenue Vs. Profit – An Overview

Revenue and profit are closely tied together. To be profitable, a business has to have revenue, or money coming in from income streams. That said, a business may have revenue but still not be profitable if the operating expenses exceed what’s earned.

You may have also heard the term net profits, which is synonymous with profits and net income. Net profit is the business’s bottom line. To calculate net profit, subtract Cost of Goods Sold (COGS), all expenses (including administrative, operating, and others), depreciation, interest, and business taxes from total sales.

To obtain a healthy profit, you need to know what level of turnover your business has to achieve. Look at the pricing of your product or services, company spending and use of your profits, and decide how each of these will help you meet your target. It would be wise to take into consideration what is happening economically, your business targets and the current situation in your industry and the market when making these decisions.

The profit your business is making determines the health of your company. This is because profit is the money you have made after meeting your business costs, so it can clearly show you if your business is in trouble or on the right track.

Profit Vs Cash Flow

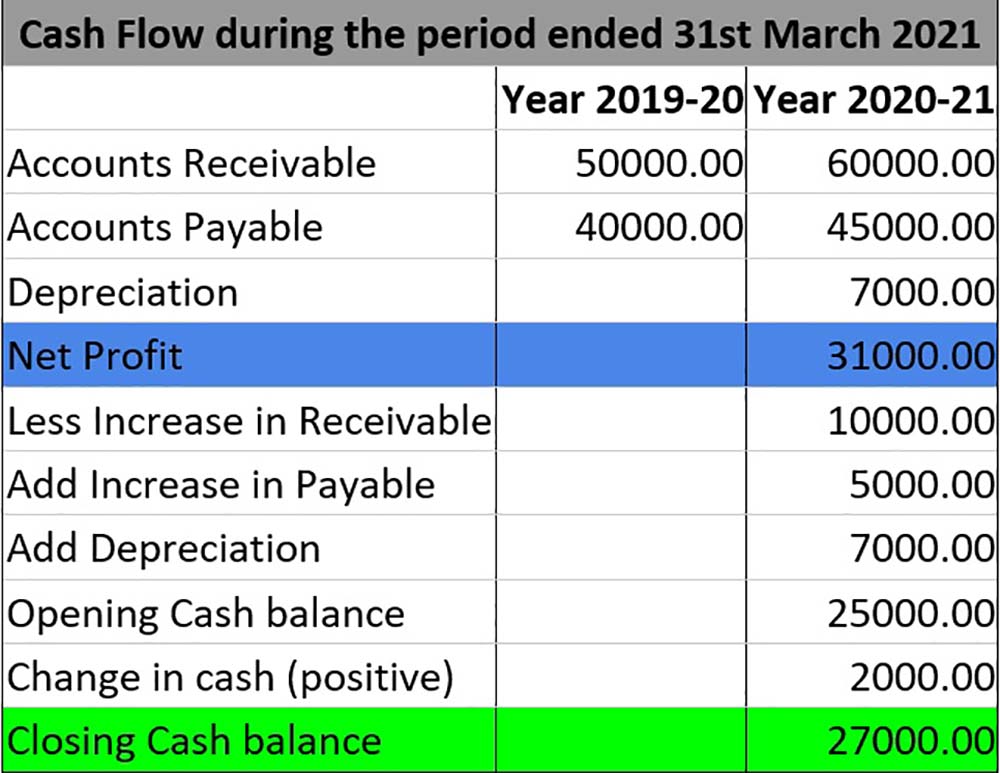

It is very important to understand the difference between profit and net cash flow. The major difference between the two is the methodology adopted to consider revenue and expenses in statements of profit and loss and cash flow. The profit and loss statement to present profit considers revenue and cost on the accrual basis and in the cash flow, they are considered based on actual receipt and payment. For the same reason, non-cash expenses like depreciation, amortisation, provisions, deferred revenue and expenses are not included in cash flow.

There are few techniques to prepare cash flow and one is the indirect method. Under this method, adjustments are made to the net profit figure derived through the profit and loss statement for the non-cash and deferred revenues and expenses.

For example, to calculate net cash flow from net profit consider the following

- Depreciation and amortisation are added back to profit (profit and loss) since they were deducted to derive the profit amount.

- Depreciation is a non-cash expense in the year of reporting though there was a cash outlay when cash was invested in the respective asset.

- Such above-mentioned cash investment in the asset is taken in cash flow in the year of investment.

- Customer invoices raised and shown in profit and loss but not collected are deducted from profit, supplier invoices accounted for and shown in profit and loss but not yet paid are added back to profit.

- Deferred revenue and provisions for expenses are reduced and added respectively.

‘‘

Profitability is, of course, critical to a company's existence, but growth is crucial to long-term survival.

Turnover (Revenue) or Profit: Which is Important?

Overview

The immediate answer to this question is – both. In normal circumstances, both are important and profit is relative to the revenue meaning more revenue will return more profit and a dip in revenue will result in loss or decreased profit.

