In a previous article, we discussed in detail about the Balance of Trade and Trade Deficits in economies. However, there’s one more term we often come across even while reading our daily newspapers or watching prime time television – Balance of Payments. What is Balance of Payments? How is it different from Balance of Trade? How does BOP impact GDP, inflation and other economic instruments? By the time you finish this article, you will know everything there is to know about Balance of Payments.

What is Balance of Payments?

The Balance of Payments (BOP) is defined as the statement of all transactions made between entities in one country and the rest of the world over a defined period, such as a quarter or a year. BOP is also known as balance of international payments- an amalgamation of all transactions that a country’s individuals, companies, and government bodies complete with individuals, companies, and government bodies outside the country. These transactions include imports and exports of goods, services, and capital, as well as transfer payments like remittances and foreign aids. A country’s balance of payments and its net international investment position together constitute its international accounts.

‘‘

The Balance of Payments (BOP) is defined as the statement of all transactions made between entities in one country and the rest of the world over a defined period, such as a quarter or a year.

Components of Balance of Payments

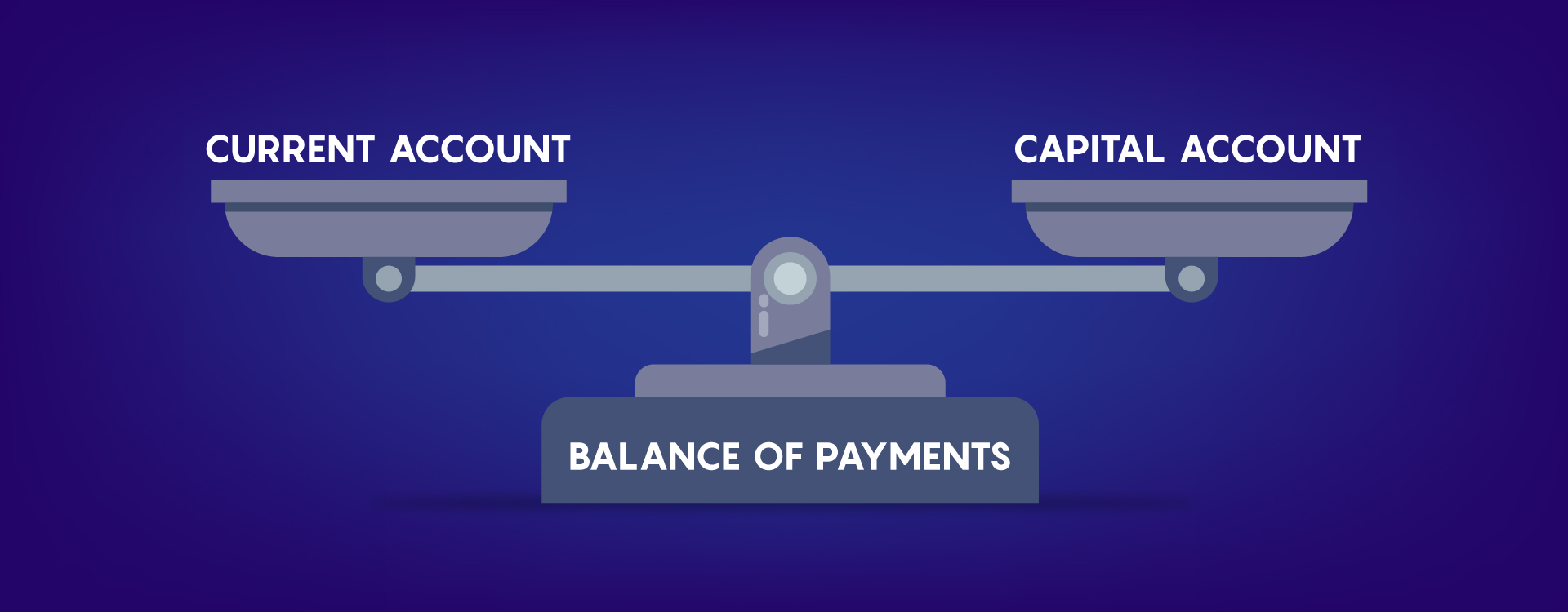

The balance of payments includes two accounts between which it divides all transitions- Current Account and Capital Account. Current Account The current account includes transactions in goods, services, investment income, and current transfers. Capital Account The capital account includes transactions in financial instruments and central bank reserves. Majorly, it includes only transactions in financial instruments and hence most of the times it is denoted as the financial account.

