The key difference between finance and accounting is that finance is the management of the money and the investment of individuals, organisations and other entities, whereas, accounting is the process of maintaining financial records as well as reporting the financial affairs of the organisation to provide a true and fair view of the financial performance and position of the organisation.

Accounting Vs Finance: an overview

In simple terms, accounting is about recording and maintaining monetary or financial transactions commonly known as books of accounts, reporting on financial results and position known as financial statements, auditing the accounts, complying with tax and other statutory obligations whereas finance is about analysing, planning, controlling and managing the assets and liabilities of an organisation for its future growth and sustenance. In other words, accounting is about today and finance is about tomorrow.

However, finance and accounting are terms often used interchangeably. This is not strictly correct or wrong. While both functions are related to the management and control of an organisation’s assets and liabilities, each discipline has a different scope and focus. When it comes to evaluating the financial health of an organisation and making strategic financial decisions, it’s important to have an in-depth understanding and working knowledge of both disciplines.

‘‘

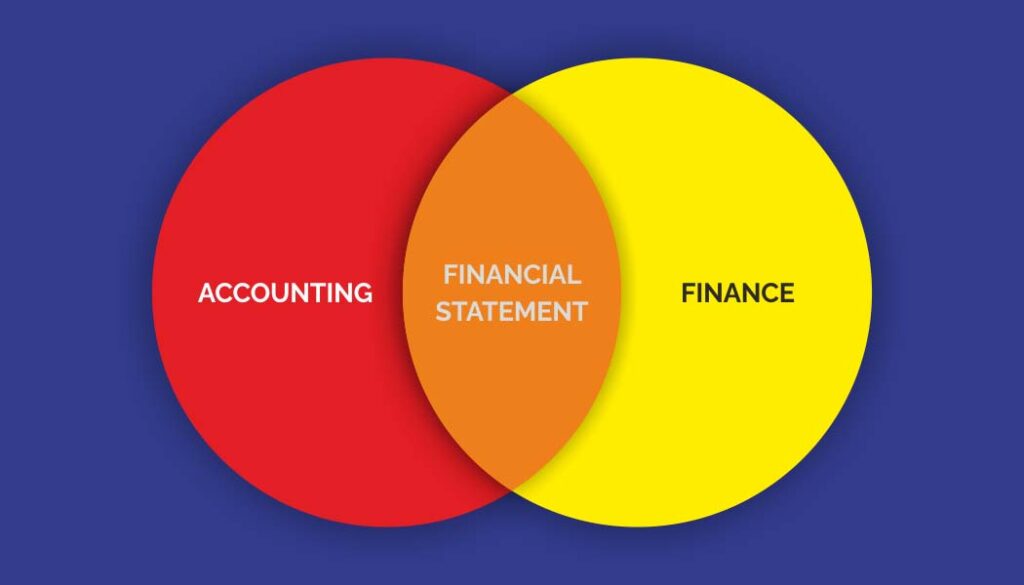

Finance and Accounting both are dependent on each other, in such a way that accounting is a part of finance and finance is dependent on accounting.

Finance is often considered as a broader term under which accounting comes as a subset. This is also not exactly true though at the same time this is not without substance. For example, the finance or accounting function, though named differently in each organisation, is responsible for all financial and accounting functions in an organisation.

Finance and Accounting both are dependent on each other, in such a way that accounting is a part of finance and finance is dependent on accounting. The financial analysis is done with the help of the financial reports or statements, an accounting output, submitted by the auditor. In other words, they both are very closely interconnected and interdependent, or we can say, finance begins where accounting ends. While it is true that finance and accounting both have evolved from economics, it is finance that is more related to economics.

Finance professionals do analyse and advise their clients or management of the organisation they work for as to which securities or portfolios or financial products they should or should not invest in from short term or long term or retirement perspectives.

