The retail investors were startled when they witnessed the stocks of three out of six listed companies of Adani group began hitting the lower circuit limits on June 2021. The stock values of overall Adani went down by 20%.

It can make any investor anxious looking at the stock prices jumping a never seen before high or low and, this is natural.

In the above case, a term circuit limit has been mentioned. Let us dig deeper to know what are circuit limits and how are they of use to investors

What is a circuit limit?

A circuit limit or circuit breaker are limits that restrict the movement of indices or stock prices of a certain index on a particular day. In simpler terms, there will be no trading of indices if it goes above the set upper limit and falls below the defined lower limit, trading is paused at that time. It is a tool to protect the interest of investors that curbs extreme price movement, speculation, and market volatility with the sudden emergence of any positive or negative news resulting in panic buying or selling of shares.

These limits are based on the previous day’s closing price.

Circuit limits are defined by SEBI that are revised every day. Similar to circuit limits, stock prices have price band limits to control pricing. There are no limits set for the companies launching their IPOs.

Why circuit limits are placed?

The malpractices committed by Ketan Parekh forced SEBI to implement index-based market-wide circuit limits with immediate effect from 2nd July 2001. News and information whether positive or negative have a profound impact on the movement of indices. Any time of the trading day if news of the government’s new policy, any civic unrest, or war arises, it can result in high market volatility and panic sell or purchase of shares. Since, retail investors are almost always the last to react to the news, in case of a sudden market swing they will not have adequate time to exit the trade thereby, incurring significant losses. Let us imagine a scenario where there are no circuit limits and an investor has bought stocks of a fertiliser company priced at Rs 200 five years back. The same stock is currently trading at Rs 1000 but due to the government’s decision to refrain from the usage of Urea in fertiliser, the stock falls back sharply to Rs 100 or even lower, resulting in heavy losses for the investor. A lower limit here could have cushioned the losses.

The upper limit ensures that a stock price does not rise sharply and the lower limit restricts the stock prices to go lower.

How limits work for the Indian stock markets

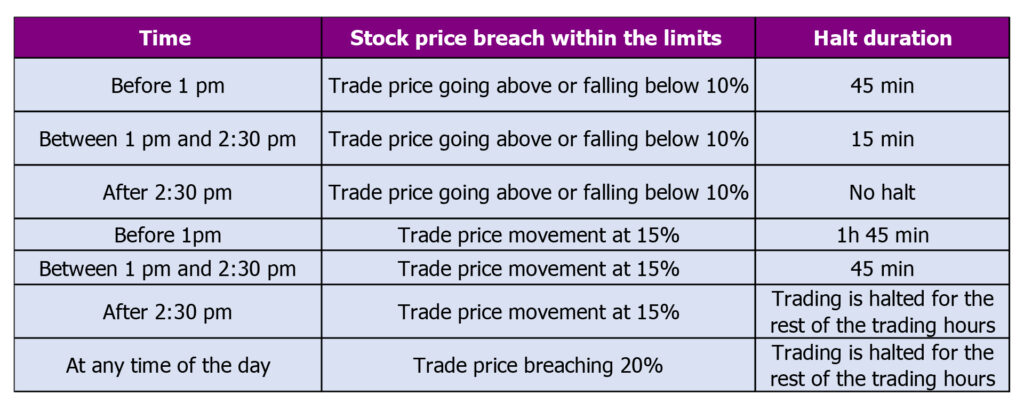

The circuit limit system of the Indian exchanges is applied at three stages of the index movement. The limits are set at 10%, 15%, and 20%. When a stock falls or increases by 10%, 15%, or 20% the trading is halted at that moment and remains paused until it resumes to the normal trading range. The limits also pause the trading in all equity and derivative markets. It is generally applied if either the BSE Sensex or Nifty 50 breaches the limits. When a stock hits an upper circuit there are only buyers present and while hitting the lower circuit there are only sellers present. Limits also differ from market to market for example in the US markets limits are set upto 7%, 13%, and 20%.

The duration of the halt after hitting the limits

The lower limit comprises of sellers only and the higher limit has buyers only, as long as there is no balance of sellers or buyers no trade is possible. Therefore, the halt is imposed until buyers and sellers are available for the trade to take place

The halt depends on the number of times a stock breaches the limits and the number of times it falls. Trading can halt for as short as 15 minutes to the whole day. Here is a table that shows halt times against breaching of limits.

New circuit limit rules

To control excessive price movement on companies listed exclusively on its platform, BSE has released a circular stating the new price brands for the movement of securities. The new circuit limit rules also known as add-on price bands will be implemented in case the price of the stock has moved 6 times in 6 months, 12 times in a year, 20 times in 2 years, and 30 times in 3 years. The stock should have a price of ₹10 or more and the market capitalisation should be less than ₹1,000 crores.