In the middle of every difficulty lies an opportunity – Albert Einstein.

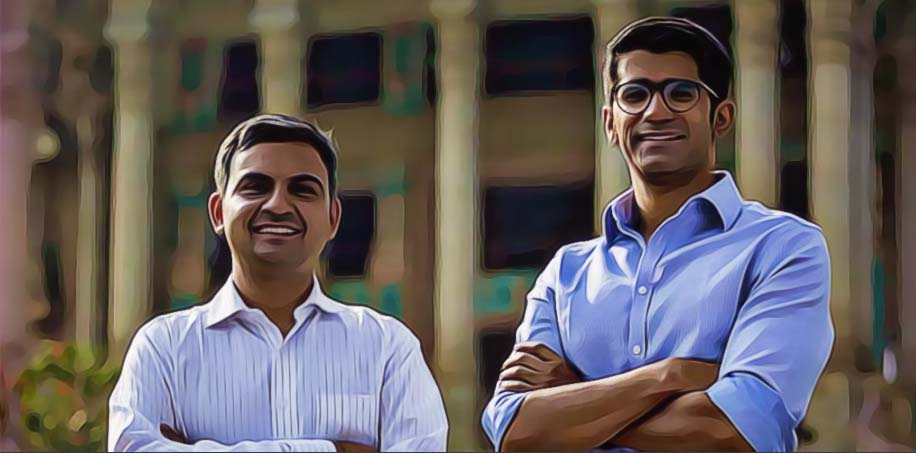

Two men brought this quote to life when faced with obstacles during their professional careers. Working with Non-Banking Financial Company (NBFC) Incred, Vaibhav Singh discovered major loopholes in the foreign lending market, while Arnav Kumar’s personal experience suggested that availing a loan without a collateral was next to impossible, during his stint at Capital Float.

Exploring new models, the duo took it upon themselves to fix the systemic inefficiencies in the lending market through innovation and decided to start – Leap Finance – in 2019.

Leap finance, as the name suggests, is a fintech start-up based in San Francisco, California, with offices in Bengaluru. The aim is to provide loans to Indian students studying abroad without collateral, at a 5% lower interest rate as compared to foreign banks. The start-up also helps students shortlisted courses, interact with experts, provide test preps, professional help desk and education counselling.

Taking the Leap to Success

In their early days, the duo aimed at building a product that suited a diversified audience. This required them to travel for six months, “living out of a suitcase”. Their first product was designed primarily for Indian students studying in the United States, with an interest rate of 8-10%. Later on, they planned to diversify the product in countries such as the UK, Canada and Indonesia.

Leap Finance tackles the problem of Indian students paying loans at as high as 13% , while their American counterparts avail it at almost half their rate, owing to the lack of credit scores of the former in the foreign countries. The company bridges the gap by assessing secondary documents and the potential income of students bringing down the interest rate, gauging the risk associated with the loan and providing excellent financial products. Thus, Leap Finance in essence, takes a smart and a calculated ‘leap of faith’ based on the alternative data points derived from the students.

“We finance your dreams to study abroad” – The start-up ardently believes in putting the focus on the future of the customer rather than their current or past situation. In simple words, they essentially take into consideration the GRE/TOEFL/IELTS scores, along with degree certificates to assess the potential income of the student. The team states clearly that the economic background of the student has got nothing to do with their ability to avail the loan.

All that the student needs is a strong cosigner to share the burden of the loan. Cosigner is a person whose credit report and income would serve as an added security to the loan sanctioned. This is in contrast with the traditional model of extending student loans.

‘‘

The start-up ardently believes in putting the focus on the future of the customer rather than their current or past situation

The Market Play

Indian education industry has been undergoing a revolutionary phase owing to digitisation with the eruption of edtech platforms such as Byju’s and Unacademy, eventually broadening the spectrum of students’ aspirations.

With overseas education being a dream of most Indians, being a fintech cum edtech start-up, Leap Finance is able to cash in on these changing dynamics of the education industry. The share of students wanting to study abroad has increased multifold over the years due to the pro-immigration policies of countries such as Australia and Canada. With the Biden administration in place, the US’s immigration policies have also taken a diplomatic stance for the Indian students.

In the United States alone, Indian students constitute 25% of top US graduate programmes.

That being said, there has always existed a growing need for one stop solution for counselling, guidance, finance among Indian students. There are students called “value maximisers” belonging to the lower middle income group. They are the ones who aspire to have a global career but can’t afford a degree abroad. Alongside them not being able to afford the hefty tuition fee and the expenses of accommodation, their main aim remains to gain the most lucrative option out of the plethora of offers they have at their disposal. Such students most often lack collateral, thus their chances to avail a loan minimizes along with their aspirations. The market thus provided a fertile ground for a business offering for these services to flourish.

Leap Finance offers not just loans on nil collateral but also assisting overseas students to open bank accounts in countries of USA and Canada along with a credit card. Customer satisfaction remains their sole priority, hence, along with assisting students through their Youtube channel called Leap Scholar, the start-up also helps students avail credit card services, provide them with Visa assistance, IELTS and GRE counselling, internship advice etc.

