Investment is an approach to save money while you are occupied with your life and have that money work for you so that you can completely reap the rewards of your labour in the future. With the decreasing value of money, if you think your cash will grow resting in a bank account only, then you are wrong. You have to make strategic and well planned investments in order to gain higher profits and for that, investment in the stock market may sound alluring. This process of investment might need a lot of patience and right knowledge, otherwise you might end up booking losses and will regret for life.

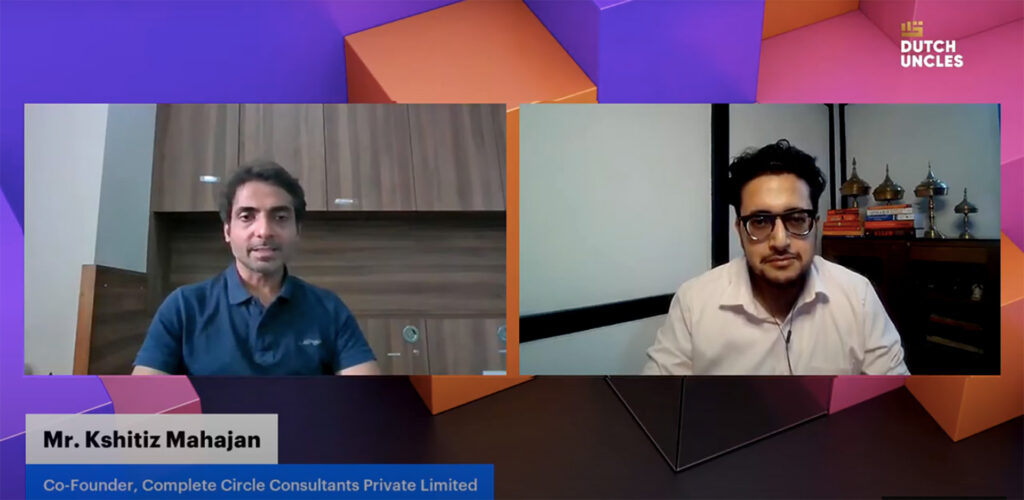

In the recent episode of MentorED – a LIVE Workshop Series by Dutch Uncles, the esteemed speaker, Mr. Kshitiz Mahajan enlightened the audience who joined LIVE from across four platforms – LinkedIn, YouTube, Twitter, and Facebook – about the steps to invest in stock market wisely and the strategies best suited for investors. Mr. Kshitiz Mahajan is the Co-founder of Complete Circle Consultants Private Limited. With more than 20 years of experience in Banking, Mutual Fund Product and Distribution, Mr. Mahajan offers innovative wealth solutions and is a renowned face across the business mediscape in India.

In brief the session had the following takeaways:

- The importance of diversification

- Impact of Market Sentiment – how it affect highs and lows

- Rewards and Risks: What strategy to follow?

- Future looking themes to invest

‘‘

Market sentiments play and people generally get into the trap of fear and greed.

-Mr. Kshitiz Mahajan

Wise steps to invest in Stock Market

The stock market is the talk of the town, but is it so easy to make money? That is the question that many young minds are looking for answers to. How exactly should one go further in this investment cycle and start growing their money? Well, the steps are really easy and practical. To start with, if something is really good, one does not have to put all their eggs in one basket. The importance of diversification plays a prominent role in the money making process as there is no positive correlation between the assets. There are two levels of diversification, first is asset class diversification and second, when you are buying equity, buy 8-10 stocks or have 3-10 mutual funds in your portfolio. Approximately 4-5 % of your portfolio should be diversified into your asset classes and in this way you diversify your risks as well.

For further clarity on the process of shortlisting the right stocks, the mentor brought in the analogy of shopping. According to him, apart from diversification one has to have a sound knowledge regarding their shopping nature. Know whether you are an aggressive shopper or a calculative shopper. Just like Amazon or AJIO give huge discounts during the festive season, whenever market equity falls, it is a discount, but one has to be very careful regarding getting into any value or ‘sasta’ trap. Mr. Mahajan mentioned that “market sentiments play and people generally get into the trap of fear and greed”. We need to control these emotions and look for quality business instead.

For millennials and the GenZ, who are starting with their investment journey, it becomes very important to look for fundamental strategies more before diving into the technicality of the process. Like Mr. Mahajan said “easy money comes easily and it goes away easily”. In order to map the risks and rewards, one has to stick around with good businesses. One has to focus on the time that they are invested in and not on the rate of interest that you are getting.

India, holds a very promising future, it is getting benefited because of its global position, government orientation around growth, low interest rates, geographical and cultural diversification within the country. All the sectors will do well but specifically the healthcare and technology sector will do better. The pandemic has taken the world 10 years ahead and it is very much evident how technology can shape up and change very soon. So in the technology sector – AI, Blockchain, Machine learning looks positive and in the healthcare sector, all the 5 vertices – Pharmaceuticals, Insurance, Hospitals, Diagnostic, and supplements regarding healthcare, will play a major role and are future themes one should look at.

Audience Asks

I want to create a diverse portfolio. How do I invest in multiple sectors and how many sectors can simultaneously invest in? Any limit to it?

Pick out 3-4 good multi-cap funds like Kotak focus, SBI focus, DSP flexi cap, Tata large and mid caps and it will give you good exposure. If you have time and know how to read balance sheets then you can go ahead with buying good companies. Having said that, start with a mutual fund investment portfolio and they will give you good exposure across sectors and market caps.

As a beginner how do I narrow down the good companies as there are many publicly listed companies in the stock market?

Out of 6000 listed companies, the actual company to look at is not more than 500 and they are further drilled down to 160-170 companies which are actually good. So instead of looking into the individual companies one of the easiest ways is to look at good portfolios of mutual funds or multi-caps or large-caps funds and work on the various parameters. Start with Nifty 50 and narrow it down in terms of earning number, longevity of business and economic growth.

Sir, as a newbie investor can you guide me regarding the small-caps, mid-caps, and bluechip companies? And also investment in which will be more profitable for me?

Mr. Mahajan quoted, “The more the risk, the more the return”, there is a variation in the market where a bluechip company will give 13-14% of return, a mid-cap company will give 16-17% return and a small-cap company will give 18-20% return. The profit is little higher for the small-caps but the risk associated is highest as compared to mid-caps and lowest in large-caps. It depends on time and therefore the best way is to invest in a multi-cap fund where you will get all these three categories and your job will be done.

Sir, since 2 days, the market is volatile, is it good to invest in new stocks or should we hold our old stocks? What is your opinion, will the market get back on track or will the downtrend continue?

Mr. Mahajan chuckled saying “If you have a fight with your girlfriend for the last 2 days, are you going to change the girlfriend? Unless you guys are not getting along”. So if you have a good stock and even if it falls, it does not matter. But if you have a shady stock, then you have to look at it and “move on from this relationship with your girlfriend and change”. Stick to your core portfolio and if it is falling and you have some money “time to shop”.

Work Hard and Party Harder – Life Mantra

Look around yourself throughout the day, observe what all products you are using starting from your toothpaste to what brand of shoes you are going out with. Things that you use on a daily basis will give you a fair idea of the best companies and will make your investment process easier. One cannot expect quick results in the equity market, as advised by Mr. Mahajan “if you really want to make money out of equity market, focus on ‘T’ and not ‘R’. He continues, “it’s very easy to make money, focus on the time for which you are investing”. We can have a very bright future from the Indian equity market so keeping that in mind, start planning and managing your investments now.

Watch the entire episode on YouTube to start with your stock market investments.