Joel Greenblatt, an American investor and hedge-fund manager, thought what could be a better lifetime gift than teaching kids the art of making money. Dedicated to his children, Joel wrote a 150-page book titled -The Little Book That Beats Market that became a bestseller in the investment space. So, what does that book have explaining a complex concept like investment within 150 pages?

Investment is simple, but not easy. His book talks about a magic formula that helps investors select the best stocks and invest in them. Let’s delve deeper to know more about the magic formula of investing and how investors can apply it to their investment to up the stock-picking game.

Joel’s Magic Formula

The magic formula investing is a rule-based disciplined investing strategy designed by Joel Greenblatt to aid investors to understand value investing theory in the simplest manner. The formula is a combination of Warren Buffets’s value investing and Benjamin Graham’s deep value approach. He emphasises investing in stocks of such businesses that are running well and can generate decent returns. To determine this, investors need to calculate ROC (Return On Capital ) and EY (Earning Yield). Based on the parameter calculated, a ranking list is created to find the top stocks.

Using magic formula, Joel has received 24 percent returns between 1988-2009.

Is the business profitable? Determine by calculating ROC

Return on Capital measures the company’s earnings before tax and interest payment (EBIT). It is the ratio of EBIT to the addition of net fixed and networking capital. Mathematically, it is denoted by :

ROC= EBIT/ ( Net fixed asset + Net working capital)

Calculating ROC helps to understand a firm’s financial strength against its competitors and the ability to convert an investment into profit. It gives an accurate result since other taxes and interest amounts are deducted.

‘‘

The magic formula investing is a rule-based disciplined investing strategy designed by Joel Greenblatt to aid investors to understand value investing theory in the simplest manner.

Will the investor receive good returns? Calculate earnings yield

Calculation of earnings per share against the current stock price indicates how much an investor will earn per share. This metric can determine if company shares are undervalued or overvalued with other companies.

How will the magic formula work here?

The magic formula helps investors purchase stocks of a good company at an attractive price through a non-emotional approach. Here are the steps to how the magic formula should be used.

- We decide upon a capital to be invested and spread it among the stocks in the portfolio. Joel suggests creating a portfolio of 20 to 30 stocks. It will be better to select companies from the large-cap.

- Calculate EPS and ROC of each company

- Create a third column for the magic formula ranking. The ranking of the stocks will be the addition of EPS and ROC values.

- The best companies are the ones that rank lower since high EPS and high ROC value. Therefore, the lower the rank the better is the company to invest.

After the ranking

Let us understand how we should systematically invest after segregating the best companies from the ranking. Nowadays, investors and traders use stock screeners to segregate stocks based on user-defined metrics. Traders can set their conditions such as market capitalisation, ROC, and EPS following which the platform displays the companies.

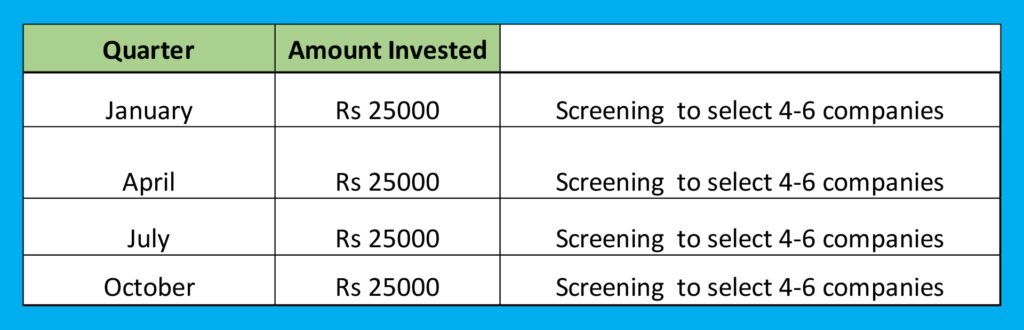

Let us imagine a scenario where the total capital for investment is Rs 10000. The investor plans to invest quarterly by investing Rs 2500 by purchasing stocks of 4-6 top companies.

Here, from this table, we can see that the investor has chosen to invest quarterly Rs 2500 in purchasing stocks of 4-6 companies in the 1st quarter. In the second quarter, the investor using the stock screener again finds out the top-performing stocks of 4-6 companies to invest Rs 2500, and this cycle of screening first and then investing goes on till the last quarter. By, the time of last quarter i.e. October the investor has invested in stocks of at least 20-30 companies.

Now, we sell off the stocks after a year of holding them. For example, the stocks bought in January 2021, will be sold in January 2022, and stocks of April 2021 to be sold in April 2022, and the cycle continues till October. After selling stocks in each quarter, more new stocks of companies will be bought. In this manner, the portfolio of the investor will always consist of investing in 20-25 companies every year.

Now, in order to realise the fruits of the magic formula this continuous cycle of selling and buying of stocks should continue for 4-5 yrs. Therefore, investors here need to be patient as unlike other investment plans where they receive returns within 3-4 months, this magic formula lays the fruits of its investment over the continuous period of investing in 4-5 yrs.

The biggest advantage presented by the magic formula is the most convenient way of building a portfolio due to the calculation of only two parameters ROC and EPS.

Now, this raises a question: If this magic formula investing is indeed magical, then why is it not used by some investors?

Is it indeed magical?

The reason why some investors don’t choose to apply this formula is that it demands consistency in investing after every 3-4 months. Meanwhile, those investors lack the patience of expecting returns or profits after a year of investment. During emergencies, investors expect securities to be liquidated easily. This forces investors and fund managers to resort to short-term investment strategies.

Analysts and fund managers are wary of using the magic formula since it might shrink their client base in case they fail to produce returns after a year. It is not necessary that if the magic has worked in the American stocks market it will work in the Indian financial market as well. In Joel’s survey spanning 17 years, there has been a situation wherein every four years the stocks have given dismal returns even lower than the market returns.

Word for the investors

The magic formula allows investors a simple method to conveniently identify the overvalued or undervalued strategy. Every investment strategy has some drawbacks but investors, for experimenting, can invest at least 5-10% of their investment capital using this strategy.