Gaining Investors’ Trust

In March 2020, the company raised its seed funding for $5.5 million led by Sequoia Capital, with participation of Bhupinder Singh of Incred and Kunal Shah, founder of CRED. The principal investor at Sequoia, Ashish Agarwal, cited the strong need for approximately $15 billion credit as the reason for market’s attractiveness, which is amplified by Leap’s mission-driven team, that made the investors place their bet on the start-up.

The capital was used to expand the company’s user base, focus on product development essentially with plans to expand the service to countries like Vietnam and Indonesia.

In March 2021, the start-up raised a whopping sum of $17 millions in the investing round led by Jungle Ventures. At the time they had a user base of 5 lakhs registered international students and 2 lakhs active users on the platform.

Securing funding at a time when the global pandemic has dampened students’ ambitions, did prove a challenge to the Leap team. However, they held their grounds. According to Amit Anand of Jungle Ventures, it was the sheer motivation and patience of the student community, especially the ones who held back their admissions at foreign universities, that encouraged hundreds more students to pursue education abroad.

In an interview, Vaibhav in fact talked about Covid-19 being a boost to their business to the extent that 2021 might even turn out to be a breakout year. Agarwal of Sequoia Capital, being impressed at the company’s approach towards tackling the pandemic, was particularly in awe with Leap Scholar – a counselling service provided by the start-up – which helped the start-up strengthen its foothold in the market. Amidst the lockdown hiccup, the company cashed on their online property.

The team aims at using the capital from Series B funding to expand their product portfolio into creating non-lending products in order to dive deeper into new markets.

‘‘

Securing funding at a time when the global pandemic has dampened students’ ambitions, did prove a challenge to the Leap team.

Democratisation of Finance

The start-up has come a long in a short span of two years. Alongside them serving as a one-stop solution for students looking to study abroad, they are also bringing in much needed change in the finance industry of the country, particularly in terms of financial literacy and financial assistance through the digital space.

India has the second largest unbanked population in the world, that amounts to 190 million people. Many people do not have access to loan services owing to documentation and collateral issues. This population ends up getting informal credit at an exorbitant rate of interest by moneylenders, often leading to a huge chunk of the population being rendered landless/assetless. Simultaneously those who can avail bank services face a crippled technological system, something that the leading banks of the country are yet to catch up with.

Current situation calls for a revolution in the lending space as the pandemic has taken a huge toll on the financial condition of many. Although NBFCs did solve the problem of collateral to some extent, however, that came with rendering security to banks through a high interest rate. It is more about affordability than availability.

Leap Finance through actively improving accessibility of credit through incentives such as no collateral, has in essence been working towards democratisation of financial services. They solve documentation problems through a requirement of minimum details such as pan card, Aadhar card and credit report of the student.

Through a thorough comparison of various loan options on its website, it offers clarity on the best loan option available via visual representation and interactive interface. This eases the job of students, particularly value maximisers and the ones with less agency, rendering them a one-stop solution in an otherwise fragmented value chain industry.

Creating a Uniqueness

There are multiple players in the edtech industry offering similar services as Leap Finance. One of them is Avanse Financial Services, an NBFC acquired by Warburg Pincus, which stands at a valuation of $66 million. Offering education loans, it has a strong competitive advantage against Leap Finances, owing to its full stack model.

The term ‘full stack’ was coined by Chris Dixon, suggesting it as a company which provided its customer with an end product. In essence, Avanse provides skill development courses and loans to educational institutions besides financial services.

At the current valuation of $22 million, Leap has a long way to go with regards to securing fundings and developing its revenue model. The start-up, in essence, is focussing on diversifying its services in the fields of counselling, customer-driven/tailor-made solutions to issues related to pursuing education abroad, and extending banking services to customers as well.

Going Beyond Loans: Monetisation the User Base

Leap through its Graduate Loan product has built a customer base of 234 crore as of now, i.e. sanctioned 234 crore loans.

At the same time, they are also focussing a great deal on their Youtube channel Leap Scholar. In an interview, the team confirmed plans to expand their services to become a neobank – a smart/digital bank that has no physical branch, but functions to cater to all the services that any physical bank does. Some of the examples of neobanks are Razorpay X and Insta Pay, that help individuals to open a bank account, make payments, request refunds etc.

While these banks essentially offer these services to businesses, Leap Finance aims at becoming the neobank in the international students community, offering full-fledged banking services to its customers.

Earlier it restricted its services to underwriting loans based on students’ future income, which slowly progressed into offering bank account services in the USA and Canada. With the new proposition, it would start earning like a typical bank but with a much more sophisticated and advanced digitised system.

The start-up’s future plans may also include offering courses and tie ups with educational institutions, similar to its competitor Avanse. Leap has been building a strong user base through offering free of cost counselling services through its Youtube platform and comparison of university programmes through its blog. There is a huge possibility in future for the company to start offering international educational courses through its amassed online user base, hence adding another revenue stream.