World’s largest human health crisis has ravaged several businesses and livelihoods of several Indians resulting in unemployment and pay cuts. Moreover, spendings on healthcare has increased in the second wave of the pandemic, forcing to empty a household’s savings heavily on essential covid drugs, hospitalization, and oxygen. Efforts from the government are null regarding additional tax deductions or concessions to help recover their covid related expenses, which impacts savings more. This is causing individuals to revisit their savings and think of generating more money in the wake of rising emergencies.

According to a report titled ‘Consumer Spending Sentiment Index’ by InterMiles, close to 70 percent of Indians have now placed greater emphasis on securing the future by increasing investments and savings. With millennials and GenZ being salaried individuals now, they must understand the basics of investment and type of various investment plans to avail long-term financial security and maximise savings to achieve their life goals.

‘‘

It is important to create a well-thought financial plan mapping out the right strategy to invest.

The top 5 investment plans for a new investor

Fixed Deposit

A fixed deposit is an investment plan offered by banks and non-Banking financial companies (NBFC). In this plan, people invest a certain sum of money for a fixed period at a predetermined rate of interest, to get guaranteed returns at the end of the period. The interest rates vary from bank to bank. A person can choose to invest either for a short-term period of 7-14 days to a long-term of 10 years. However, premature withdrawals of FD will incur a penalty, hence it is advisable to choose a suitable deposit period after evaluating future financial goals.

Bonds

In this investment plan, people lend money to a corporate or a government company. The money received from the people is used by the companies, government, and municipalities to finance their projects and operations. The term ‘bond’ is a document that contains the details of the loan taken, interest payment, and the time at which the loaned funds must be paid back. The individual here earns from the interest payment which is the return for loaning their money to the company or the government firm. A bond traditionally comes with a fixed rate of interest.

Public Provident Fund (PPF)

This is one of the safest investment plans in India, which is backed by the government. An individual can invest in PPF by opening an account with any bank or post office. The feature of this investment plan is that one can begin by investing money as low as Rs 100, however, for some banks, it may vary. The investors are exempted from paying taxes at every stage of investment made.

The maximum investment limit in PPF is Rs 1.5 lakh in a financial year and the minimum limit is Rs 500 to keep the PPF account active. The amount invested in the PPF account comes with a lock-in period of 15 years and is eligible for tax deductions under section 80C of the Income Tax Act, 1961.

Investing in stocks

Similar to how we need money, companies do require money for expanding their business and for future growth. A stock is a fraction of the ownership share offered by the company to its investors in return for their money. When we purchase a stock, it means we are getting a small piece of ownership in that company which is called a share.

Investors here need to be diligent while investing in a company and should have the anticipatory and research skills to understand which company or sector can or will generate profits. It requires continuous monitoring of market insights and investment trends happening in the market. Investing in stock markets gives the chance to earn the highest returns among all investment options.

Mutual funds

A type of investment plan where a trust for example – HDFC Mutual Fund collects money from several investors who share a common investment objective. The money collected from the investors is further invested by HDFC Mutual Fund in bonds and stocks. The income or profits generated by this collective investment is distributed proportionately amongst the investors after deducting the plan’s net asset value. Each investor in this plan owns units that represent a portion of the holdings of the fund collected.

Before investing in mutual funds, an investor should understand the taxation system and various charges involved that will add up as expense ratio. For higher returns, they can invest in tax-saving mutual funds such as the ELSS (Equity Linked Savings Scheme). To help investors invest in a disciplined manner, the mutual fund companies offer SIP (Systematic Investment Plan). SIP is a facility that allows an investor to invest a fixed amount of money at pre-defined intervals in the selected mutual fund scheme.

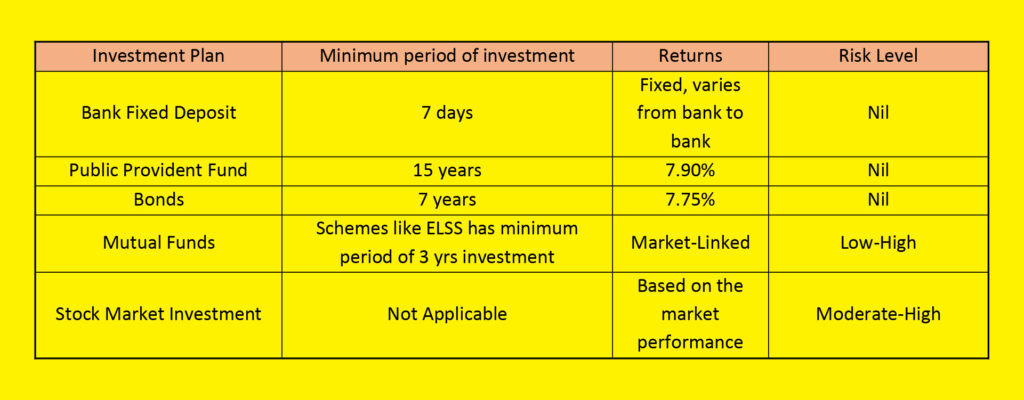

Here is an overall summary for the new investor to understand the interest rates and risk levels involved in the above-mentioned investment plans:

What is in it for the newbie investors?

In the wake of adversities brought in by the pandemic, there is a requirement of money to sustain. The newbie investors, if investing in stocks, need to invest in good companies which have good balance sheets and are market leaders who can turn the corners, as they are less likely to make losses.

Investing in mutual funds is a new found love amongst investors as data insights from Association of Mutual Funds in India reveals that the mutual fund industry has added more than 81 lakh investor accounts in 2020-21, taking the total tally to 9.78 crore. The rise in mutual funds investments can be attributed to investors interested in meeting financial goals both long term and short term.

At the end, it is important to create a well-thought financial plan mapping out the right strategy to invest. Here, experts always advise to follow the ‘Egg and Basket Rule’.