Starting a business or a company involves numerous challenges and processes.

From planning out the basic foundation of the business and amassing enough capital for it, to analysing the business climate and your position in it, it is certainly a long and hectic process. You naturally face a lot of questions about your own self as well as the workings of the professional world.

And among these doubts, one question that puzzles new and budding entrepreneurs, as well as the new workforce entering the professional world, is the question of the ‘provident fund’- EPF. To understand what the Employees Provident Fund (EPF) and the Employees Provident Fund Organisation (EPFO) are, let’s delve into some details of the scheme and the organisation.

‘‘

It is a welfare scheme for the benefits of the employees. Both employer and employee contribute their share of the amount and the whole amount is deposited by the employer in employees’ EPF account.

What is EPF?

By definition, EPF is a scheme under the Employees’ Provident Funds and Miscellaneous Act, 1952. It is a social security scheme which is maintained and monitored by the Employees’ Provident Fund Organisation (EPFO) — a body that promotes employees to save funds for retirement, and more recently for other life events like marriage, child birth or even a medical emergency. EPFO is governed by the Ministry of Labour and Employment, Government of India and was launched in 1951. Basically, it is a welfare scheme for the benefits of the employees. Both employer and employee contribute their share of the amount and the whole amount is deposited by the employer in employees’ EPF account.

Applicability of the EPF Scheme

As a new entrepreneur, it is imperative for you to know the details about EPF as it has a significant influence on the working environment of your venture. The most important thing for a new business owner to know about EPF is— is her/his company required to register with the EPFO? Well, EPFO registration is mandatory for any company which is engaged in any industry and has 20 or more persons. Thus, it is compulsory for the company to register with the EPFO and contribute to the employees’ EPF account.

It must be noted that companies that have less than 20 employees can also obtain PF registration as a completely voluntary measure. Such a company can choose to opt for the EPF scheme. The employees will be eligible for a PF from the starting of their employment with the said company. The responsibility of deduction & payment of PF will lie with the employer as directed by the law.

