The apprehensions of going out are arising due to the rapid spread of the infection. Businesses are trying their best to reduce visits to banks, skipping the paperwork, and adapt to virtual banking. For years, businesses in India have been collecting large payments from bank transfers. The collection of payment is easy, but what seems to be cumbersome for the businesses is the reconciliation process since it is subjected to human error that increases administrative costs.

What are Virtual Bank Accounts?

Virtual bank accounts that have no physical existence, are temporary where transactions happen on behalf of a real, physical account. Similar to creating an account on Facebook or Instagram, a virtual bank account can be created in seconds. Reconciling payments in a virtual bank account happens in real-time conserving time and money. The operating and maintenance costs of a virtual account are lower than a physical bank account. A business can open multiple virtual bank accounts that are difficult in a physical bank account.

Types of Virtual Account

Virtual accounts are of two types

Account created on top of a nodal or escrow account

An escrow account is an account where funds are held in trust whilst two or more parties complete a transaction. Virtual accounts created on nodal or escrow are temporary. Here the funds remain only for a short duration till transferred to its payee. In this when we make payment, the money goes to a nodal/escrow account through a payment gateway for ex-PayU, Razorpay. These payment gateways have various virtual accounts. Let us understand this with an example- Suppose a business owner purchases goods from a wholesaler using transaction medium NEFT/RTGS or IMPS, the funds are transferred in a virtual account given by the payment gateway that stays there temporarily until it reaches the wholesaler in a settlement.

Account created on top of a business or current account

In this, the virtual accounts are made based on a business or current account where a banking institution is involved in setting up virtual accounts. When a customer transacts through the virtual account, the business owner will identify the payer’s details through the virtual account number. Businesses can deduce customer information and reconcile payments with ease, also it can get an overview of transactions happening across departments. Virtual accounts are beneficial for educational institutions to easily manage student fees. With every student being assigned a virtual account number that can be created based on roll number and batch year, the institute can e-collect fees via bank accounts and use the account number to track where the payment has come from.

‘‘

Virtual bank accounts that have no physical existence, are temporary where transactions happen on behalf of a real, physical account.

Benefits to a Business for using a Virtual Bank account

Automated Payment reconciliation

For businesses that involve thousands of transactions on a day-to-day basis, payment reconciliation can be a daunting task. For instance, let us take an e-commerce business that receives payments from various sources such as payment gateways, direct bank transfers, wallet payments, and transactions funded by loans. In such cases, where a virtual bank account is absent, the company would have deployed a finance executive for the task of reconciling with the actual funds received in the bank accounts, which is a tedious task.

Reduced Expenditure

Small businesses spend approximately 2-3 percent per transaction on payment gateways. Considering the volume of the transaction the business receives per day the collective amount of spending becomes an expensive affair. Instead of spending a small percentage of the transaction amount, businesses can pay a fixed cost for each payment processed. This benefit while dealing with high ticket transactions.

Improved Customer Experience

Customers for digital transactions want the process to be smooth and hassle-free. They expect a confirmation from the payee side. Customer experience can be enhanced by organising the cash flow and financial management. We should not be giving the customers doubt about the successful payment transaction.

How Razorpay’s Smart Collect Can Help Create Virtual Bank Account

Razorpay’s Smart Collect, one can generate virtual bank accounts and virtual payment addresses (UPI IDs) on-demand and share the details with customers to accept payments through NEFT, RTGS, IMPS, and UPI. The virtual bank accounts and UPI IDs are linked with the bank account that the business owner has registered with Razorpay.

Since a new virtual bank account or UPI ID can be created for each customer, businesses easily track payments made by payers. Razorpay sends notifications of the payments made to any of the accounts or UPI IDs and also handles the complexity of reconciling these payments on the owners’ behalf.

Reasons to choose Razorpay Smart Collect

Below are the reasons why businesses should implement Smart Collect over other e-collect options:

- Instantly create virtual bank account: We can generate virtual bank accounts and virtual UPI IDs in no-time assigned to individual customers in real-time via Razorpay Dashboard and APIs (Application Programme Interface)

- Zero Costs: There is zero cost involved to create customised virtual bank accounts and UPI IDs bearing your company or brand’s name as a prefix.

- Multi-Bank Support: We can create customised account numbers on multiple banks within a single integration.

