For any newbie investor, it is essential to know that the stock market consists of two segments: primary and secondary. Let us dig deeper into knowing what happens in both these market segments.

What is a primary market?

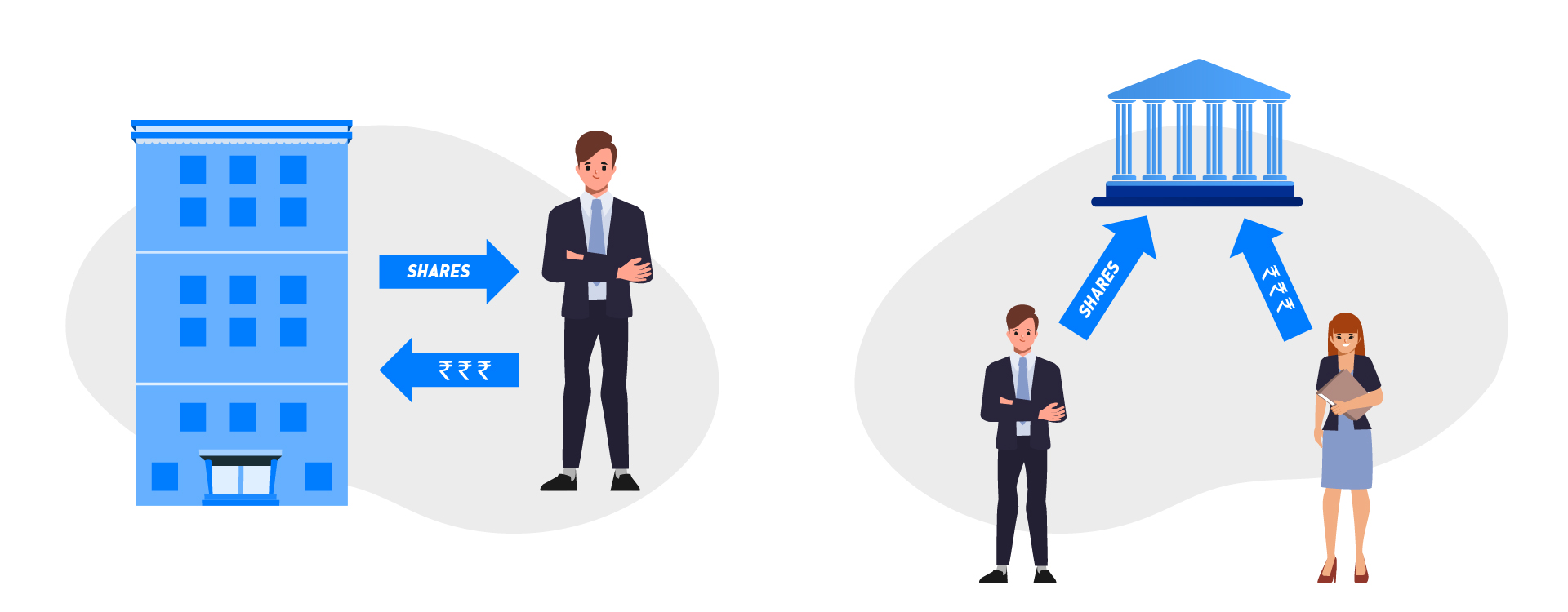

The market where a company decides to go to the public for the first time to raise funds is known as the primary market. Companies in the primary market issue IPO (Initial Public Offering) in the primary market first. The primary market offers an opportunity to retail investors to buy stocks directly from the issuing company. On purchasing stocks from the companies in the primary market, the investors help them to raise capital. The balance sheet of the company will now reflect the overall capital contributed by the investors.

Other than IPO, a company in the primary market can raise funds in the below ways:

Rights issue

In this, a company raises more capital from the existing shareholders. To its existing shareholders, it will offer more shares at discounted rates than the market price. The number of shares offered here is on a pro-rata basis.

Preferential allotment

In preferential allotment, the company issues a fresh bulk issue of shares to individuals such as venture capitalists at a pre-determined price. The preferential allotment is chosen by the company when it wants to offer its present and existing shareholders – promoters, venture capitalists, and financial institutions a strategic stake in the company.

‘‘

The market where a company decides to go to the public for the first time to raise funds is known as the primary market.

What is the secondary market?

Companies that issue their shares in the primary market get listed on the secondary market. The secondary market is where shares, bonds, debentures are traded among investors. All exchange platforms like NSE, BSE, and international exchange platforms like Nikkei, NASDAQ, NYSE, and German DAX fall under the secondary market. Unlike the primary market the trading of stocks in the secondary market involves only investors and not the issuing company. Companies listed in the secondary market indicate a benchmark for fair valuation. It is easier for investors to liquidate their shares by selling as there are a large number of buyers in the secondary market.

Other than stock exchanges, there are two more secondary markets:

Auction market: It is a platform where the individuals and institutions come together at a mutual understanding about the rate at which stocks are to be traded. The information on stock pricing and the bidding price of the offer is made public.

Dealer Market: In this kind, dealers trade on specific securities. Mostly foreign exchange trade and bonds are traded in the dealer market.

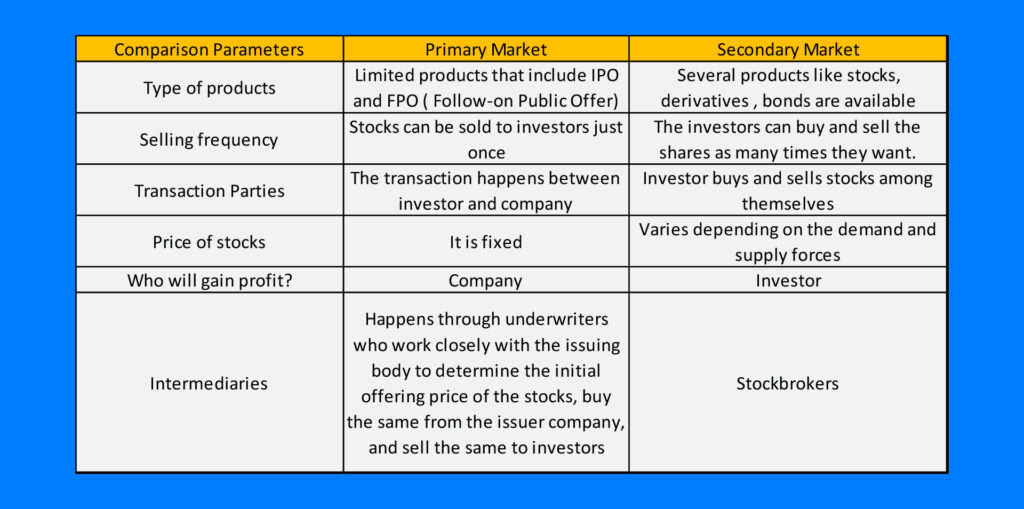

Difference between primary and secondary market