If you are following stock market updates, you must have heard the buzz around these two recent cases:

Standard life sold 10.65 million shares or a 4.99 percent stake in HDFC Asset Management Company at Rs. 2,873.8 apiece through a bulk deal on the BSE.

Nalanda India Equity Fund sold 517,765 shares of Just Dial at Rs. 991.4 apiece through a bulk deal on the National Stock Exchange.

The above two cases are examples of bulk deals happening in the stock market.

There have been several such instances when we are up in the morning to get the news of huge movement happening in the stock markets whether positive or negative within a few minutes of market opening and eventually setting the pace for the market.

What is this market phenomenon that involves a huge volume of shares being traded?

The investors of the stock market comprise retail investors and large institutions involving investment banks, mutual funds, hedge funds, pension funds, foreign institutional investors (FIIs), high net worth individuals (HNIs), company promoters, etc. The latter set of investors have deep pockets and intensive knowledge of companies which is sometimes not available to the retail investors. Leveraging their knowledge and money they conduct share transactions of high value. There are two types of transactions done by large and institutional investors – block deal and bulk deal. Let us delve deeper to know what they are and how such heavy deals impact the market.

What is a block deal?

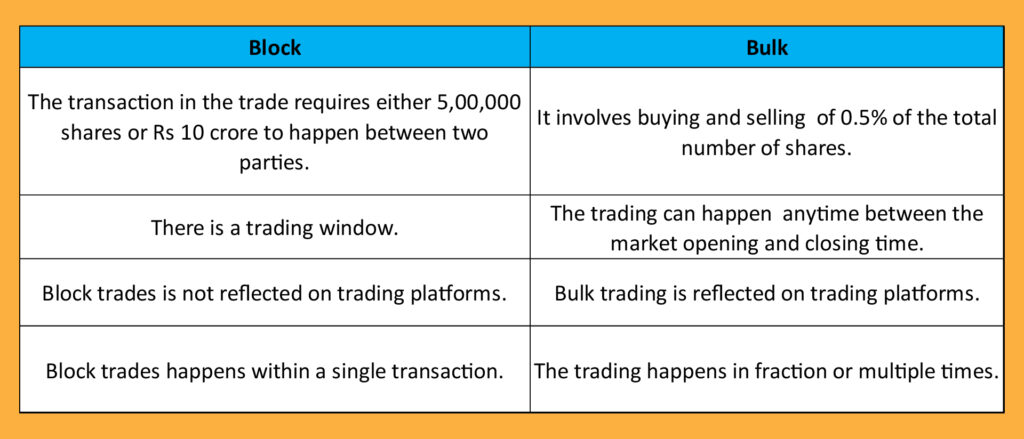

It is a transaction that involves either a minimum quantity of 500,000 shares or a minimum order value of Rs 10 crore between the two parties. The agreed parties buy or sell shares at a predetermined price. Block deals have two separate trading windows of 15 minutes each meaning within the said time the deal needs to happen. The first trading window opens in the morning from 8:45 AM to 9:00 AM and the second trading window opens in the afternoon from 2:05 PM to 2:20 PM. The idea of keeping separate trading windows is to ensure confidentiality of the large trades, transparency, and curb unnecessary volatility while trading such a large number of shares.

Block deals are transacted concerning a block reference price. For the morning trading slot, the reference price of the share will be the previous day’s closing price of the stock. The reference price of stocks for afternoon trading will be based on the volume-weighted average market price (VWAP). This deal is a single transaction and does not appear in the normal trading window for retail investors to see.

Before initiating block trades, the parties are supposed to inform the stock exchanges.

‘‘

Standard life sold 10.65 million shares or a 4.99 percent stake in HDFC Asset Management Company at Rs. 2,873.8 apiece through a bulk deal on the BSE.

What is a bulk deal?

Bulk deals involve the transaction of shares of at least 0.5 percent or more of the total listed shares of a company. There are no separate trading windows and the trading happens during normal trading hours. Unlike block deals it is visible to the retail investors and the trading is reflected on the volume charts in trading platforms. The broker participating in the bulk deal trade has to provide the details of the transaction to the stock exchanges whenever they take place. Investors can find out the number of shares traded in bulk deals, provided that he/she already knows a company’s total outstanding shares. It can be calculated like this

No. of shares traded in bulk deal = Total number of shares * 0.5 %

Bulk deal vs Block deal

Impact of such voluminous trading on the stock market

Institutional investment or trading of massive volumes in companies signifies a company’s high potential to grow which in turn throws a positive impact on prices. If several such deals happen continuously for a period of time it will push the price up in near future, eventually bolstering retail investor’s confidence in that particular stock. However, sometimes such trading does not necessarily mean the stock is profitable as it could be the last shot in luring retail investor’s interest towards a stock. Such investment is used as bait to attract more investment. Many investors sometimes report the bulk deal to be 0.5% of the total shares, but actually, it is traded lower than the reported, to build up the investor interest in a particular company’s stocks. Therefore, investors should not blindly believe in such voluminous deals and do a detailed study before investing.