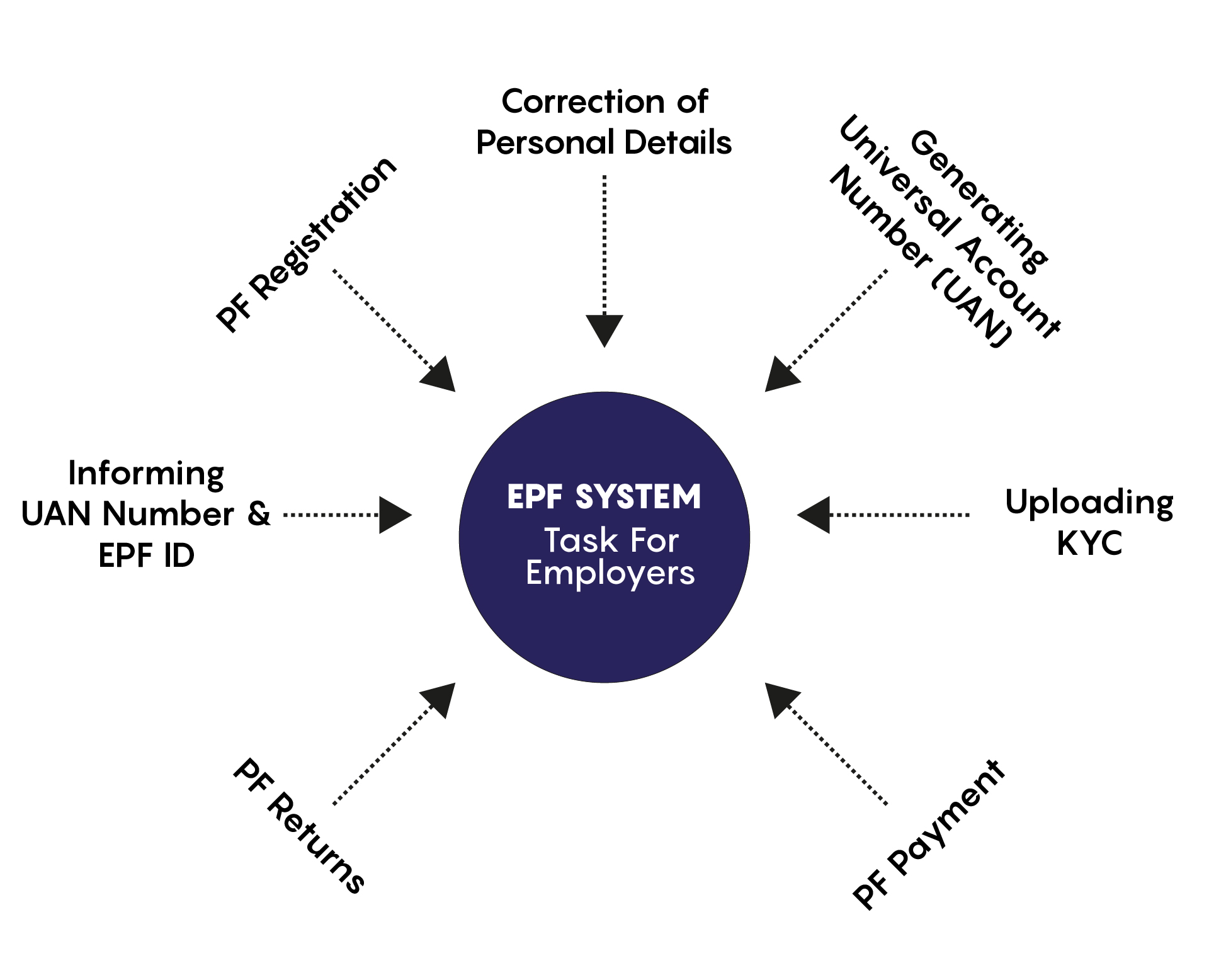

To understand more about the applicability and further rules for employers regarding the EPF, let us understand the EPF system for employers.

EPFO Tasks for Employers

We have established that any company with more than 20 employees has to register with the EPFO and contribute to the employees’ account. Now, you must know that as part of the process involved in EPF, the employer is supposed to do the following tasks while onboarding employees in her/his company:

PF Registration: The employer has to register the new employee into the EPF scheme with the help of Form 11. Form 11 is a self-declaration form that has to be filled and submitted by an employee at the time of joining a new organization. This form can be downloaded from the EPFO website, the link for the same is https://www.epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/Form11Revised.pdf;

Correction of Personal Details: The employer has to verify the details filled by the employee. EPFO’s Universal Account Number (UAN) with the Aadhaar, the errors in the personal details of members like spelling errors have to be fixed by the employer;

Generating Universal Account Number (UAN): Now, the employer has to generate UAN for the new employee who does not have an existing UAN. To make a new UAN, the employer has to login UAN employer portal;

Uploading KYC: KYC is mandatory for the withdrawal of EPF. The EPFO needs the PAN, Bank account number and Aadhaar or other KYC details of each EPF member. Hence, it is the responsibility of the employer to record and upload the KYC details of her/his employees;

PF Payment: The employer has to pay the EPF contribution to the EPFO every month. The employer has to pay EPF contribution within 15 days of the next month. If the deadline is missed the company will be in the defaulter list and they have to pay a penalty for the default period;

PF Returns: An employee has to file a return of monthly payment by logging in to UAN employer portal and filling the Electronic Challan cum Return (ECR). The employer will give details of the employees, their salary as well as contribution. EPFO will then update the passbook of every employee. It is tallied with the aggregate of the EPF amount paid and an annual return is then filed by the employer;

Informing UAN number and EPF ID: The employer has to inform about the UAN and EPF member ID to its employee. It is usually printed in the salary slip. The employer persuades its employees to activate their UAN in order to do EPF related tasks online.

Employee and Employer Contributions to the Employee Provident Fund (EPF)

Employee’s contribution towards EPF – 12% of the employee’s salary is deducted by the employer on a monthly basis for a contribution towards EPF. The entire contribution goes towards the EPF account.

Employer’s contribution towards EPF – The employer also contributes 12% of the employee’s salary towards EPF.

For EPF, both the employee and the employer contribute an equal amount of 12% of the monthly basic salary of the employee. You need to understand here that the basic salary is the total amount (before any deductions) paid to employees including any allowances. Simply said, it is the fixed amount that is paid to employees by their employers in return for the work performed. So, it is from this fixed amount that the 12 per cent deduction is made to contribute to the EPF scheme, and your employer deposits the same 12 per cent sum in your EPF account. The PF contribution of 12 per cent is divided equally between the employer and employee. The employer’s contribution is 12 per cent of the basic salary.

If the establishment has employed less than 20 employees and still voluntarily opts for the scheme, the PF deduction rate will be 10 per cent. Another interesting fact here is that employees can contribute more than 12 per cent of their salary voluntarily; however, the employer is not bound to match the extra contribution of the employee.

