It will not be an exaggeration to say that scarcity of essential products in the pandemic due to market closures in lockdown led people to purchase more from e-commerce. A study from Bain says that the e-commerce Gross Merchandise Value in India reached $30 billion in 2020. Small and mid-sized startups, apart from selling products on e-commerce biggies like Amazon, Flipkart, BigBasket, and Grofers, have leaped to leverage new channels to offer shoppers a customized and interactive shopping experience. Social commerce – that is selling products through social media channels such as Facebook, Instagram and Snapchat was nascent till date is gaining prominence. Since many social media platforms and content creators are going the vernacular way to deliver content, social commerce can firmly place its hold among millennials and in tier-II and Tier-III cities of India.

Social commerce: A new e-commerce

During the lockdown, many people lost access to essential goods overnight. Many local retailers and store owners sought refuge in social commerce platforms such as WhatsApp, Facebook and Instagram to stay afloat with their businesses. The fact that people will trust local and small-medium merchants for product delivery made their debut in online business using social commerce. Besides trust, the duration of time spent on social media by the Indians has catalysed more sellers to ramp up their businesses on social media platforms. According to a Bain & Company report, Indians spend an average of over three hours per day online, of which around two hours consists of messaging, social media networking and watching videos. The study also showcases that India’s social commerce sector, which is a $1.5 to $2 billion Gross Merchandise Value (GMV) market today, has the potential to grow to $16 to $20 billion in just five years, increasing to $60 to $70 billion in revenue by 2030.

‘‘

According to a Bain & Company report, Indians spend an average of over three hours per day online, of which around two hours consists of messaging, social media networking and watching videos.

Rural India is responding to social commerce

The deluge of affordable smartphones and cheaper data plans is causing rural India to explore themselves online or more of a hybrid model where the buying is assisted by someone they trust. Assisted buying has led to many homegrown social commerce apps like Meesho, Bulbul TV, City Mall, Mall91, Meri Saheli app to foray into their businesses in the low tier cities of India. These social commerce apps have provided a means of livelihood for many housewives turned businesswoman, micro-entrepreneurs and resellers who can sell products through social media like WhatsApp and Facebook, thus able to build their online presence with no costs involved and increase the customer base. A report from Bain & Company states that small sellers and merchants form 85 percent of all social commerce players that have the potential to empower over 40 million small businesses and entrepreneurs across India.

The skepticism towards online shopping

Despite a bright future that lies ahead for social commerce in India, a report from Bain says that only 100 million out of a universe of 700 million internet users transact online. The main deterrent of online shoppers from going with online transactions is the fear whether the money will reach the concerned person’s account or bank accounts getting hacked. There is a visible lack of trust. The customers from tier -II and tier-III cities are comfortable with smartphones and the internet but find it unconvincing to fulfill payments online due to their apprehensions about digital privacy and complicated user interface. For online sellers this becomes a roadblock for running a business smoothly. Imagine, for receiving payments, the seller needs to share his bank account details mentioning the IFSC code, branch number, and account number; that is a tedious and manual job. With this, there is no guarantee for instant payment or might cause customer drop-off. We require a convenient payment solution here that solicits the customer for instant payment and does not allow the customer to have room for second thoughts about buying, and close sales quickly. Small business owners should create a seamless shopping experience by enabling their businesses with fast, safe, and secured payment solutions through payment links.

How Payment links from Razorpay can help here

An online visitor might want to reconsider their purchase decision if we present them our bank account details on social media platforms. The Razorpay payment links enables businesses to accept digital payments from any social media channel in a hassle-free and secured manner. One can create a payment link from the Razorpay dashboard or through the ePOS application on mobile. Once the link is created, we can copy the link to share it with the customers to accept social media payments.

For instance let us say, we have an online store on Facebook and a prospective buyer is seeking answers to her queries through direct messages, after she is convinced, we can share the Razorpay payment link for the payment. Razorpay payment links can be used to accept payments online by businesses that do not own a website. Once a customer receives the payment link, they get various payment options such as debit card, credit card, UPI, netbanking, and wallets.

Features of the Razorpay Payment links

- The payment links are secured with PCI DSS compliance.

- Business owners will receive automated notification through powerful webhooks every time a customer makes payment using payment link.

- The payment links from Razorpay are easily shareable that can further be personalised to enhance customer’s shopping experience.

- No complex integrations, coding, or design knowledge to begin with.

