Investments in stocks, gold, government schemes, bonds, and debentures are popular, but what remains an underrated or ignored investment option is real estate. For young investors who have just begun their careers, investing in real estate might not be a good option. But, experienced investors can consider it. Unlike, stock market, the overall market risks associated with an investment in real estate are fewer.

According to IBEF (Indian Brand Equity Foundation), the real estate sector is estimated to grow a massive Rs 65000 crore in 2040 from Rs 12000 crore in 2019, and India is expected to reach a market size of US$ 1 trillion by 2030 from US$ 120 billion in 2017 and contribute 13% to the country’s GDP by 2025. The reasons for its massive growth can be attributed to the breaking of joint families to nuclear, the emergence of commercial spaces like malls and offices, and the interest of international investors to shift their investment from China to India as that would require more offices to set up. But, investment in the real estate sector is laden with presumptions like a huge initial capital is required to invest and this is what prevents them from investing. Not many are aware that investment in real estate can happen in two ways: One is through direct real estate investing and the other is through REIT (Real Estate Investment Trust) Let us dig deeper to know what these are and the investor’s dilemma regarding REIT vs Real Estate.

What is direct real estate investment?

As the name suggests, direct real estate investment happens when we directly purchase a flat, land, shopping centre, farmhouse, etc. The income or profit in direct real estate investment is generated through rent, appreciation, and income from business activities in the property.

‘‘

According to IBEF (Indian Brand Equity Foundation), the real estate sector is estimated to grow a massive Rs 65000 crore in 2040 from Rs 12000 crore in 2019.

What is REIT (Real Estate Investment Trust)?

This real investment plan is similar to how mutual funds work. In mutual funds, investors do not invest directly in securities but their funds are invested in stocks whose dividends or profits are distributed. In a similar fashion to investing in REIT, the funds are invested by that trust to build and finance various real estate projects such as hotels, malls, offices, IT parks, residential properties, and other commercial spaces. It cannot invest in vacant or agricultural land provided there is a project involved. REIT is a company that makes investments in income-producing real estate. So far only three REITs on the Indian exchange are listed – Embassy office parks, Mindspace office parks, Brookfield India Real Estate.

This real estate investment is ideal for investors who do not have deep pockets to invest in direct real estate. The beauty in this investment lies in an investor being able to invest with a minimum of Rs 2 lakh.

There are three types of REIT:

Equity REIT: In this, the trust uses an investor’s funds in building or purchasing commercial spaces like malls, hotels, SEZs or offices, etc. The trust here generates income through rent or sell properties that are further distributed to the investors as dividends or returns.

Mortgage REIT: In mortgage REIT, the trust collects the funds from the investors to lend loans to a different investor or a different builder at a certain interest. The trust here earns dividends for its investors through interest applied to the loan lent.

Hybrid REIT: They are a combination of the above two where the trust can either lent loans to other investors or can invest in building and purchasing properties.

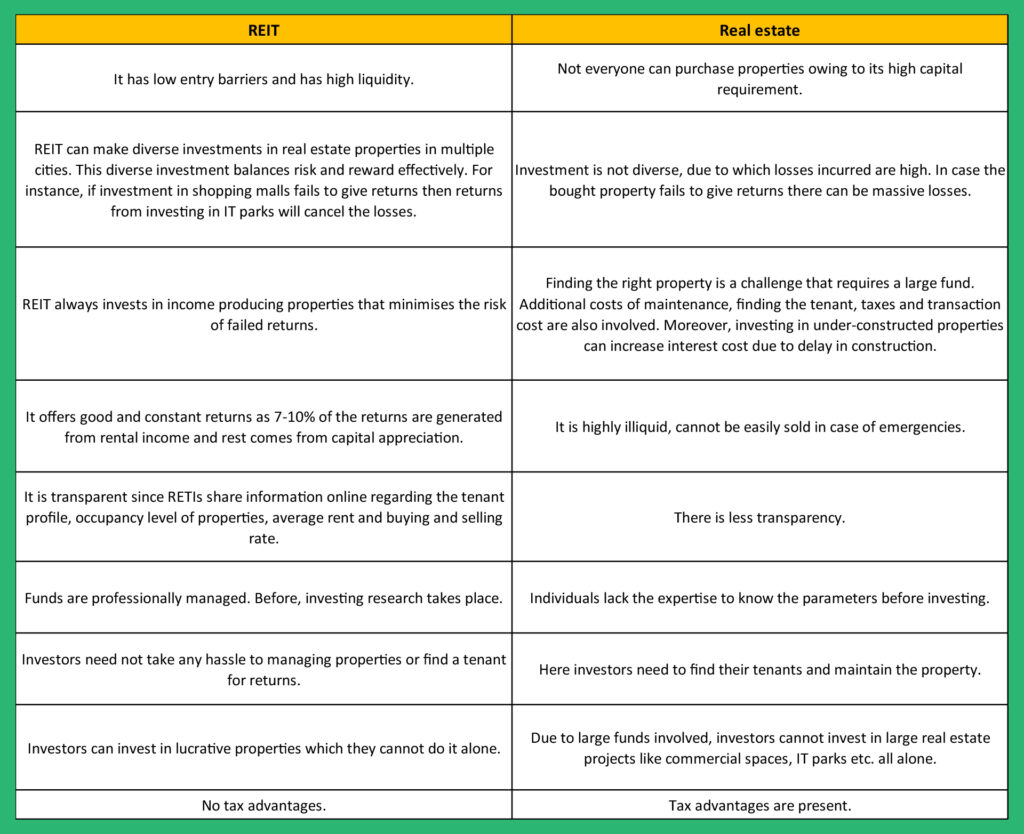

REIT vs direct real estate – the ideal investment

Word of advice – REIT vs direct real estate and the pandemic impact

REIT has performed well for many years owing to the rapid emergence of IT and software companies paving the demand for commercial spaces and getting a high-quality tenant base. But, the pandemic led several offices to allow their employees to work from home thereby, shrinking the demand for office spaces. Frequent lockdowns have also impacted malls and other commercial spaces. However, in the post covid scenario, commercial real estate is likely to bounce back from the pandemic grip as companies feel work from home is not sustainable and are positive about coming to offices. Moreover, companies in sectors of Tech, E-commerce, financial services, IT, and research & analytics are likely to open more in 2022. Whereas, in the pandemic, the residential properties segment in direct real investment is witnessing a K-shaped recovery amid lower interest rates and a cut in stamp duties. A report released by credit information bureau CRIF High Mark says that the housing loan market has bounced back registering a y-o-y growth of 9.6 percent of portfolio outstanding (PoS) in the third quarter of FY2021.