External debt is a national debt borrowed from foreign lenders, including commercial institutions, banks, governmental or global financial entities. The loan has to be repaid with interest applied on it over time. To even out the loaned capital, a borrower nation can adopt various repayment methods, including trade and export options for the lending country.

If a country fails to repay its external debt, it spirals down the vicious debt trap. If the state does not repay its external debt, it is declared as a defaulter on the global financial institution’s books. External loans can take the form of supplementary loans, where the borrower has to use the lender’s financing costs in the state.

How can an external debt crisis occur?

A debt crisis can arise when a country with a weak economy cannot pay off its external debt because of its incapacity to produce, sell and profit from its assets. The International Monetary Fund (IMF) is a critical organisation that supervises countries’ external debt. The World Bank issues a quarterly bulletin on external debt statistics.

If a country is incapable or unwilling to pay its external debt, it is considered bankrupt. This can lead lenders to reject future asset sales required by the foreign country. Failing to repay the loan threatens the borrower’s currency with the collapse and stagnation of its macroeconomic growth.

How do borrowers use external debt?

In addition to governments, corporations can also borrow external loans. In many cases, the external debt is tied up in fixed loans, which means that the money secured by the funding must be used in the country providing the financing. For example, a loan can allow a country to purchase its resources from the loan sanctioning country.

Foreign loans, especially this bond sort of loaning system, can be taken for specific purposes. Borrowers can use this financial support to respond to human needs or disasters. For example, if there is a drought in a country and the affected nation cannot provide emergency aid with its own funds, it can ask for the foreign debt to buy essentials from a foreign donor country. Or, when a country needs to build energy infrastructure, it can use its external debt by acquiring resources such as materials designed to produce energy in, say, an unoccupied area.

The debtor, or the entity that owes money, can be a government, business, or citizen of that country. Debt includes amounts owed by private commercial banks, foreign governments, or international financial institutions such as the International Monetary Fund (IMF) and the World Bank.

Role of principal and interest in external debt

If borrowed charges are paid regularly, as is often the case, they are called interest payments. All other expenses of financial value from the lender to the borrower that reduce the principal amount are called costs.

However, the interpretation of external debt does not differentiate between the initial payment and the payment of interest or the cost of both. Besides, the description does not indicate that involved parties must know the principal and/or interest’s future price for the obligation to be classified as debt.

Vital elements of external debt

The IMF defines the main components of external debt as the following:

Residency Clause

To be considered an external loan, the loan must be sanctioned by a non-resident to a country’s resident. Place of residence is determined by whether the centres of economic interest of creditors and borrowers are common- and not necessarily by nationality.

Current and not contingent

The definition of foreign debt does not include contingent responsibility. These are defined as contracts in which one or more conditions must be met before a financial transaction can occur. But from a weak perspective, there is analytical interest in the potential consequences of contingent liabilities in the economy, especially in institutional sectors such as government.

Generally, external debt is divided into four heads:

Guaranteed Government and State Debt: Guaranteed government and state debt encompass the long-term external responsibilities of the public sector, including the national government, state-owned companies, development banks, and other related industries.

Unsecured Personal Loans: The servicing of unsecured personal loans is the external responsibility of a private lender, which is not guaranteed by any public body.

Deposits with the Central Bank: For deposits with the central bank, commercial banks are usually required to deposit money into a central bank account. This amount is usually part of a bank’s reserve.

IMF Loans: The purpose of IMF loans is to repay member countries’ debts, stabilise their economies, and achieve sustainable economic growth. The role of solving debt crisis is at the heart of the IMF fund.

‘‘

If a country fails to repay its external debt, it spirals down the vicious debt trap. If the state does not repay its external debt, it is declared as a defaulter on the global financial institution's books.

External debt stability

Sustainable debt is the level at which the recipient can meet current and future obligations and accept redistribution or repayment to avoid arrears by allowing proper economic growth. The stability of external debt is generally analysed over the medium term.

These terms are statistical evaluations that properly consider economic variables, debt, and other indicators to determine the economy’s appropriate risk and policy adjustment requirements. In these analyses, macroeconomic uncertainties, such as the current account’s opportunity, and policy ambivalence, like fiscal policy, tend to dominate the medium-term outlook.

External debt sustainability indicators

Many indicators determine the stability and sustainability of external debt. The angles abound among economists don’t specify a single predictor for estimating the sustainability of a loan. These indicators are primarily like ratios—i.e., comparing two heads and the relation thereon and facilitating the policymakers in their external debt administration exercise.