- Has facilities like chatbot payments and cash-on-delivery

- Enables businesses to offer 100+ payment options to their customers

- Receives insights, data and reports about the payment status on Razorpay’s dashboard.

- The appearance of the payment links can be customised.

- There is no additional charge required to create links except a standard gateway fee of 2% per transaction.

Creating the Payment Links for accepting Social media payments

The payment links for social media on Razorpay can be generated through the Razorpay dashboard and ePOS app

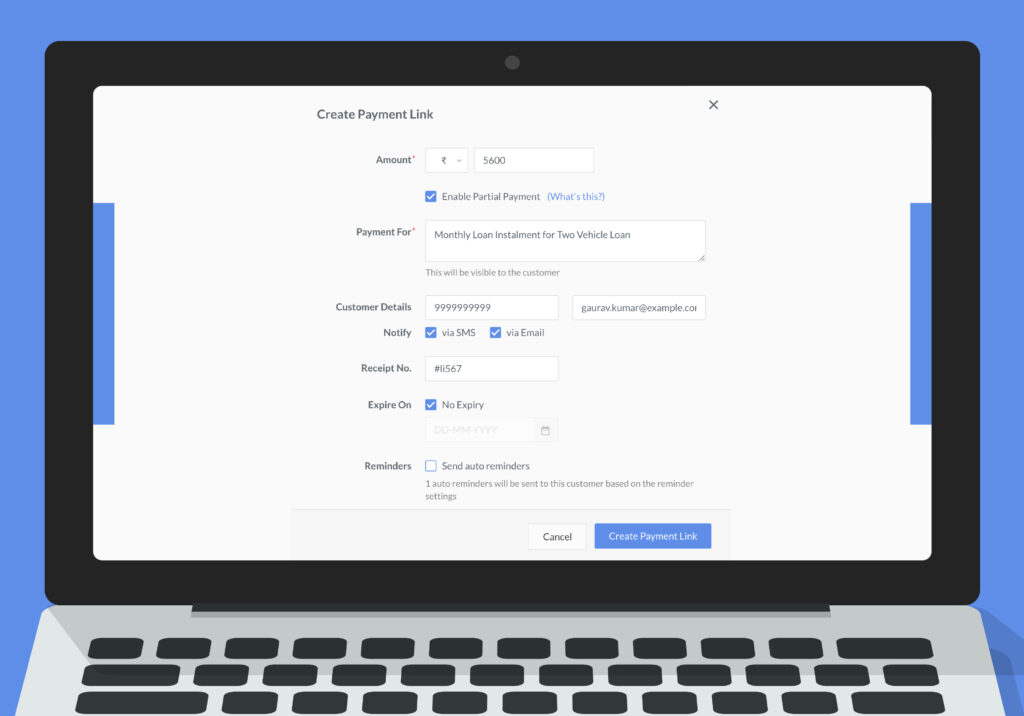

- Link Creation through Razorpay Dashboard

Creating payment links through the Razorpay dashboard is a no-brainer, one needs to create an account on Razorpay, and click on ‘ Payment Links’. There we enter details such as the amount to solicit from the customer, customer name, for what the payment is, etc., and click to create the payment link which can be shared. As soon as the customers make payments the owner will get notification of the same.

