In the early 2000s, India was reaping the true benefits of the economic liberalisation of 1991. The markets were thrown open and the country was in the spotlight. The red carpet was laid out for companies to step into the world of trading with the Sensex reaching an all-time high. However, the dream was short-lived as the crash of 2008 brought the stock market to its knees. It was a bad time for investors and brokers – they had lost everything.

“In dreaded times, brave are the ones that will not lose hope, it’s what keeps us human”.

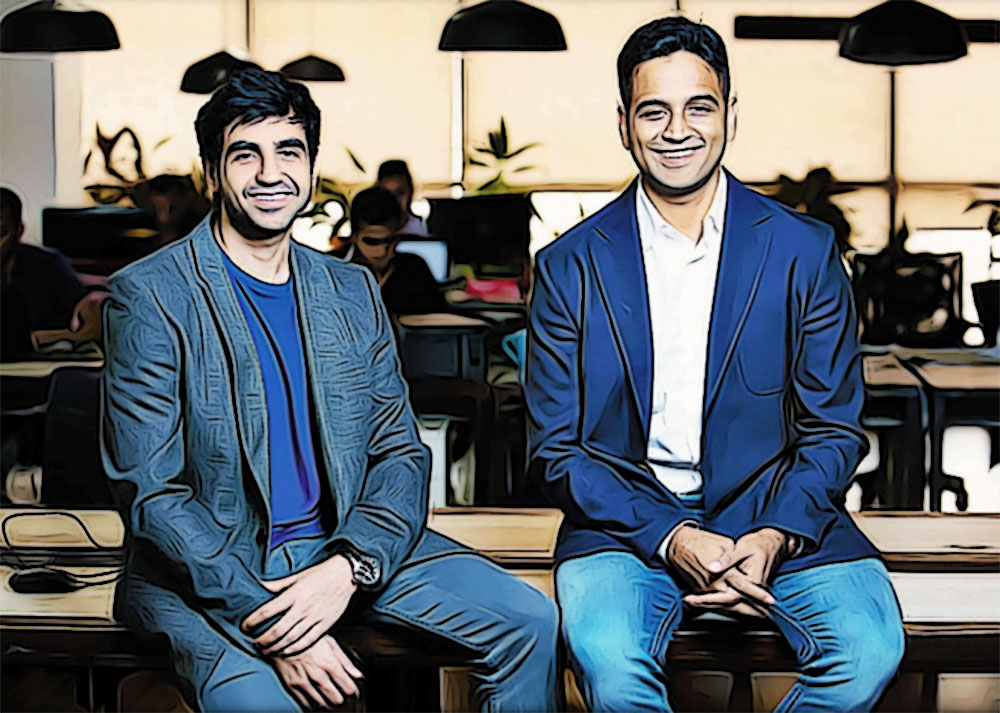

Around 2010, following the crash, it was the worst time to enter the market with the broking industry being at an all-time low. However, one company saw this “low” as an opportunity for disruption. The brother duo Nikhil and Nithin Kamath decided to create a complete online brokerage firm that would offer broking services at a discount, giving rise to – Zerodha.

A “Bull” Run

The word Zerodha means ‘zero barrier’ (number zero is coupled with ‘rodha,’ a Sanskrit word meaning barrier). In simple terms, Zerodha’s platform is an online retail and institutional broker dealing with commodities and currencies.

The company is currently valued at $1 billion and is one of the very few bootstrapped start-ups to achieve this feat. It stands at the top of the list with the highest number of active users to date. The company facilitates more than 5 million trades a day, accounting for nearly 15% of all such transactions in the country. Zerodha has grown by leaps and bounds over the years having face-offs with established brokers such as ICICI Securities and Kotak Securities.

Nithin, who serves as the Chief Executive Officer (CEO), presents Zerodha’s rise as a culmination of the ease of access to the millennial generation, which garnered the use of such apps on the basis of ‘free brokerage.’

Journey from $1 to $1 Billion

The founder duo come from a very different background. The older brother, Nithin, was an average student who discovered trading at the age of 17. He went on to pursue his Bachelors in Engineering from Bangalore Institute of Technology following which he picked up jobs at call centers before starting a franchise of Reliance Money where he worked as a sub-broker. On the other hand, Nikhil, a Mathematics genius and a chess pro, hated school. At the age of 17, the school dropout started selling phones and worked shifts at a call center.

The Kamath brothers had one thing in common: An appetite for savings. The duo saved a comfortable amount of money during their early days and started ‘Zerodha’ in 2010. And there was no going back. They had stints at multiple places in the field of stock trading and market analysis and hence were not alien to the “sophisticated” world of trading.

They churned out strategies that targeted the newer generation and it worked wonders.

‘‘

Zerodha is currently valued at $1 billion and is one of the very few bootstrapped start-ups to achieve this feat.

Remaining Lean: Pure Technology Play

Besides providing an online broking platform, the Zerodha Universe is home to a number of other apps that make trading easier. These apps have been developed for specific needs:

Kite

It caters to the equity and commodities market using a meticulously designed website that serves a raging number of millennials with its ease-of-access and well-designed graphics.

Console

The console website offers customised reports on the basis of user’s investments and sector growth and variation.

Small Case

It is mainly concerned with mutual funds and portfolios that are designed by Zerodha experts to help millennial and fresh investors find their way in the stock market. The app provides ‘customised investment portfolios’ for the users which is one of its distinctive features.

Streak

Streak is a platform that is used for creating and testing out trading strategies.