The employer’s monthly contribution is restricted to a maximum amount of Rs 1,800. Even if the employee’s salary exceeds Rs 15,000, the employer is liable to contribute only Rs 1,800 (12% of Rs 15,000).

An employer can also create a trust to manage the EPF contribution. For this reason, an employer is not required to remit EPF contribution as it goes to the private trust. Instead, the trust should provide an equal or higher return than the EPFO.

The next logical question that arises is the eligibility of employees for this scheme.

EPF Eligibility for Employees

As far as the eligibility of employees for the EPF is concerned, every salaried individual working in the organized sector (PSUs, Private Companies, Banks, Start-up, etc.) is eligible for the EPF scheme. It must be noted though that the EPF scheme is mandatory for salaried employees with a basic income less than Rs15, 000 per month. You have no choice but to contribute to the scheme.

On the other hand, employees earning a basic salary of more than Rs 15,000 per month have the option to either choose the scheme or to opt out of it. And if the employees want to opt out of the EPF scheme, they will have to do so at the start of their career. Because, once they become a member of the EPFO, the membership cannot be cancelled or opted out from.

But, in a company where, let’s say all the employees are earning more than Rs 15,000 per month. What happens in that case? In such a situation, the employer and a majority of employees come to an agreement that they either choose to be a part of the scheme or opt out of it.

‘‘

It helps in saving money at the time of retirement and helps an individual maintain a good lifestyle.

What happens to the EPF in Contractual Employment?

EPF Contribution can be done only for the Permanent employees of the company. Contract staff, Temporary staff and other people who are not on the permanent payroll of the company do not get covered under EPF.

One might argue that they don’t see any positive point in getting a mandatory deduction from their salary which is already as low as Rs 15,000, while those who earn more than Rs 15,000 have an option to choose it or opt out of it. Well the reasoning behind this is simple- a person earning less today might be at a higher financial risk in future. And to ensure their future financial security, this contribution to EPF in the present is certainly important and a very viable plan.

Let’s identify some more benefits of EPF.

EPF Benefits

The EPF scheme benefits employees in many ways, some of which are mentioned below:

There is no requirement to make a single, lump-sum investment. Deductions are made on a monthly basis from the employee’s salary and it helps in saving a huge amount of money over a long period.

It helps in saving money at the time of retirement and helps an individual maintain a good lifestyle.

It can help an employee financially during an emergency. It helps in saving money for the long run.

There’s more. You also get interest in the contributions made to the EPF by you and your employer. This is called the EPF Interest Rate. Currently, the PF interest rate is 8.50%. This amount is added to the employer and employee contributions at the end of the year to find the total balance in the account.

It is possible to easily calculate the interest amount accumulated in the EPF account at the end of a financial year.

Withdrawal of EPF

Withdrawals are made from the EPF account for financing an insurance policy, buying or building a house, and other situations mentioned on the EPFO website. EPFO subscribers can now withdraw 75% of their PF after 1 month of unemployment. Also, the remaining 25% of the amount can be withdrawn after 2 months of unemployment. The claim settlement period for PF withdrawal is now just 10 days

Recent changes to the policy

Following changes have been recently made to the EPF Scheme by the government:

Aadhar Card is compulsory for pensioners and subscribers.

EPF contribution rate for the newly recruited female employees has been reduced from 12% to 8%. This will be available to the new female employees for the first 3 years of employment.

Employers must consider special allowances paid to the employees as a part of the “Basic Wage” for deduction towards provident fund.

Women employees resigning to get married can withdraw their 100% without waiting for two months.

In a nutshell

EPFO is the largest social security scheme in the world. It is aimed at achieving the socio-economic stability of the organised working class. Even during the COVID-19 pandemic, the government used the EPF accounts of citizens to give them some form of financial aid as the economy took a hit by the pandemic. The EPF organisation announced measures like the payment of 8.5% of the deposited PF to its subscribers in two instalments. The Indian government also mulled on options to open up EPFO subscriptions for all self-employed people.

The fact that 8 million people withdrew their EPF during April to July amounting to Rs.30,000 crore clearly indicates that this scheme is extremely beneficial for the Indian working class It is safe to say that the EPF is one of the best ways of financial security and even investment.

Share this article if you found it helpful and comment your queries below if any. If you want to understand more about financial planning, investment, GDP, economy, or any other topic, browse the vast library of our website.