You can’t escape tax even in capital gains. Taxpayers are required to declare their profits on sales of stocks. Naturally, the government has stepped in to prevent tax evasion and to enforce tax outflow on financial market transactions.

What is Securities Transaction Tax?

Securities Transaction Tax (STT) is a tax accrued on the buying and selling of shares and other tradable securities of publicly listed companies. This tax is levied on listed securities including equity, derivatives, and units of equity-oriented mutual funds. STT is a turnover tax levied on the total consideration traded in shares. It’s a small tax but nonetheless significant for a retail investor. A financial transaction tax, it is similar to the Tax Collected at Source (TCS) and is applicable for all the recognised stock exchanges in India.

Purpose of STT

The main purpose of introducing STT was as an initiative to curb evasion of tax on capital gains or profits for transaction on securities. It was also meant to be a clean and efficient means of extracting taxes within the finance market. STT is governed under the Securities Transaction Tax Act which was introduced during the Union Budget of 2004. It was aimed at replacing the low tax on Short-Term Capital Gains (STCG) and 0 tax on Long-Term Capital Gains (LTCG) on equities. The initial tax bracket was too high for brokers and the trading community and a request for reduction was subsequently accepted by the government.

‘‘

STT is a turnover tax levied on the total consideration traded in shares.

How is it levied?

STT is added to the stock price during a transaction and is auto-added to the transaction price. The STT must be collected by a recognised stock exchange or by a prescribed person in the case of mutual funds. In the case of an IPO, it must be collected by the lead merchant banker. The STT collected is payable to the government by the 7th of the following month. Tax evasion is near impossible since the broker or the asset management company deducts it at the source.

Securities that comes under the ambit of STT

The securities defined under the Securities Contracts (Regulation) Act, 1956 that come within the scope of STT include the following:

- Marketable securities including shares, scrips, stocks, bonds, debentures, and debenture stocks.

- Derivatives

- Government equity securities

- Equity oriented units of Mutual Funds

- Security rights

- Securitized debt instruments

STT calculation

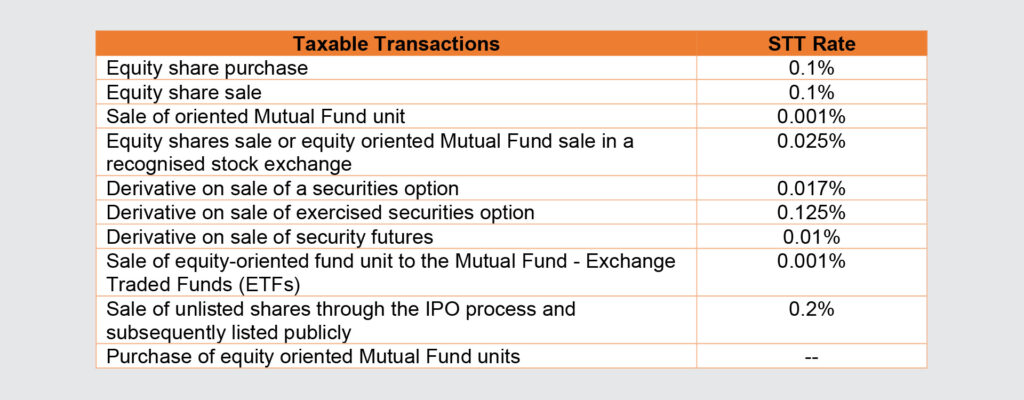

STT is calculated as a percentage of the unit value of the security being traded and can be anywhere between 0.001% to 0.2%.

Let’s see how STT is calculated for Intraday Trades. For the sell side of the transaction at 0.025%, let’s assume that a trader purchased 100 shares of HDFC at INR 1000 each on a Monday morning and sold them off at INR 1005 in the evening. A simple STT calculation will be

STT = (1005 X 100 X 0.025) / 100 = INR 25.125.

About STT Tax Rate

The rate of STT levied may vary depending on several factors including the type of security traded and on the type of transaction (purchase or sale). The tax rates are decided by the Central Government. Off-market, commodity, and currency transactions do not accrue tax. Here is a breakdown of the varying tax rates levied on various transactions.

Although STT’s tax quantum is a relatively small amount, it contributes to a high transaction cost and may impact the profits of investors. Apart from STT, two other taxes are imposed on stock market investors namely, the Capital Gains Tax and the Dividend Distribution Tax. Although the investments in the stock and share market cannot be predicted, investors are still required to pay taxes even if they incur losses.