These indicators can be thought of as dimensions of the country’s “solvency”. They consider the stock of debt at a specific time concerning the country’s ability to generate resources to repay the outstanding balance.

Examples of debt burden indicators include:

Debt to GDP Ratio: The debt to GDP ratio is an easy way to compare a country’s economic performance (measured in terms of gross domestic product) with its debt.

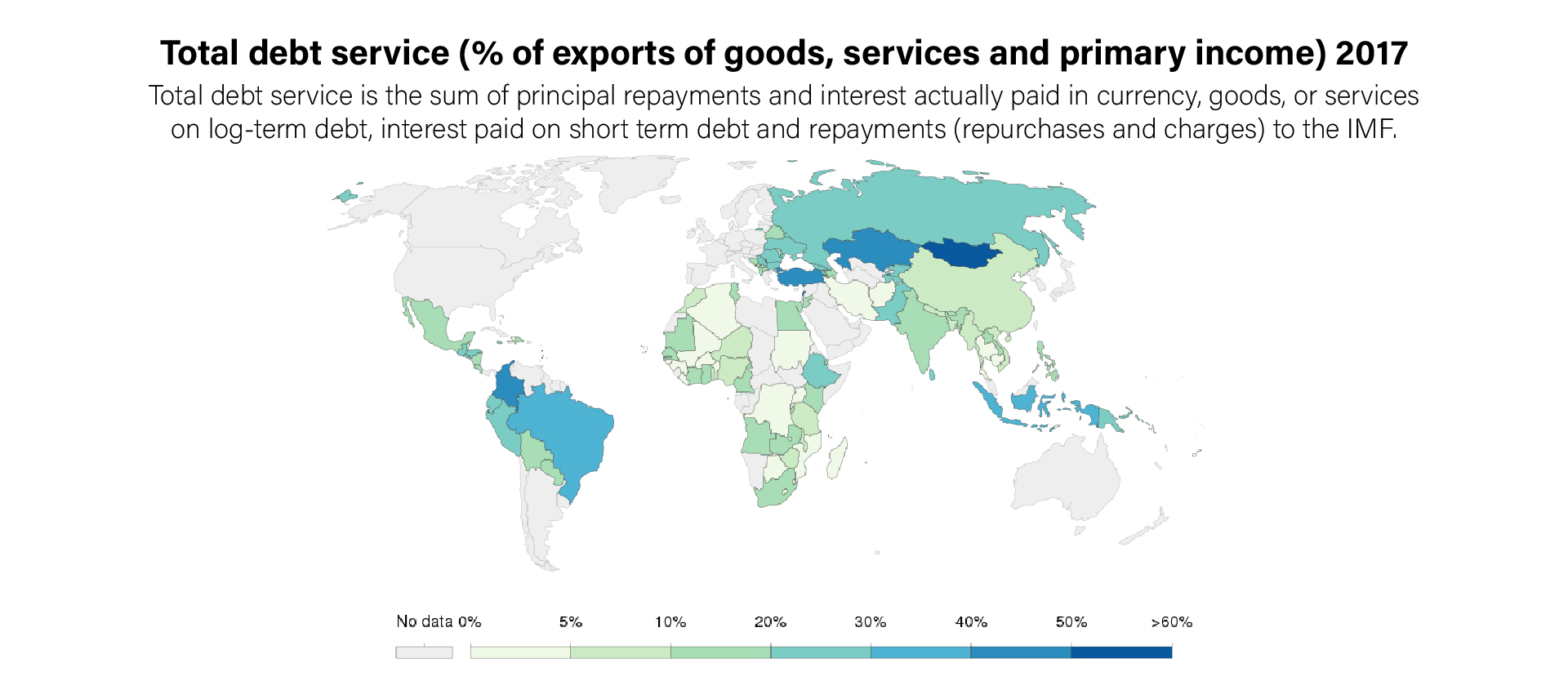

External Debt-to-exports Ratio: It is defined as the total outstanding debt ratio at the end of the year to the economy’s exports of goods and services for that year.

Risks associated with external debt

Foreign loans carry two main types of risks. First, as with mortgages, unexpected changes in mortgage rates can occur. This can lead to widespread insolvency if interest rates rise, for example, because debtors may not pay higher interest rates, increasing the risk of a systemic crisis.

An unexpected devaluation of the rupee could pose severe problems for Indian companies repaying loans in dollars. They would have to spend more rupees than expected to buy the currencies they need. Lenders usually take possible currency fluctuations into account when determining the interest rates for a loan. However, these predictions are not always perfect. Unexpected changes in exchange rates can still bring you incredible gains or losses.