- Auto-Refund: It can instantly refund any payment made to wrong and deactivated accounts.

- Payment from Multiple payment modes: Virtual bank accounts created from Razopay’s smart collect can accept payments through NEFT, RTGS, IMPS, and UPI.

- Third-Party Validation: It accepts payment-only accounts that are KYC (Know Your Customer) verified.

- Real-time notifications: Receive real-time notifications on payments with Webhooks.

- Personalisation: Create custom UPI IDs to match your business needs and branding.

How Smart Collect enables accepting payments.

- Single, large one-time payments

Smart Collect enables the customer to collect a single, large one-time payment from a customer (preferably via NEFT, RTGS, IMPS or UPI. We can create a virtual bank account or UPI ID and share the generated account details (account number and IFSC) or UPI ID with the customer. When the customer makes the payment to this account or UPI ID, Razorpay sends notifications so that the account can be closed.

- Regular payments of large volume

For payments of large volume where we need to send customers regular invoices, a virtual bank account or UPI ID for them can be created to share the details where the customer can add the bank account as a beneficiary on their preferred netbanking portal and transfer the money using NEFT, RTGS or IMPS. The customer can add a UPI ID on their UPI payment service provider app such as Google Pay and transfer the money using UPI. Razorpay notifies you every time a payment is made towards the account, thus simplifying the reconciliation process.

- Campaign or event-based payment

Accepting payments from multiple sources for a multitude of campaigns or events is possible through Smart Collect to create a virtual bank account or UPI ID for each event or campaign and share details accordingly. The payment is made for each event through any of these accounts or UPI ID, Razorpay sends alerts of the account or UPI ID used to do the payment, thus eliminating the need to identify which campaign or event payment was made for.

‘‘

Razorpay’s Smart Collect, one can generate virtual bank accounts and virtual payment addresses (UPI IDs) on-demand and share the details with customers to accept payments through NEFT, RTGS, IMPS, and UPI.

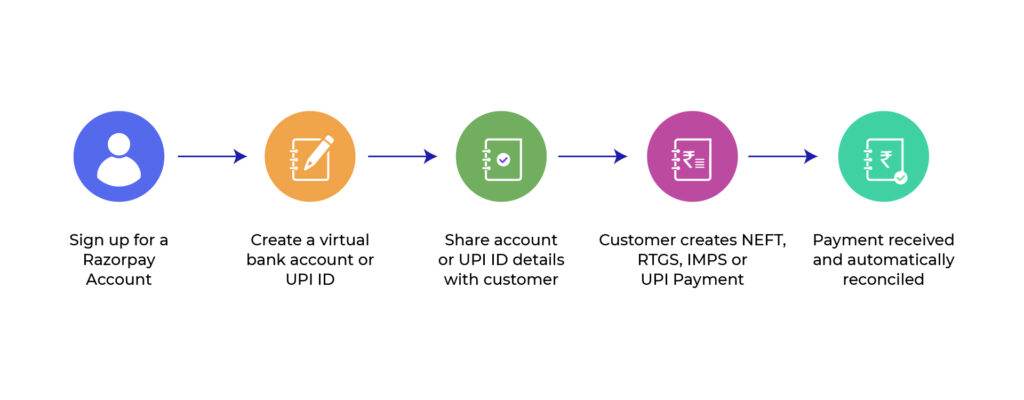

How Does Smart Collect Work?

- Sign up for a Razorpay Account.

- Create virtual bank accounts or virtual UPI IDs tagged to the customer.

- Share account details (such as account number, IFSC, and Name) or UPI ID with the customer.

- Customers add essential details like adding the bank account as a beneficiary on their preferred net banking portal and transferring the money using NEFT, RTGS, or IMPS. If using UPI apps then the customer adds the UPI ID on their UPI payment service provider app, such as Google Pay, and transfers the money using UPI.

- Payment deposited in these virtual accounts or UPI ID is settled into the business’s bank account linked with Razorpay.

What is in it for the businesses?

Thus, creating a virtual bank offers a seamless payment to the customers and gives businesses the flexibility to businesses. With lockdowns and the effects of pandemic persisting, the future of payments will be dominated by digital mode, thus businesses must pivot to virtual bank accounts for convenient reconciliation. So, without much wait, start using smart collect to create virtual bank accounts now.