While calculating national output, the current account is included but the capital account is not. When you add all transactions in BOP, they must add up to zero. This is because every credit that appears in the current account will have a corresponding debit in the capital account and vice versa. For instance, if a country exports one product (current account transaction), it imports foreign capital in terms of payment for that product (capital account transaction).

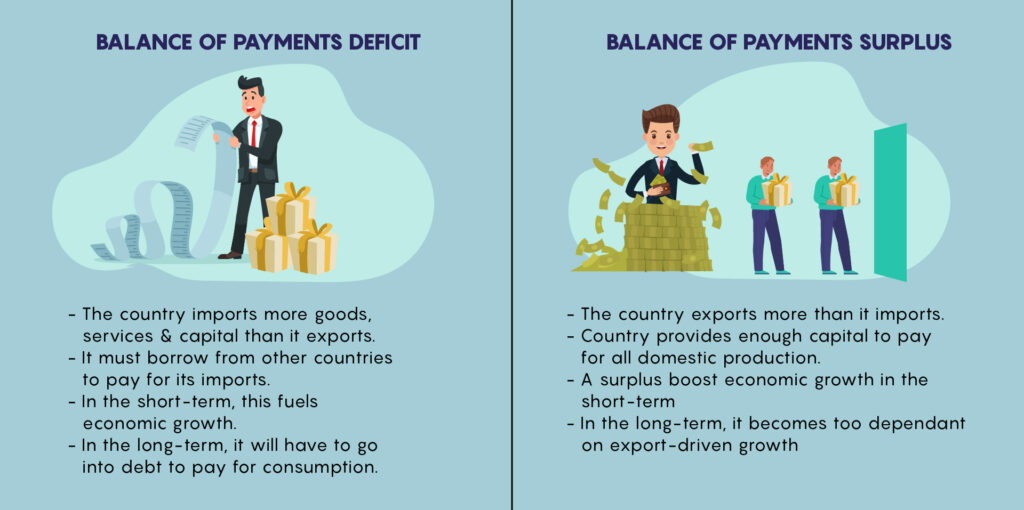

When a country is unable to fund imports via exporting capital, it has to run down its own reserves. This is known as a balance of payments deficit. This is based on the fact that the capital account excludes central bank reserves. Though in reality, the balance of payments must add up to zero by definition it is not what happens in practicality. Several statistical discrepancies occur as it is difficult to accurately count every transaction between an economy and the rest of the world and foreign currency differences also cause errors.

A country’s balance of payments necessarily has to zero out the current and capital accounts. But imbalances often appear between different countries’ current accounts. This is justified by The World Bank’s statistics for 2019: The U.S. had the world’s largest current account deficit, at $498 billion, while Germany had the world’s largest surplus, at $275 billion.

How to calculate BOP?

Balance of payment accounts reflect every monetary transaction, i.e., commodities, services and incomes during that period. It combines every private and public investment to report the money inflows and outflows over a specific period. The ideal status of BOP should be zero but this situation is highly unlikely. In case payments and receipts do not tally then the balance will be presented as errors and omissions. BOP is maintained to keep an eye on the flow of money within an economy and formulate policies accordingly.

Example: Suppose a country imports electronic products worth ﹩50 billion and exports food products of ﹩20 billion. In the same period, that company takes a foreign aid of ﹩6 billion and invests in a technology company of another country worth ﹩5 billion. This country’s BOP for given period will be: [﹩20billion +﹩6billion (total inflow) – ﹩50 billion +﹩5 billion (total outflow)] = – $19 billion. The value of exports and foreign aid is ‘total inflow’ and the value of imports and foreign investment is ‘total outflow’.

Balance of Payments v/s Balance of Trade

Today, every country is free to trade with each other and therefore two financial statements keep the record of international transactions made by a country- BOT and BOP. BOT records of import and export of goods by a country with others. While the BOP keeps track of every economic transaction made by a country globally. These two terms are used interchangeably, but they are completely different.

1.Balance of Trade only records the physical items. Whereas, Balance of Payment records physical items along with non-physical items.

2.Capital transfers are only included in a Balance of Payment and not in BOT.

3.BOT can be positive, negative or balanced. However, BOP must always be balanced.

4.BOT is a major part of a BOP. In fact, it’s a component of a BOP’s Capital Account section.

5.Both reflect the true condition of any economy. However, BOT only shows a partial picture, whereas BOP reveals an entire view of a country’s economy.

Balance of Payments and Economic Policy:

International investment position and Balance of payments are crucial in formulating national and international economic policies. Payment imbalances and foreign direct investment are important to address the nation’s policymakers.

Economic policies target specific objectives which then impact the balance of payments. Countries can adopt policies designed to attract foreign investment in a particular sector, policies to keep the currency at an artificially low level to stimulate exports and build currency reserves. The impact of these policies directly affects BOP.

