Whether to invest actively or passively has always been a matter of debate among investors. But, both investment patterns come with their own set of advantages and disadvantages. Let us dig deeper to understand what these two investment styles are.

What is an active investment?

Active investment refers to the investor having a dedicated portfolio or fund manager who selects stocks that they predict will perform well to invest in using the investor’s money. They take advantage of the short-term stock price fluctuations. The ultimate goal of the fund manager is to outperform the index or beat the market and seek out good investment opportunities to double an investor’s money.

What is passive investment?

Passive investment is when the investor purchases the shares of a group of companies from a certain sector also known as an index by religiously tracking to get maximum profits. If the stocks of the invested companies collectively perform well, the index performs wells and gives good returns. Unlike active investment, there is no human interference involved in passive investment. The goal here for an investor is to match the performance of certain market indices rather than trying to outperform them.

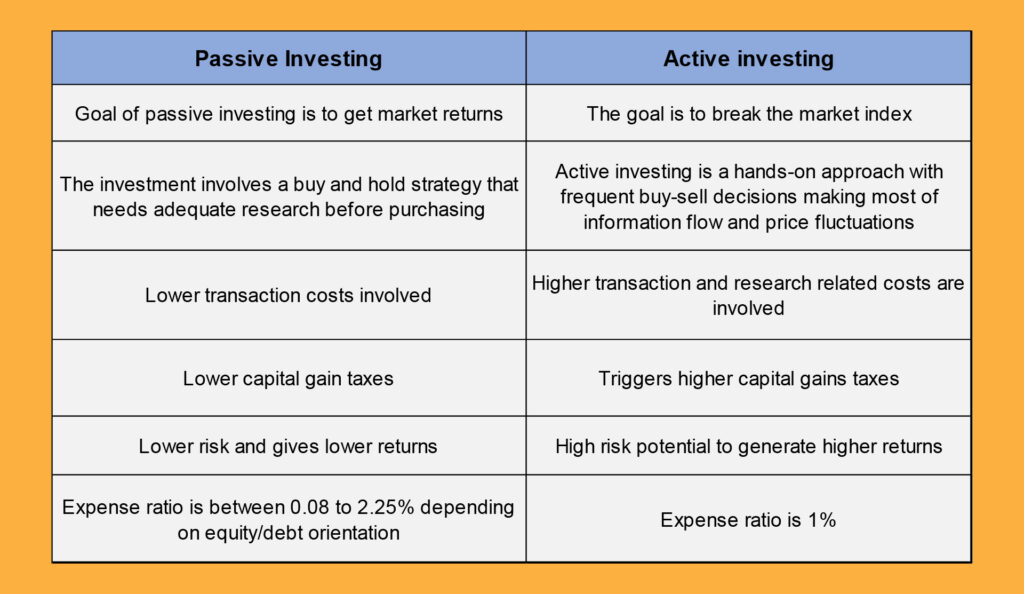

‘‘

Both active investment and passive investment come with their pros and cons.

The Pros and Cons of Active investment

Pros

- The buying and selling of stocks are based on research.

- Fund or portfolio managers are not bound to invest in a specific index. They can buy the potential money-giving stocks if they believe they have found it.

- Investment risks can be reduced with hedging. With techniques such as shorting or put options, they can achieve small profits and exit at the right time when the risk becomes high.

- Capital gains tax is inevitable when we earn profits by selling securities. The fund managers also provide advice to individual investors regarding ways to attract fewer taxes, such as by selling investments to lose money for offsetting the taxes on the big winners.

Cons

- As active investment requires a fund manager, the fees can be expensive because active trading attracts transaction costs. The money that we invest is also funding the salaries of the analyst team who are researching the best stock picks to invest.

- Active investors are free to buy any investment that they predict to give good returns but sometimes it can backfire to give low returns, as man-made decision-making is prone to errors. Therefore, finding a competent fund manager who can pick the right stocks is a challenge here.

Passive Investment: Advantages and Disadvantages

Advantages

- Lower fee is required as no one is picking stocks.

- There is transparency regarding the assets in an index fund.

- In passive investment, funds are invested in proportion to a certain index that is being tracked. The fund invested is roughly the market return deducting the fees.

- The passive investment follows a buy-and-hold strategy that does not trigger massive capital gains tax. This is due to the lower frequency of transactions. The charges involved in brokerage, advisory fees, and sales commission are also low.

Disadvantages

The returns in passive investment are moderate. The returns can be equal to the benchmark’s returns or less. Sometimes, a passive fund may beat the market by a little, but it will never post the big returns as an active investment.

Active investment vs passive investment

Which is better – active investment or passive investment?

There is no set rule that says either of the two investments is the better one. It is dependent on the market behaviour. Active investments tend to give good returns during certain market climates such as when the market is volatile or the economy is weakening. Whereas, going passive is better when the equity valuation is more uniform.

An investor may also choose a combination of both investments depending on the opportunity in different sectors on the capital markets. The varying market conditions often require an informed eye to decide when and how much to invest in passive and active.