However, focusing on turnover, in isolation, is not always the answer. You can have all the sales you like but if you’re spending more than you’re bringing in, the business won’t last, let alone grow.

Making a crore rupee in turnover is not the same as putting a crore rupee in your pocket. Out of this crore in turnover, you need to pay for the expenses incurred towards producing and or delivering the final product or service that you are selling. The expenses include costs of materials, pay for your staff, premises and all the other costs required to be spent for running the business. What you put in your pocket is likely to be nowhere near the crore you earned as total sales.

In addition, if the business is growing rapidly you will need to invest in more stock, more debtors, better resources, good technology tools, bigger premises and the like. The result can often be that whilst your top line is growing, you’ve got no cash. This is a dangerous situation.

This applies also to established businesses that have been around for a long time but have found “the next big thing”, and invest heavily in growing business in that new area. Often, rapid growth in sales is built on the back of aggressive pricing by buying market share. That might be a good strategy for the short term, but sooner or later you have to make money out of those sales or your business is likely to perish.

Profitability

When the business grows in sales rapidly it is generally a good time to improve margin by getting a good price, even at the risk of losing sales. In other words, you’ve acquired and retained a loyal customer line, and sales are growing strongly but you’ve never made a profit. Though this is not a hard and fast rule, the ideal situation is to increase sales and profit in sync unless certain thought-out strategies are in place and the business owners are well aware of this.

Profit goes directly to the owners of a company or shareholders, or it is reinvested in the company. Profit, for any company, is the primary goal, and with a company that does not initially have investors or financing, profit may be the corporation’s only capital. On the other hand, revenue is shared among many stakeholders like suppliers, employees, lenders and finally the shareholders.

Without sufficient capital or the financial resources available to sustain and run a company, business is certain to fail. No business can survive for a long time without making a profit, though measuring a company’s profitability, both current and future, is critical in evaluating the company. Although a company can use financing to sustain itself, it is ultimately a liability, not an asset.

Growth

Determining and focusing on profitability at the beginning, or start-up, of a company, cannot be avoided. At the same time, growth of market and sales is the means to achieving that initial profitability. Identifying growth opportunities should become the next important item on any company’s long term goal list after a company moves beyond the early-stage start-up phase.

Growth for a business is essentially an expansion, making the company bigger, increasing its market share and ultimately making it more profitable through the synergy of strengths and economies of scale. Measuring growth is possible by looking at some pertinent metrics, such as overall sales, staff strength, market share, and turnover.

Though the present profitability of a company may be good, growth opportunities should always be explored, since they offer opportunities for greater overall profitability and keeps analysts and potential investors interested in the company.

Growth enhances the value of your business. Having a proper understanding of the present condition of any company is essential to creating a successful growth strategy. If a company has too many weak areas, such as performance, sales or marketability, a premature attempt to grow can ultimately collapse the business. A first step is the consolidation of current markets, essentially meaning the lockdown of the current state of a company before attempting to alter it with growth.

There is Only One Key Measure of Overall Business Performance, And it is Not Revenue.

Start-ups and fast-growing companies need to be aware that growth can be both good and bad. To be successful and remain in business, both profitability and growth are important and necessary for a company to survive and remain attractive to investors and analysts.

At a broader level, you have two options to increase your margin, either by lifting prices or buying better. In other words, by increasing the sales realisation or reducing the cost. Your rate of growth may slow down but you make more money and you’ll find improvements in your cash flow.

You’ve invested money in your business and you should understand how much and what profit you need to generate to earn an attractive return on that capital invested. This is called your return on capital employed (ROCE). You should get a return on your investment that is better than the return you might get in other alternative investment opportunities. That is the real test of the performance of your business. Though not part of this discussion, the return has to be read in terms of present value using discounted cash flow techniques.

The Bottom Line

Profitability and growth go hand-in-hand when it comes to success in business. Profit is key to basic financial survival as a corporate entity, while growth is key to profit and long-term success. Investors should weigh each factor to understand which one, revenue or profit, is more important at a particular point in time of your business as they are correlated and interconnected. The importance can change from revenue to profit and vice-versa spending on the stage of your business.

We won’t go into more details about various economic and financial theories which depict different pictures than what we see at the first look. It is not always true that profit is linearly proportional to revenue. Sometimes, you may make more profit, not only in terms of a per cent but in an absolute amount too, on lesser revenue. It all depends on many factors like the cost structure – the proportion between variable and fixed costs-, dynamics of pricing – whether market decided or business decided-, whether in a monopolistic or competitive market, the status of your product or services in the market and many such factors.

Profitability is, of course, critical to a company’s existence, but growth is crucial to long-term survival. A growing company may not be earning any profits yet, but may nevertheless provide a great investment opportunity. Last but the least, you need to look at both profit and cash flow as they give different perspectives to profitability.