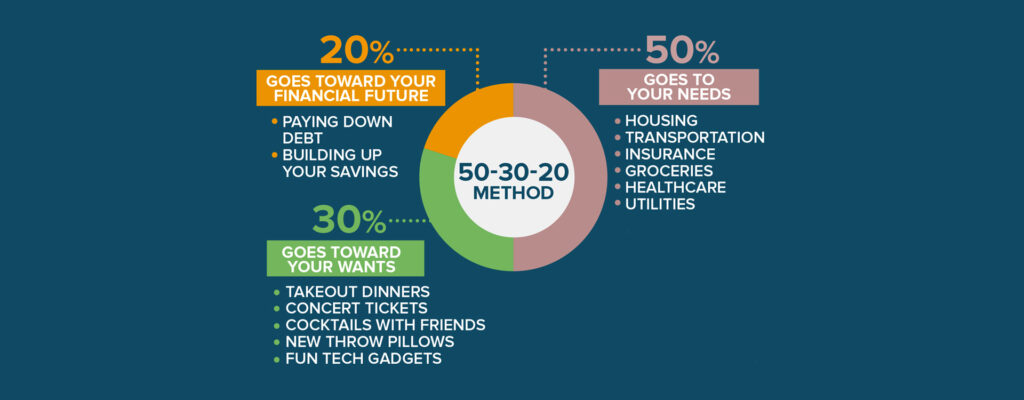

Every salaried professional or businessperson who gets a fixed income each month is aware of the importance of dividing expenditures into parts so that every commitment is taken care of. For example, apart from fixed daily and monthly expenses, your income must also accommodate savings, investments and bill payments in equal proportions. The 50/30/20 rule in the basic sense is the division of your monthly expenses as follows:

- 50% – Needs (Necessary expenditure)

- 30% – Wants (Expenses that are not mandatory which you wish to undertake)

- 20% – Savings

What is the 50/30/20 rule?

The 50/30/20 rule is a planned method for expenditure by segregating one’s expenses into three categories

- Indisputable expenses

- Hearty expenditures (maybe on a car down-payment, a vacation, or a new gadget)

- Savings

If handled well, this money rule will allow an individual to easily meet all kinds of investment goals. It’s a simple, yet smart monthly budgeting rule that will allocate your income into different fields. It will provide you with a clear picture of your finances for each month. The 50/30/20 rule is applied on the ‘after-tax’ income. To calculate your after-tax income, subtract your tax liability from your total income to obtain your net ‘after-tax’ income.

‘‘

The 50/30/20 budgeting rule helps achieve financial stability by identifying the problem areas in your finances.

How does it help investors meet investment goals?

The 50/30/20 budgeting rule helps achieve financial stability and will help you understand the problem areas in your finances to fix them accordingly. Here’s how you can categorically divide your income to meet your investment goals:

Essential expenditure

By restricting your essential expenditure to 50% of your income, you will be able to successfully fulfill your financial commitments that are unavoidable including paybacks, household expenses, dependents expenditure (children, spouse, family), fuel costs, rent/mortgage payments, etc. This will give you enough legroom to focus on investments while keeping you safely within your obligations.

Discretionary expenditure

Also perceived as ‘lifestyle expenditure’, these are not strictly necessary but are light-hearted expenses including casual shopping, travel, fine dine bills, etc. which are allotted a 30% share in your monthly income. They can be dodged but you are welcome to accommodate them in your monthly expenses as long as they don’t cross the assigned threshold. Discretionary expenses tend to balloon uncontrollably and are hence dependent on the individual’s ability to restrict themselves and their vision for their financial goals.

Investments

The third and most important part of your investment goal setting is to smartly divide 20% of your income for saving and investing purposes. This is the most crucial aspect since it will take you closer to your financial goals.

Expert advice

A calculator for your expenses

According to Jitendra Solanki, SEBI registered tax expert, the 50-30-20 rule of investing and budgeting has a high scope of implementation in India. It is helpful for an earning individual to decide how much and what needs to invest in. It’s a sort of calculator that advocates for the important and semi-important expenses.

He also advises that important and necessary expenses include the kind that are unstoppable. On the other hand, important yet not strictly necessary expenses are covered in the 20% of the budget allotment.

Possess wealth in ‘liquid form’

The Founder & CEO of Optima Money Managers, Pankaj Mathpal, believes that this money rule benefits earning individuals since they will have a devoted amount of investment for various goals. Additionally, it will allow them to dedicate their money for different options to help meet short-term, mid-term, and long-term investment goals.

This ‘calculator’ will also pave the way for redirecting the 30% of non-essential expenses that are unattainable during the pandemic to the 20% of allotment towards savings and investments. A lot of earners are left with surplus amounts due to lack of avenues for unimportant expenses. Backed by the social and financial lessons left behind by Covid, investors need to possess wealth in ‘liquid form’.

If you are left with savings from the unused 30% of your income, create an emergency liquid corpus from this excess amount as reserve cash in the event of loss of income source. Meet your liquid needs, following which you can increase or decrease allotment based on your various investment goals.

Takeaways for readers

Budgeting and financial planning are the toughest tasks for most individuals. By following simple money rules like the 50/30/20, you can guard against overspending and instability in your financial outcomes. Popularised by ‘Elizabeth Warren’, 50/30/20 will create a balance in your financial health since you won’t tend to overspend, nor will you have to compromise with your lifestyle.