The pandemic brought unprecedented challenges that caused disruption in the functioning of businesses giving jolt to India’s economy. Amid GDP showing dismal growth, research firm Morgan Stanley analysed cyclical stocks to outperform defensive stocks as soon as the economy opens up to trade and people’s consumption returns to normalcy. The firm projected the stocks of Havells, Crompton, and Voltas to go up while its sales were impacted in the pandemic due to government regulations pausing to sell non-essential goods.

In the above case, the stocks of the mentioned companies are expected to perform well as the economy begins to improve, such stocks are cyclical stocks. The defensive stocks are those whose prices remain stable irrespective of the economic condition. Let us delve a little deeper to understand what these are and the difference between the two.

What are cyclical stocks?

Cyclical stocks are the type of stocks whose price is impacted by macroeconomic factors or systematic changes in the overall economy. The performance of the stocks is directly proportional to the economic condition – it varies with the rise and fall of economic performance. Several investors find this to be an apt opportunity to purchase stocks at their low price to sell them at a higher price to earn maximum profits.

Let us take the companies mentioned in the beginning. Companies Voltas, Crompton, and Havells are consumer durable brands. If the economy is on a growth trajectory, individuals will have savings to purchase AC, refrigerators, kitchen chimneys, etc. Therefore, pushing their stock prices to go high.

The pandemic inflicted job losses and paycuts that impacted the savings of an individual. In such times, purchasing an AC, or a TV set will be considered as a luxury or any discretionary spending. With tightened purses, people will be conscious about spending on luxury goods thereby pushing the stock prices to go down. Such stocks are called cyclical stocks. Other than consumer durables, automobile sector stocks are cyclical.

What are defensive stocks?

Defensive stocks are those stocks that deliver constant returns as dividends and remain resilient to the fluctuations in the stock market. The stability of the stock prices, irrespective of the economic condition, can be attributed to the nature of products that have a constant demand. For example – stocks of personal care, utilities, healthcare, FMCG remain unaffected by the swings in the stock market.

Having defensive stocks in the portfolio can prove to be beneficial since during a recession these stocks can deliver stable returns. However, there is a flip side to these stocks. The stocks tend to underperform while the economy is growing and will not deliver as high returns as cyclical stocks.

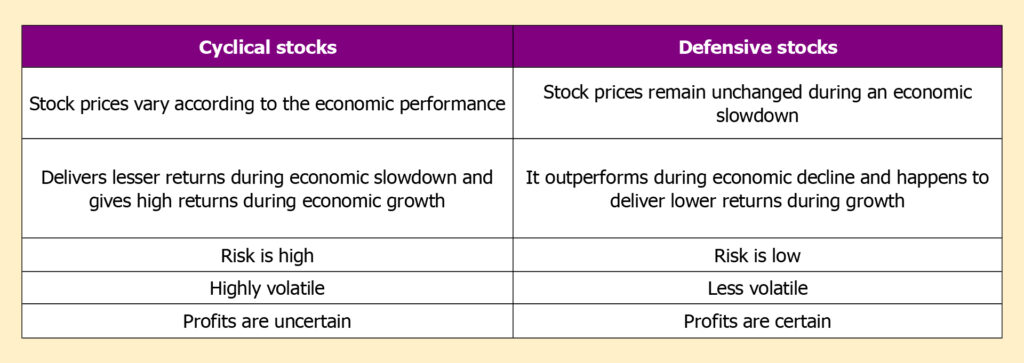

Cyclical stocks vs Defensive stocks

‘‘

The investment dilemma – Cyclical stocks vs Defensive stocks

It all depends on the investor’s ability to risk appetite. One can only invest in cyclical stocks if he/she feels to read the market sentiment and plan exit and entry from a trade accordingly. Whereas, one can invest in defensive if he/she prefers to avoid risks and enjoy stable returns irrespective of the economic situation. However, the portfolio will look more balanced if a certain percentage of capital is equally invested in cyclical and defensive stocks. By doing this, the investor can leverage the benefit of both stocks i.e. high returns during growth and stable returns during harsh economic conditions. Having defensive stocks in the portfolio acts as a protective shield. Stocks of reputed companies can absorb market fluctuation and remain unaffected by market volatility.

The trick is to understand the nature of stocks and how they will respond to the economy, which is known as the top-down approach. Alternatively, investors can adopt a bottom-up approach that will require them to thoroughly investigate the company, its background, and financial performance to make an investment decision.

Will cyclical stocks roar in a post-pandemic world?

Afraid to incur losses during the pandemic, the investors shifted their investment to defensive stocks of Pharma and IT. But, with vaccination drives growing at a rapid pace, the cyclical sectors can make a comeback since the availability of vaccines can bring businesses back to normalcy.