Companies can finance themselves in two ways. One is through equity financing, where the company dilutes a part of its shares for retail investors for collecting funds and in return promising ownership in the company and a fraction of profits. The second way is through debt financing where companies take loans from banks or the public in the form of bonds or debentures. Bonds and debentures, although similar, are still different and create confusion among the investors. Let us deep dive a little to know more about how bonds and debentures differ from each other.

What are bonds?

Companies require money for financing several projects for expansion, acquisition, or strengthening research and development for which they seek loans from the public. Bonds are investment securities where an investor lends money to a private company or a government firm for a fixed time period in exchange of regular interest payments. The interest payment from the firm can be either cumulative or annual.

After the bond reaches its maturity period, or the time promised, the company or bond issuer returns the investor’s money. A bond is also secured with collateral. This means that in case a company wraps up, it will liquidate its assets to pay money to its bond investors. Fixed income is also a term used to describe bonds since the investment earns fixed payments over the life of the bond.

What are debentures?

Similar to bonds, but a little different, debentures are unsecured investment instruments that are not backed by any collateral. Not secured by collateral means, if a company shuts down investors will not be able to recover the money they invested. Since there is no collateral involved the interest rates offered are also high in debentures. Corporations collect funds through debentures when there is a financial crunch or there is a plan to expand their business with a new project.

‘‘

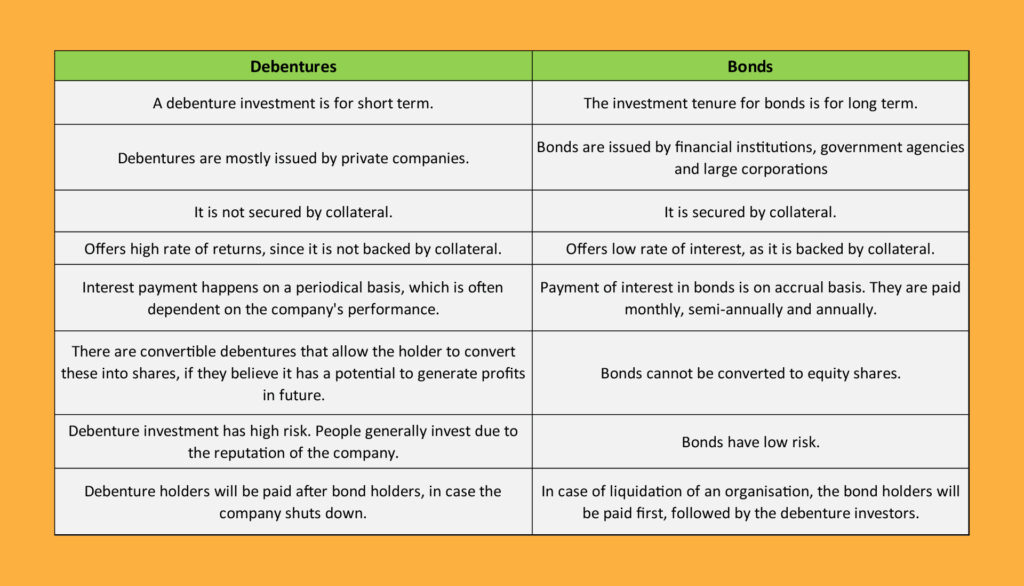

Debentures vs Bonds - has always remained a dilemma for investors. Although, the investment instruments are similar but investors should know the thin line between the two.

Debentures vs Bonds – The difference

Apart from collateral, there are several other parameters that differentiates the two from each other.

Types of debentures

Depending on financial goals and objectives, a company can issue various types of debentures.

- Convertible debenture:

The debentures can be converted into equity shares after a pre-decided time and pre-decided price. All this information is mentioned in the debenture certificate. After converting the debenture, the investor will be receiving the dividend and share price growth given by the company along with the fixed interest.

- Non-convertible debentures:

These debentures cannot be converted into equity shares.

- Registered debenture:

The debenture is issued in the name of an individual and can be only transferred by a transfer deed. The interest is paid only to the individual whose name is mentioned in the debenture certificate.

- Bearer debentures:

The debenture certificate does not have the name of any individual and is transferable by delivery. Whoever has this debenture is eligible for receiving interest.

- Redeemable debentures:

In this type, the date on which the investors will get their invested money is mentioned on the company’s debenture certificate. On the said date, the company will have to return the principal amount to the debenture holder.

- Irredeemable debenture:

It has no such specific date mentioned which makes the debenture continue for infinity. There is no fixed date for paying the debenture holder. It is redeemable only when the company goes into liquidation.

The dilemma of an investor – Debentures vs Bonds

It depends on the risk appetite of the investor. To some investors, debentures can be attractive as it offers high-interest rates. An investor in this investment plan puts money based on the face value or trusting the issuer company’s strong reputation. But, here the investor should ascertain the quality of the issuer by checking the credit rating of issuers. Credit agencies give opinions about the creditworthiness of issuers with grades as AAA, AA, etc.

Investing in bonds, on the other hand, is simpler and has low risks due to collateral as there is a defined maturity with fixed returns where the bond issuer commits to pay back the invested amount on a specified date.

Hi Shalmoli,

In your point of view can you review Assetmonk’s Vertex opputurnity.

They are raising fund in the form of NCD’s with a collateral.