Hence, it was a pure technology play. Zerodha avoided all kinds of frills and remained attuned to their goal of providing tech-backed trading platforms/apps.

However, they believed in creating a community and educating their users to keep the buzz going. Zerodha brought in a stock market education app known as ‘Varsity’ containing lessons on everything about trading. The main motive for this app was to target prospective millennial investors and help them learn trading on their own. This way, Zerodha was able to build a well-rounded offering which helped them bring in a large customer base.

It managed to build credibility with such products, which is extremely important for any start-up. If you see, Zerodha avoided the whole model of relationship managers and sub brokers as well and avoided spending mullahs on advertising, hence maintaining a lean business model.

The stock market had never seen such a revolution where the technology removed the barriers of extreme high cost and poor support system in the broking industry. It created a buzz in the world of start-ups as not many dared to bootstrap their way to success at their early stages.

‘Zero’ dha Funding: Using Every Penny Wisely

Zerodha was set up with complete internal funding (Kamath brothers’ savings). It is commendable how the start-up entered the unicorn club without a single rupee sourced from outside.

The company adopted the slow and steady pace and took almost a decade to boom. They wanted to build a seamless, easy-to-use and transparent trading platform/app and roped in their chief technology officer Dr Kailash Nadh in 2013.

Every penny was used to innovate and develop products that could provide advantages to trade easily. The core strategy was ‘zero brokerage’ – no charges other than for intraday trading at Rs 20. The market grew, the users boomed and Zerodha was able to scale up efficiently.

Zerodha has focused on quality products and dynamic innovation since the beginning and continues doing the same. The company reinstated the fact that “one can grow within a pool of limited resources as well, if the technology is strong”.

The Game Changer: ‘Zero’ Brokerage USP

Zerodha brought in the era of discount broking, fixing rates of intra-day trading at a maximum fee of Rs 20. Equity of delivery was free, with no applicable charges on the same. The company was one of the first institutional brokers to keep such low prices on their services.

When a Demat account is opened with Zerodha, a customer is charged Rs 300 as annual maintenance charge (AMC), per year. The company brings massive revenues from such trades, 2/3rd of which are from the millennials aged between 18-35. These youngsters require a platform which is easy to use and has low brokerage charges. ICICI Securities has a minimum fee of Rs 35 for intra-day trading, while Zerodha caps it at Rs 20. This factor of competitive pricing led users to hop to the Zerodha platform.

This “discount strategy” was exceptionally well-thought of. Zerodha follows a low operational cost model and the entire company operates online due to which they were able to scale-up the business instantly. The strategy not only led to a continuous inflow of consumers all year round but also aided the word-of-mouth marketing. This is clearly reflected in the company’s revenue numbers.

It is important to mention here that the Zerodha model is not unique. It is similar to that of American financial company – Robinhood. However, Zerodha is credited for aptly implementing the same in the Indian territory.

‘‘

Zerodha was set up with complete internal funding (Kamath brothers’ savings). It is commendable how the start-up entered the unicorn club without a single rupee sourced from outside.

Catching the Millennial with ‘Ease’

Zerodha is one of the first companies to come up with strategies to garner customers from the millennial segment of the population.

They had started out by targeting independent traders but soon understood the need of the hour to tap this younger segment, which remained very different from the “complex” stock market. Zerodha came in as an agile, easy-to-use and transparent tech-based platform which made things simple, rather “cool”. The motto was simple- Buy shares in the most hassle-free manner.

This strategy works wonders among a tech-savvy generation that runs low on time and high on impatience. If you look at Zerodha’s app, it has a supercool black mode and even the most complicated and boring graph looks right out from Tony Stark’s garage.

Zerodha became that one-stop solution that had everything you could ask for – an easy-to-use trading portal, a stock market educational app and a mock trading platform.

Sustaining the First Mover’s Advantage

Zerodha, indeed, cashed on the first mover’s advantage and became the top stock broking firm. It has remained attuned to its core offering of keeping the equity delivery free. No other company has managed to do this.

As the industry witnesses an influx of new-age fintech start-ups, Nitin believes that they will continue to dominate the segment because of their “never-ending hunger for innovation, development and consistent growth”.

With newer stockbrokers like Angel Broking, Upstox entering the market, Zerodha remains unaffected. The race for technological leverage always lies with the one who did it first and did the best. Having said that, digital payments giant Paytm’s entry into the segment will be something to watch out for. But investors will always rely on an experienced institutional broker who would also provide support that is internationally renowned.

Zerodha, has beaten established institutional brokers like Motilal Oswal, ICICI, HDFC, Kotak Securities to affix its name at the top of the list. So much so, that the competitors have reduced their pricing to Zerodha’s level. However, this move has been deemed ineffective by experts as Zerodha has managed to create that credibility for itself above others.

Not in an IPO rush

The company has no IPO plans as of now. When asked, Nithin shared with Dutch Uncles that taking Zerodha public might take away the simplicity and the distinctive feature of the company. He states that the founders will lose their autonomy and will have to divert their focus to cater to the demands of the shareholders.

Experts also do not feel the need for Zerodha to raise outside capital as it is raking in enough profits to run the company, keeping the costs at check. Having said that, Nithin is not completely shut to an IPO plan and said will consider the same if the company’s user base widens extensively. As of now, Zerodha relies heavily on its own revenue and profits to sustain its business model.

The brothers refuse to rest their laurels and continue to hustle each day. They are also running a successful hedge fund known as True Beacon. One thing common in Kamath brothers ventures is their strong tech base and product focus. This is one of the biggest reasons why their products need no advertising.