The pandemic has led the fintech ecosystem to undergo a historic transformation. The recent economic crisis, pay cuts and rapid rise of unemployment are forcing people to revisit their personal financial provisions. The pandemic-induced cautious buying behaviour with an urgent acquittance with savings gave businesses a run for their money. To fight uncertainties and help businesses to ease sales, Fintech in India launched its newest offering Buy Now Pay Later. This payment method is rapidly being incorporated by India’s online shopping and the payment ecosystem. Buyers opting for this method are making purchases in categories such as EdTech, high-end smartphones, large appliances, electric vehicles, fitness accessories and fashion. The profiling of such consumers being an average Indian – 34-year-old, and almost 70 percent from Tier II and Tier III cities.

In the coming years Gen Z and millennials will form the next target consumer base for most brands, fintech apps and e-commerce that are sceptical about making payments through credit cards. Pine Labs which is India’s largest Buy Now Pay Later EMI platform, has seen a 60-70 percent spike in demand from January 2020. This is exactly the time when the purchase graph was at its all-time low.

‘‘

Pine Labs is India's largest Buy Now Pay Later EMI platform, which has seen a 60-70 percent spike in demand from January 2020.

What is Buy Now Pay Later Payment Method?

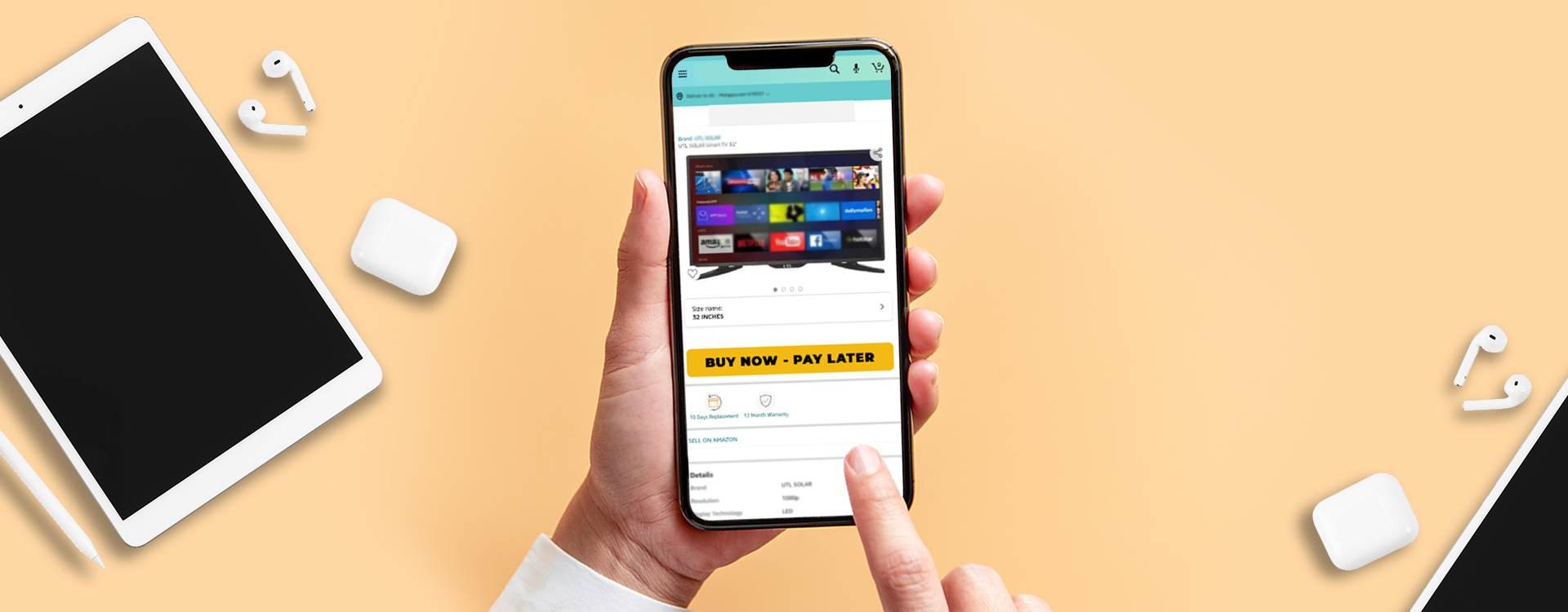

The Buy Now Pay Later is a convenient financing option where the customers can make their purchase but pay for it over time. It eases the spending burden and credit crunch on the consumer by helping to break down a large expense into small EMIs.

Buy Now Pay Later Payment Method

There are two ways of adopting the BNPL payment:

- Merchant transaction fee loan: It is a point-of-sale loan where the consumer is not charged any interest instead the merchant is charged a transaction fee by the BNPL platforms.

- Shopper interest loan: An alternative BNPL is a point-of-sale loan where the consumer is offered an on-the-spot loan by a third party. The customer will receive the item right at that moment but will pay over time, including interest. There is no charge for the merchant.

How beneficial is it for merchants to adopt?

- It offers a holistic purchase experience through its one-click financing feature to its digital native consumers who find the paperwork and other formalities to be gruelling, thereby removing their buying hesitations.

- There is an increase in overall sales.

- With the opening of a new stream of income shoppers are motivated to buy more as it increases their affordability of a product.

- It gives an increase in the average order value and induces shoppers to make bigger ticket purchases bringing an overall increase in sales.