Both accountants and finance professionals work for financial services organisations, businesses, and government agencies. However, they provide different services for their clients and employers. While accountants can help with your tax advice, provide audit services, a financial advisor can help plan and save for retirement or advice on the best investment products.

Accounting can also be broken down into managerial accounting and financial accounting. The main difference between managerial and financial accounting lies in the presentation of information and its use. Managerial accounting, also known as management accounting or cost accounting, focuses on internal reporting that is used by management for planning and decision making, while financial accounting focuses on aggregating financial information into financial statements, which are used both internally and externally.

Major differences between Finance and Accounting

Accounting vs. Finance: The basics

The difference between finance and accounting is that accounting focuses on the day-to-day flow of money in and out of a company, whereas finance is a broader term for the management of assets and liabilities and the planning for future growth of the organisation.

If you want to take a detailed look at a company’s books of accounts and financial position you need to be skilled more in accounting. It’s often said that accounting looks back to a company’s past financial transactions and performance, whereas finance looks forward to planning future acquisition and management of its assets.

Accounting is more about accurate reporting of what has already happened, compliance with corporate and tax laws, and accounting standards relevant to the respective country; it is Ind-AS in India, US GAAP in the USA, IFRS in Europe. On the other hand, finance is about looking forward and reaping benefits from investments, growing the value of the organisation, and mitigating risks and losses. Finance looks at a longer time horizon whereas accounting is typical of a one-year time frame.

Finance refers to how a person or organisation generates and uses capital—in other words, how its funds are managed. This often encompasses activities such as investing, borrowing, lending, planning, budgeting, and forecasting. The field of finance can be broken down into three branches viz. personal finance (for individuals) corporate finance, and public finance (for the government) depending on whose finance is managed.

The typical activities involved in accounting include summarising financial position and publishing thorough financial statements—including income statements or profit and loss statements, balance sheets, and statements of cash flow—that are used to understand an organisation’s financial position at a given time.

Compliance

Accounting has to comply with many statutes like tax laws, company and other corporate laws, accounting standards, rules and regulations of central banks like RBI in India or Federal Reserve System in the USA, stock exchange regulators like Securities and Exchange Board of India (SEBI) in India or Securities and Exchange Commission (SEC) in the USA, and as well report to creditors, shareholders, investors and other stakeholders.

Finance has no such statutory obligations except maybe concerning central banks (RBI in India) or securities boards (SEBI in India) if compliances related to some of the finance activities like IPO, exchange listing, borrowing, forex matters, investments become finance mandates.

Scope and focus

Both finance and accounting operate on different levels of management of the assets and liabilities of an organisation. While accounting provides a snapshot of an organization’s financial situation using past and present transactional data, finance is inherently forward-looking assuming that all value comes from the future.

In accounting, insight into an organisation’s financial position is gained through what is known as the “accounting equation,” which is: Assets = Liabilities + Shareholders’ fund or equity as is seen in a Balance Sheet. One side of the balance sheet are Assets and another side are Liabilities and Shareholders’ funds or equity. Both sides will always be equal.

The above formula looks at what a company owns (its assets) by way of fixed assets (like plant and machinery, computers, furniture etc) and current assets (like accounts receivable, cash, inventory etc.), what it owes (its liabilities) by way of long term liabilities (loans and liabilities payable after one year) and current liabilities (accounts payable, overdraft etc.), and the residual, which is assets minus liabilities, belongs to shareholders (fund or equity) which constitutes paid-up capital, reserves and surplus and retained earnings.

Finance considers cash as king and looks at business through the lens of cash. While accounting relies on transactional data, finance looks at how effectively an organisation generates and uses cash through the use of several measurements.

Free cash flow is arguably the most important financial tool or technique, which examines how much money a company has to distribute to investors and shareholders or reinvest after all expenses have been met. It’s a strong indicator of profitability and can be used to make investment decisions today based on an expectation of future cash inflows.

