A majority of the new investors might not be aware, but a company issues two kinds of stocks in the market. One is common or ordinary shares owned by retail investors and, the other is preference shares. Let us dig deeper to know what they are and if investors should invest in such shares.

What are preference shares?

Preference shares also, known as preferred stocks are shares of a kind issued by a company where company profits or dividends are distributed first to the preference shareholders than the common shareholders. The dividends paid to the preference shareholders are fixed irrespective of variations in stock prices and company profits. The returns on these shares are generally higher than the dividend paid on the common stocks.

The power of preference share is such that if a company lands up in bankruptcy, then the amount generated by selling all company assets is first distributed amongst preference stock investors than the common stocks. The preference shares investors are generally mutual fund firms and financial institutions, and company issues such shares to generate more funds or money in a short time.

What are the types of preference shares?

There are many types of preference shares prevalent in India, below are some:

Cumulative shares: In this, if a company is not able to pay dividends due to a slump in revenues, then the company has to pay the previous dividend as well the current year’s dividend to the investor. Let us understand this with an example, suppose a company promises to pay a dividend of 10 % for 5 years to the investor. Say, In the first year, it could pay a dividend but in the second year it could not pay. Eventually, in the third year, it will be paying a 20% dividend adding 10% from the previous year and 10 % from the current year. The law forbids the company to make any dividend payment to common shareholders, unless and until the preference shareholders receive dividends.

Non-Cumulative shares: Unlike cumulative, if a company is not able to pay the dividend in a certain year, then in its consecutive year, it will pay only the current year’s dividend and not the previous years. Taking the above example, the company is liable to pay 10 % only to its preferential shareholders.

‘‘

Preferred stocks are shares of a kind issued by a company where company profits or dividends are distributed first to the preference shareholders than the common shareholders.

Convertible shares: In this, the shares are eligible to be converted into common shares after certain years. For instance, if a company issues a share certificate to its preferential shareholders mentioning that shares are convertible after 5 years, it means after 5 years the shares will become ordinary shares. In converted preference share, the individual will not be receiving any fixed dividend but will get the profits earned from the share price growth.

Non-Convertible Shares: Company cannot convert the preference shares into common shares.

Redeemable shares: The company has the right to buy back its shares from shareholders at a fixed date. Say, if the shares are redeemable after 4 years, which means that the company will purchase its shares from preference shareholders, at a price that was issued at that time.

Irredeemable or perpetual Shares: These shares can only be redeemed by the company at the time of liquidation or when the company shuts its operations but the shareholders will receive fixed dividends as promised. But, irredeemable shares are not allowed in India, as according to the Companies Act, 2013 all preference shares must be redeemed within 20 years.

Preference share with a callable option: It is similar to redeemable shares but with a difference. Here, the company has the right to purchase the stocks at a decided price after a pre-decided date.

Adjustable-rate preference share: In this, the dividend rate is not fixed as companies do not want to take the interest rate risk. The dividend is linked with the existing interest rate in the market.

Participating preference share: Apart from receiving fixed dividends, the preferential shareholders will receive the additional dividend difference on the common shares. This happens when the dividend on ordinary shares is more than the dividend of preference share. For example, if the dividend on the ordinary share is Rs 12 and it is Rs 10 on preference, then the company needs to pay Rs 12 ( 10+ {12-10}) for each preference shareholder.

Non-Participating preference Share: The shareholders are entitled to receive dividends at a fixed rate and will not receive benefits from the surplus profit. The extra profit is distributed among the common shareholders.

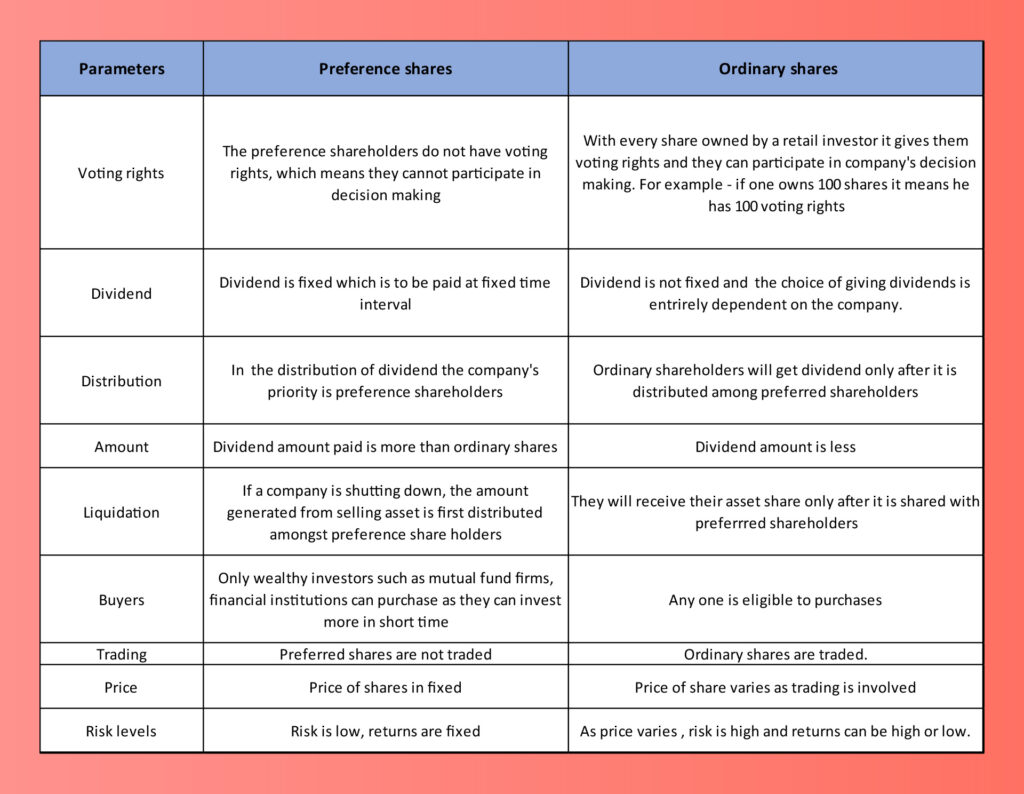

Ordinary shares vs Preference shares

Though both preference and ordinary shares promise ownership in a firm, they differ from each other.

Is preference share investment for retail investors?

Since preference shares are not traded on stock exchanges, it is not available for retail investors. A company rarely keeps its preference shares to be purchased by retail investors. But, in case anyone is interested he/she can invest in such shares of a company through their financial broker.