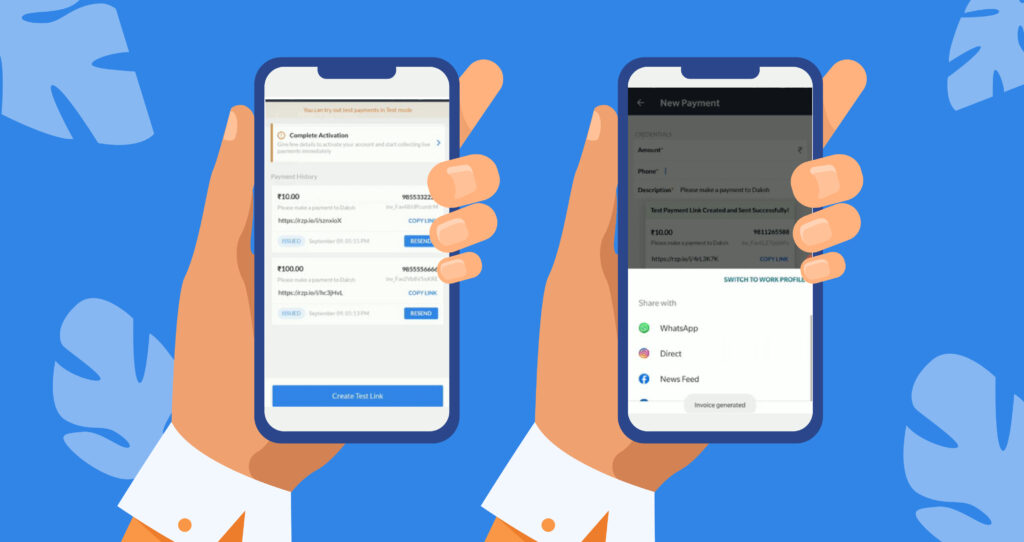

2.Creating payment link through the ePOS app

If we want to generate payment links from mobile, then we need to download Razorpay’s ePOS app whereby by clicking on ‘Create link’ we need to fill in the details such as the amount to be collected, phone and description of the transaction. After the link is generated it can be shared on any platform from mobile.

‘‘

A study from Bain says that the e-commerce Gross Merchandise Value in India had reached $30 billion in 2020.

Sharing payment links on Facebook

Business owners can create business accounts on Facebook in two ways. One is through creating a Facebook business account that carries product photos and catalogues for buyers to choose from and another is a Facebook marketplace, which is a free service where customers can explore, buy and sell products all under one platform. Facebook does not have its delivery or payment systems to offer. It is a platform where sellers and prospects can interact. The challenge for the sellers is that there is no checkout page or payment system created by Facebook. Once a purchasing decision has been made by the customer, the seller needs to share his bank account details that delay the process making it complicated and giving the buyer the room to rethink about its buying decision, which is certainly disappointing. Therefore, payment links make a seller’s life easier by which he/she can easily share the payment link over chats or conversations. Sellers, once they receive confirmed orders over direct messages, can share the Razorpay payment link with or without message. The customer can click on the link and complete his/her social media shopping in no time after which sellers can process the orders, post the receipt of payment.

Sharing payment links on Instagram

Instagram has transformed itself from a photo and video sharing platform to a business platform for cosmetics, apparel and jewellery. To enable ease of doing business on Instagram, it has introduced many plugins. As per a study from Deutsche Bank, it is estimated that ventures on Instagram to be a global market worth $10 billion by 2021. Sellers on Instagram can sell their products in two ways – Instagram business account, which is similar to Facebook page where ventures can showcase their product pictures and via Shop feature. The Shop feature is a new tab on Instagram which upon clicking we get a product tag showing the name and price details of the product.

While the customer clicks on the ‘Shop’ feature, it redirects the customer to the business website to place the order and make the payment. Sometimes if the customer is visiting the website for the first time and the website demands to create an account, it might be a bummer since no customer wants to face the ordeal of sitting and creating an account while using the phone. Besides the ordeal, customers on Instagram seem uncomfortable with social media payments with excuses such as redirection, net banking servers not working, and UPI linking issues. Razorpay’s payment links come to the rescue for Instagram businesses with customised links, multiple payment options, and instant notifications. The payment links can be sent directly over direct messages (DMs) when a customer is placing an order. It can be used to remind customers of the remaining payments, reducing bad debts and missed payments.

In the ‘Shop’ feature, by using ‘DM ME’ (Direct Message Me) sticker we can receive orders and share payment links. Using DM ME stickers can reduce the chances of customers abandoning cart items, with payments done instantly.

Accept Payments from Email and SMS

Besides, Instagram and Facebook the payment links can be shared over e-mails and SMS. Razorpay has an in-built feature where the system can directly send the customer SMS or e-mails payment links. For new businesses whose websites are not fully equipped to handle too many payment requests, might give customers a ‘failed payment’ experience. In such cases, sending payment links through SMS or emails is a saviour that offers a smooth payment experience to the customer.

Sending Payment Links on Twitter, LinkedIn

Payment links created from Razorpay’s ePOS app allows instant sharing on platforms like Twitter, LinkedIn, WhatsApp or Reddit based on the requirements. If you are planning to conduct a skill workshop, courses or any seminar then sharing of payment links on professional platforms such as LinkedIn will garner more participation.

Payment links create a frictionless and secured shopping experience for the customers at the checkout. It increases the business efficiency of those who currently do not have a website or a mobile storefront. Hence, without giving much thought, start creating payment links on Razorpay to receive online payments.