Balance of Payments and Inflation

Inflation makes it difficult to meet consumption demands as the price hike prevents you from consuming. Importers observe the fall in demand and import less. This saves the government the effort of finding more dollars for imports. This reduces the liability side of the country’s BOP from the earlier period

Now suppose an importer from a foreign country sees the prices have gone up and the nation’s central bank decreases the value of its currency to prevent local exporters from stagnating. Foreigners can import more than the previous year with lesser dollars by the amount of devaluation. This raises the asset side of the Balance of Payment.

The BOP now has more assets and lesser liabilities along with an increase in reserves. This means that there is a higher supply of dollars and higher demand for domestic currency, which pushes the value of the domestic currency to original value. Domestic importers then import more and export less reversing the BOP situation attained as there will be more liabilities and lesser assets. And this cycle keeps repeating. Economies plan their future states based on this simultaneity feature of the BOP.

India’s BOP 2020-21 First Quarter ( RBI )

- India’s current account balance (CAB) recorded a surplus of US$ 19.8 billion (3.9 per cent of GDP) in Q1 of 2020-21 on top of a surplus of US$ 0.6 billion (0.1 per cent of GDP) in the preceding quarter, i.e., Q4 of 2019-20; a deficit of US$ 15.0 billion (2.1 per cent of GDP) was recorded a year ago [i.e. Q1 of 2019-20].

- The surplus in the current account in Q1 of 2020-21 was on account of a sharp contraction in the trade deficit to US$ 10.0 billion due to steeper decline in merchandise imports relative to exports on a year-on-year basis.

- Net services receipts remained stable, primarily on the back of net earnings from computer services.

- Private transfer receipts, mainly representing remittances by Indians employed overseas, amounted to US$ 18.2 billion, a decline of 8.7 per cent from their level a year ago.

- Net outgo from the primary income account, primarily reflecting net overseas investment income payments, increased to US$ 7.7 billion from US$ 6.3 billion a year ago.

- In the financial account, net foreign direct investment recorded outflow of US$ 0.4 billion as against inflows of US$ 14.0 billion in Q1 of 2019-20.

- Net foreign portfolio investment was US$ 0.6 billion as compared with US$ 4.8 billion in Q1 of 2019-20 as net purchases in the equity market were offset by net sales in the debt segment.

- With repayments exceeding fresh disbursals, external commercial borrowings to India recorded net outflow of US$ 1.1 billion in Q1 of 2020-21 as against an inflow of US$ 6.0 billion a year ago.

- Net inflow on account of non-resident deposits increased to US$ 3.0 billion from US$ 2.8 billion in Q1 of 2019-20.

- There was an accretion of US$ 19.8 billion to the foreign exchange reserves (on a BoP basis) as compared with that of US$ 14.0 billion in Q1 of 2019-20.

Balance of Payments and Trade

The current account involves trade in goods like import and export of finished goods, semi-finished goods, and commodities; services including financial services, tourism, and consultancy. It also includes investment income made from investing abroad, profits from business activities of subsidiaries located abroad: interest received investments and loans abroad, and dividends from owning shares in overseas firms. The current account also includes payments to individuals who are residents of a country and employed in another. Investment and employment income are together termed as ‘primary income’. Finally, transfer payments from gifts between residents of different countries, donations to charities abroad, and overseas aid are also a part of the current account.

Capital account trades in real FDI like investments in an enterprise where the owners/shareholders have some control of the business; portfolio investments like buying shares in an existing business abroad where investors have no control over the enterprise; financial derivatives and reserve assets controlled by monetary authorities.

Current Account Deficit – A Problem?

A current account deficit is when a country’s residents spend more on imports than they save. Other countries lend funds or invest in the deficit country’s businesses to fund the national deficit. The lender countries usually pay for the deficit as their businesses profit from exports to the deficit country. In the short run, the CADs benefit both lending and deficit nations. But in the long run, CAD slows economic growth. But if the current account deficit continues for a long time, it will slow economic growth. Foreign lenders wonder whether they will get adequate returns on their investment. As demand reduces, the value of the deficit country’s currency may also decline to lead to inflation as import prices rise. This pushes interest rates up as the government must pay higher yields on its bonds.

CAD deficits can be an issue if they are persistent, form a large part of GDP, there are no compensating inflows of capital account flows or investment incomes. It can be a problem if the economy has a poor record of repaying debt and the Central Bank has low reserves.

If you wish to read about Balance of Trade, check out Dutch Uncles article on Trade Deficit.