Since the COVID-19 pandemic began, several emerging market currencies have depreciated sharply against the US dollar. The rupee, in particular, has fallen by around 7% since 2020. The devaluation of emerging market currencies is due to increased demand for dollars by investors who yearn to sell their assets in rising markets and invest in the United States, where earnings are proliferating.

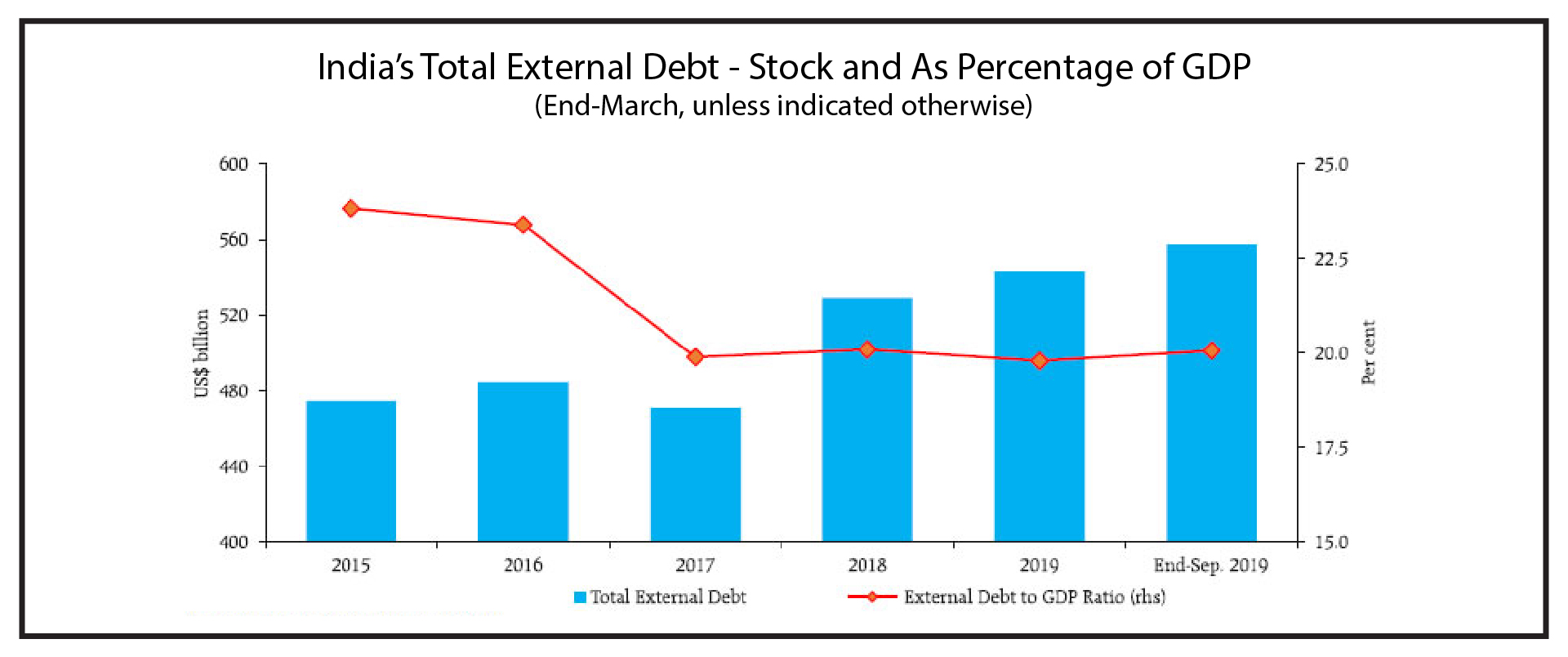

External debt and India

Rising interest rates could lead to larger capital outflows from emerging markets, causing unexpected changes in interest rates and rupee prices. Therefore, both the government and non-government borrowers in India are open to foreign debt and are consequently more susceptible to losses.

The Reserve Bank of India (RBI) held foreign exchange reserves as of January 2021 amounted to approximately $584 billion. This power of the central bank’s fire makes it possible to take advantage of the RBI and save troubled debtors.

We cannot conclusively state whether external debts are good or bad for a country. Taking loans from international forums and partners is a good and reliable way to raise money in emergency times. But, failing to repay those loans can prove to be fatal for countries, as is the case in many modern-day economies, like Pakistan in South Asia and Nigeria in Africa, to name a few.

Nevertheless, a well-formed national policy, leadership and international commitment are necessary to help nations and their people in need.