Risk is a very real part of stock market investing. While betting on stocks, it is important to identify those stocks that are less susceptible to the fluctuations in the market.

What is Beta?

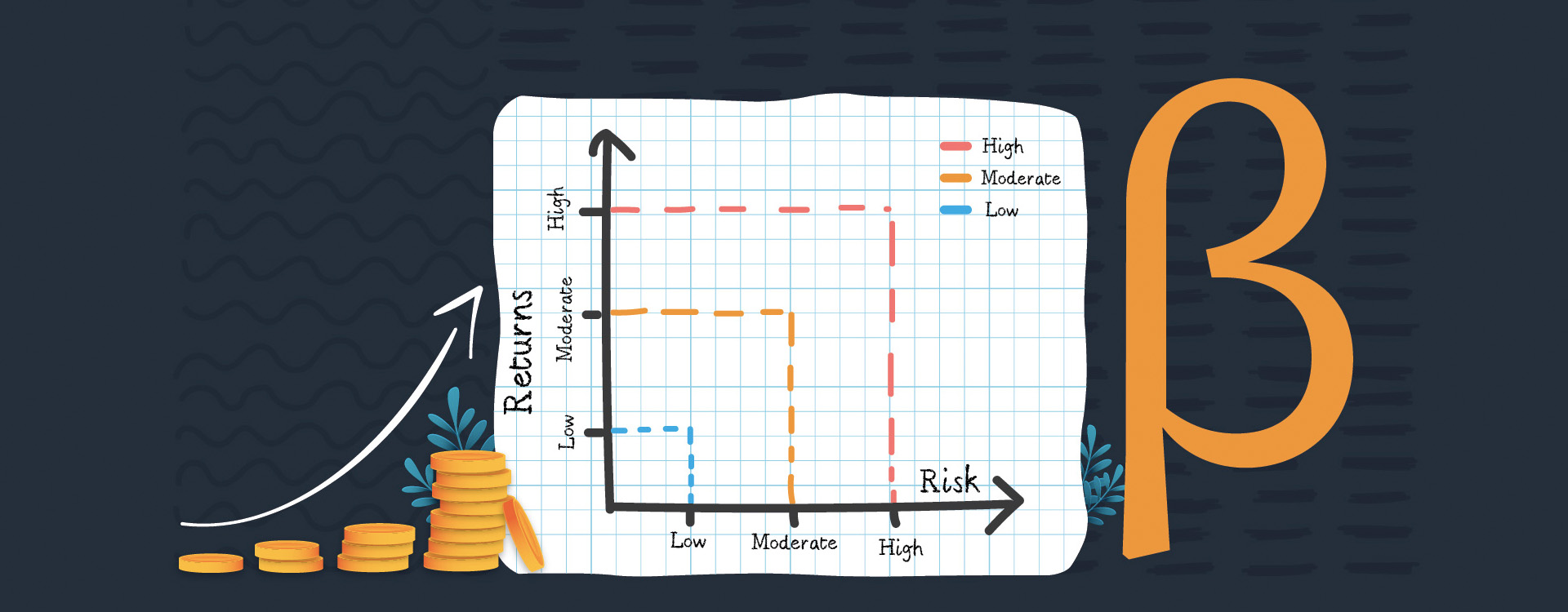

Beta is a measure of fluctuations in the overall stock market. Indicated by the Greek letter (β), beta shows the relative change in investment against a broader index (e.g., NSE NIFTY). In other words, beta calculates the volatility or risk for an asset. It’s a reflection of a stock’s responsiveness in relation with changes in the overall stock market. Using beta, you can decipher a pattern which reflects a stock’s openness to the market risk. A beta value above 1 indicates a risky stock whereas a beta value below 1 shows a less volatile stock. A positive beta value shows that the stocks and the market are moving in the same direction. If the stock’s beta value is 1.5, this stock will display 50% higher volatility than the market.

What information does it provide to investors?

Beta essentially helps investors’ pin-point how much their portfolio will swing when the market moves. It is also helpful for short-term decision making and lays the susceptibility of an investment on the table. The value of beta is an indicator of whether a particular stock, fund, or even an entire portfolio could go through large swings in the future. Beta is also a key metric in the Capital Asset Price Model (CAPM) which measures stock return.

‘‘

Using Beta, you can decipher a pattern which reflects a stock’s openness to the market risk.

How beta works

Beta estimates the correlation between the movement of an asset and overall market changes based on historical data. It measures risk that’s not specific to a particular investment and cannot be avoided through diversification. Beta is commonly used by financial advisors, investors, and fund managers to analyze portfolios and to determine how an investment impacts a portfolio.

Calculation of Beta

Calculation of beta is done through regression analysis. As an example, by considering the beta value of a stock to be 1.3, if the stock market is projected to increase by 10%, by multiplying both the parameters, we can be sure that the stock will rise by 13%.

Beta can be calculated using several methods. Here we will take up the variance/covariance method for calculating the Beta which is the most commonly used method.

Here is the formula for calculating the Beta coefficient:

Beta coefficient (β) = Covariance (Re,Rm) / Variance (Rm)

Where

Re = Return on individual stock

Rm = Return on overall market

Covariance = stock return changes in relation with market return changes

Variance = Market data points’ distance from average value.

A simple calculation

Let’s calculate the Beta of a stock RELIANCE against the S&P 500 (Standards & Poor’s 500, a stock market index) benchmark. On the basis of past data, let’s consider the correlation between RELIANCE and S&P to be 0.75. If RELIANCE’s standard deviation of returns is 25.20% and that of S&P is 35.81%,

Using the formula provided above,

The Beta of RELIANCE = 0.75 x (0.2520/0.3581) = 0.5278

Takeaways for investors

- Beta is useful for making investment decisions for investors who do not want their portfolio to make big swings.

- Also, investors trying to make money in the short-term without ample time to recover during a quick downturn will benefit from the insights provided by beta.

- Retail investors must ensure to diversify when it comes to both their portfolio as well as beta.

- You can protect your overall portfolio against large swings by choosing investments with negative, low, moderate, and high beta. This will result in a well-constructed portfolio that will display good performance during varying economic cycles.

Beta is particularly important for investors since it’s important to know where your investments or even your portfolio may be headed during various market conditions. If you want to escape big swings, invest in stocks with low beta value. You can also choose investments with negative beta and thus guard against high beta investments.

On the other hand, if you are fine with taking a certain amount of risk, invest in stocks with high beta to get higher returns. Of course, the possibility of incurring losses is also high in this scenario. The value of beta is incredibly useful for portfolio building when seen from the larger picture instead of just as a single piece of analysis.