Due to simplicity and low to moderate risk factor, mutual funds are often the most sought-after investment option. Since one can begin investing with as low as Rs 500, it is the simplest and effective investment for amateur investors to create wealth and secure their financial future. According to the data from the Association of Mutual Funds in India (AMFI), the pandemic did not deter people from investing in mutual funds. In 2020-21, the mutual fund industry added more than 8.1 million folios than 7.29 million in 2019-20. But, before we begin to invest, one must have clarity regarding strategies of investing strategically in mutual funds.

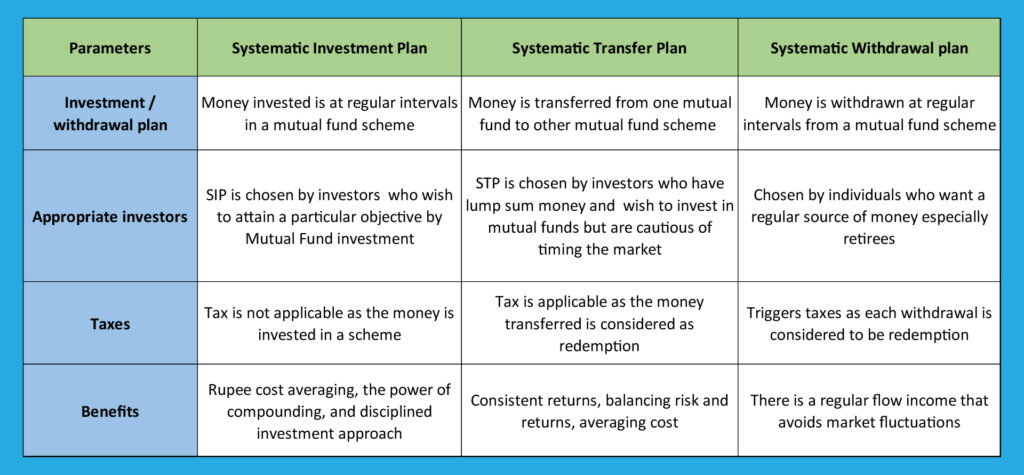

Systematic investment planning (SIP), systematic transfer plan (STP), and systematic withdrawal plan (SWP) are strategic methods of investing in mutual funds that an investor should know about.

What is systematic investment planning (SIP)?

A systematic investment plan (SIP) is a tool for investing in mutual funds where we invest a fixed amount at regular intervals. The facility also offers flexibility to investors to invest a smaller amount every month. For instance, one can invest Rs 1000 in a mutual fund scheme every month, and suppose the individual is promoted or receives a hike in salary, he/she can invest Rs 1200 from next month.

SIPs help in disciplined investment and are a convenient tool that reduces the probability of making losses due to market fluctuations, preserves capital, and is an effective way to double wealth.

‘‘

In 2020-21, the mutual fund industry added more than 8.1 million folios than 7.29 million in 2019-20.

What is a systematic transfer plan (STP)?

Unlike SIP, where the transfer of money takes place from a savings bank account to a mutual fund plan, STP transfers money from one mutual fund plan to another. In STP the funds are transferred at regular intervals from one mutual fund scheme to another of investor’s choice. It is considered to be a smart strategy to reduce risks and balance returns since at times market conditions might prove to be unfavourable to the mutual fund scheme chosen by the investor thereby giving low returns. Therefore, it will be smart to shift the investment to other profitable mutual fund schemes.

The transfer in STP takes place by investors selecting a mutual fund from which the transfer should take place to put in another mutual fund. The transfer of money can happen daily, weekly, monthly, or quarterly based on the STP chosen and the options available with the asset management company.

Systematic transfer plans are of three types

Fixed STP: A fixed sum of money is taken from one mutual fund to another.

Capital appreciation STP: The profit earned by investing in a mutual fund is invested in other.

Flexi STP: The money to be transferred varies. Here, the minimum amount is fixed by the amount decided by the investor and the maximum amount has no limitations, and depends on the volatility in the market.

What is a systematic withdrawal plan (SWP)?

The above two facilities in mutual fund investment were related to investment, but a systematic withdrawal plan (SWP) is about withdrawing money invested in any mutual fund scheme at regular intervals. Sometimes, lower interest rates on mutual fund schemes make investors afraid of meeting their income needs. This problem is solved by mutual funds by offering an investment plan in which fixed amounts at regular intervals can be withdrawn on a monthly, quarterly, and yearly basis. The regular withdrawal from mutual fund investment thereby creates a regular flow of money. SWP also offers tax benefits where instead of earning profits in one go, it offers earnings in multiple intervals lowering the total tax.

The difference – SIP vs STP vs SWP

Lastly, the three different investment tools SIP, STP, and SWP depend upon the risk appetite of the investor. There is no right or wrong way to invest in mutual funds using these tools. STPs are suitable for investors if they have excess funds but are wary of market risks. STPs are a transfer from debt to equity funds that give investors stability, security, and higher returns. The regular withdrawals from SWP plans help investors to receive significant returns from funds and seek a source of income from it. SIPs on the other hand make an investor disciplined with his/her investment.