The Indian Parliament has passed the Factoring Regulation (Amendment) Bill, 2021, which will help the micro, small and medium enterprises (MSME) sector by ensuring enhanced working capital assistance and cash flow.

According to the finance minister, the bill is essential because it will help Indian MSMEs overcome their default receivables problems. Under the new bill, MSMEs can sell their receivables to a third party. If third parties offer money directly, MSMEs should be able to run their business with ease. There are several such advantages in factoring from the payment of the seller.

‘‘

The changed status and definition of “assignment", "factoring business" and "receivables" to align with international rates will help and benefit the small businesses.

What is factoring?

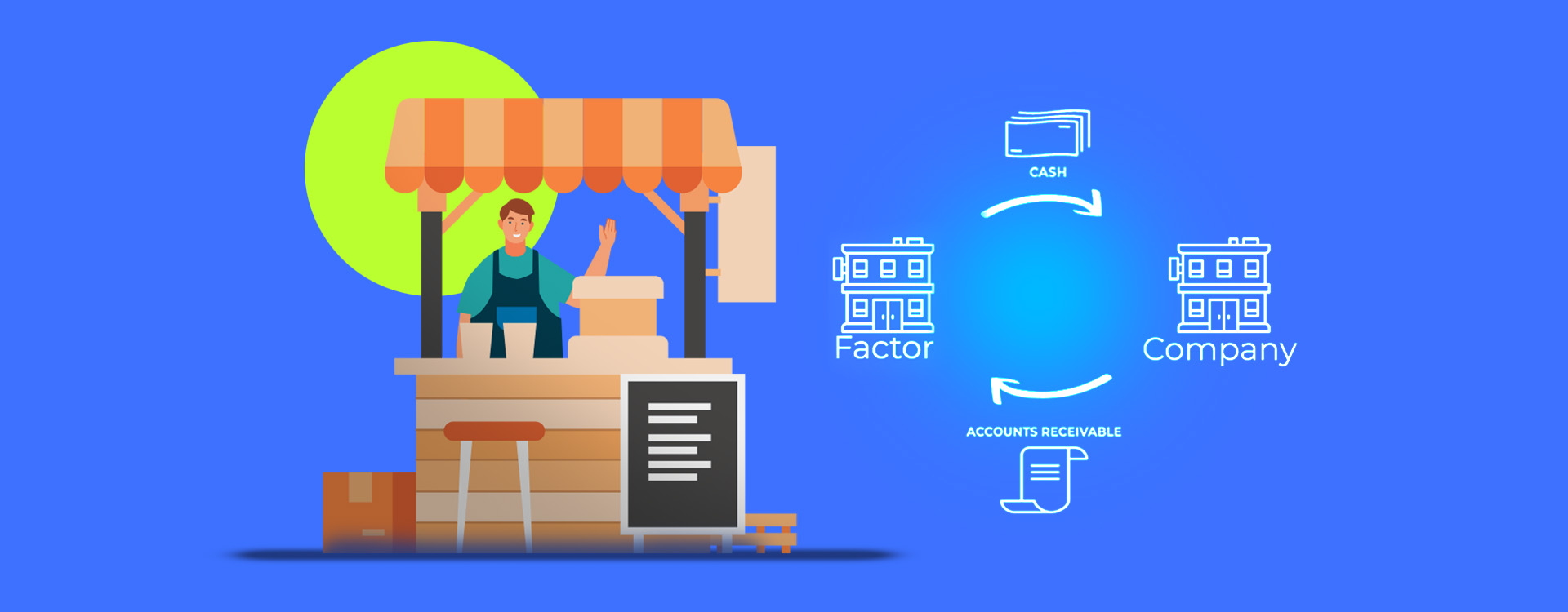

Factoring is a transaction in which an organisation (such as an MSME) sells its receivables (customer claim) to a third party (an “agent” such as a bank or NBFC) for direct funding. This often helps a business meet its initial working capital needs. Despite the growth in recent years, India’s factoring market represents only 0.2% of GDP, lagging behind comparable economies such as Brazil’s 4.1% and China’s 3.2%. The largest factoring market of Europe dominates the global factoring segment at 68% of the international total. The factoring market worldwide is expected to reach a $9.2 trillion valuation by 2025.

Factoring Regulation (Amendment) Bill: Changes in favour of Indian MSMEs

The proposed changes to factoring practices in India aim to increase the lenders’ share of factoring activities, easing restrictions and allowing the central bank (RBI) to bolster norms for better oversight of the $6 billion market. The new bill also aims to enable all non-banking financial companies (NBFCs) to carry out factoring activities, thereby helping to improve MSMEs cash flow.

Under the current law, NBFC’s financial assets and income from factoring activities must exceed 50% of total assets and net income or exceed the threshold before commencing traditional factoring activities. The new law removes this barrier and makes it easier for NBFC to enter the factoring industry. Many MSMEs, whose payments against supplies are stuck, participate in the factoring business with receivables.

What can MSMEs and small businesses expect going forward?

Small businesses will be empowered under the new factoring bill and receive some cash liquidity for operational costs. Moreover, the red tapes will also be diluted as compared to the existing rules. The RBI will make regulations for the manner of granting the certificate of registration, filing of particulars of transactions with the Central Registry on behalf of factors, and any other matter required to be specified by regulations.

The benefits for MSMEs via invoice discounting, recourse and non-recourse factoring, collections, and reverse factoring will give them a much-needed relief, even though authorities can do more for them in the long run.