There is always a difference between the profit as per profit and loss statement ( accounting) and cash generated as per cash flow (finance) because cash flow does not consider non-cash expenses like depreciation and uncollected receivable or unpaid payables. Only cash realised and cash disbursed are considered in the cash flow.

‘‘

An entrepreneur, particularly of start-ups, should understand finance more than accounting.

Measurement of financial performance

This is one major difference in scope that underscores the underlying principles of accounting and finance. Most of the accounting standards, tax authorities and corporate laws insist on maintaining accounts on an accrual basis. The accrual method of accounting mandates recording financial transactions as they are incurred or earned as opposed to when they are paid or received in cash.

For example, you have invoiced a customer on 30th March 2021 but payment is received on 28th April 2021, it will be accounted as revenue in the financial year ending 31st March 2021 under the accrual accounting method. In contrast, in cash flow, this revenue will be considered only in the next financial year starting on 1st April 2021.

The accrual accounting principle makes it possible to compare the year-on-year growth of a company’s revenues, costs, and profits without factoring in one-off events, as well as seasonal and cyclical changes. It also assumes matching principles that expenses incurred for earning an income should both be accounted for in the same period.

Finance does not follow the accrual method, instead believes that the best way to measure economic returns from a company is to calculate the cash it’s able to generate and leverage, which is dependent on when that cash is exchanged, paid or received.

Assessing Value

Another point of difference between the two disciplines is their value approach. In accounting, the assets and liabilities are captured at historical cost. This is handled much differently in finance, through a method known as valuation, to determine the worth of a company. Finance considers the time value of money in high esteem. The time value of money is a widely accepted notion that there is a greater benefit to receiving a sum of money now rather than an identical sum later.

The popular technique to service the present value of future benefits or cash flows is discounted cash flow analysis, which is applied to a series of cash flows over a period of time. To apply the method, all future cash flows are estimated and discounted by using the cost of capital to give their present values (PVs). The sum of all future cash flows, both incoming and outgoing, is the net present value (NPV), which is taken as the value of the cash flows in question. Here is the DCF formula:

where: CF = Cash Flow in the Period, r = the interest rate or discount rate. n = the period number.

For example, assuming a 5% annual interest rate, Re.1 in a savings account will be worth Rs. 1.05 in a year. Similarly, if Rs.1 payment is delayed for a year, its present value (pv) is Re.0. 95 because it cannot be put in your savings account to earn interest. We can calculate the PV using the above formula as: 1 (cf) /(1+05 (r))^1 (n) = .0.95

The valuation of the business is done pre and post-funding or acquisition using discounted cash flow (dcf) and with/or a combination of other methods. This is one finance tool the knowledge of that cannot be skipped by any entrepreneur.

Leveraging financial know-how

Both finance and accounting are highly valuable and important tools for assessing a company’s position and performance. By understanding the underlying principles of the two disciplines and how they contrast and complement, you can develop greater financial intuition and make better business decisions. That is why almost all accounting qualifications have curriculums that give equal importance to both accounting and finance. No finance leadership can do justice to their role without having a deep understanding and expertise in both disciplines.

For those who want to better understand their organisation’s financial performance in the context of the markets and external factors, and contribute to financial strategy, understanding the fundamentals of finance is crucial. Developing your financial acumen is key to making better business decisions.

Author’s views

A lot has already been written by academicians, educational institutions, career consultants, subject matter experts and researchers on Accounting Vs Finance from different standpoints.

An entrepreneur, particularly of start-ups, should understand finance more than accounting. This is because of two reasons; one is that accounting tasks especially in the early stages can be outsourced to accounting service providers but it is not that easy to do the same for finance though virtual CFO services are plenty these days.

In the early stages of a start-up, the entrepreneur should have a grip on working capital, funding, cash flows, risks and more importantly valuation which are all finance functions. That said, some basic understanding of accounting, even though outsourced, is a must to understand finance too. In nutshell, both accounting and finance vary in scope and substance but are interconnected, interrelated and complementary.