Start-up and small-business owners woke up to a day of rejoicing following Vani Kola’s (founder of Bengaluru’s leading Venture Capital firm, Kalaari Capital) email. Mukesh Ambani’s Reliance Industries came on board Kalaari Capital’s Fund no. 4 as a Limited Partner (LP) with his Anchor Investment.

Mukesh Ambani had been watching from the side-lines as the Indian start-up world was bubbling with enthusiasm coming from both investors as well as investees.

But Ambani is what Ambani does and both Urban Ladder and Zivame emerged victorious when they were picked to receive Reliance’s gracious hand over them.

The 15th of November saw Reliance Retail Ventures stake its claim on 96% of Urban Ladder in exchange for 182.12 crores.

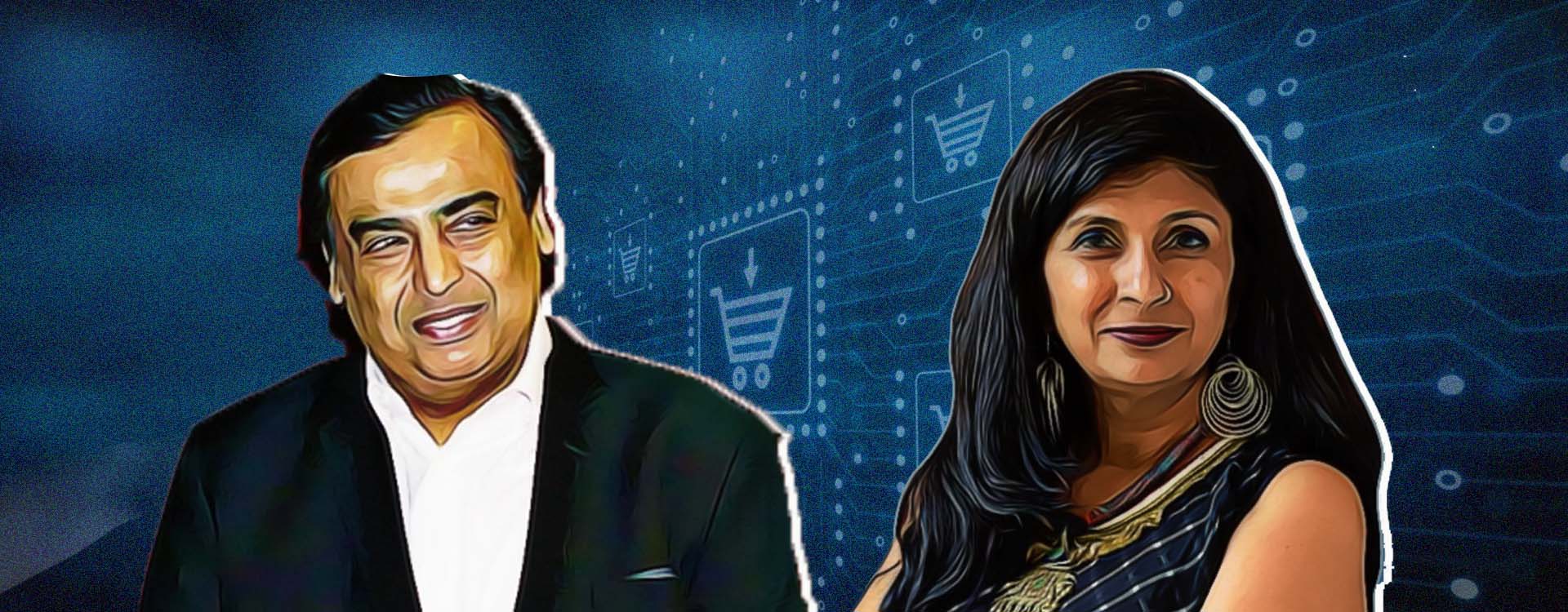

Vani Kola, MD of Kalaari Capital and Mukesh Ambani – India’s richest man’s shared enthusiasm reflected in their start-up uplifting spree.

In a bid to possess a bigger online retail portfolio than his arch nemesis Amazon.com, small but sturdy e-commerce companies including Urban Ladder and Zivame ended at the receiving end of Reliance enthusiasm.

‘‘

Vani Kola, MD of Kalaari Capital and Mukesh Ambani - India’s richest man’s shared enthusiasm reflected in their start-up uplifting spree.

What does this mean for internet start-ups?

Kalaari Capital and Vani have already been blessing consumer internet retail start-ups but having a blue-chip investor like Reliance join hands on this fervour spells good news for more online portals trying to break through into the tech start-up bubble.

The $200 million deal between Vani Kola’s Kalaari Capital and Mukesh Ambani’s Reliance Industries is a celebration in the e-commerce space.

Notable e-commerce companies like Myntra and Snapdeal owe their presence to Vani Kola and Kalaari capital. Now that Mukesh Ambani has boarded ship, fledgling e-tail companies like Urban Ladder and Zivame have a chance at the opportunity of a lifetime.

What’s in it for me?

Mukesh Ambani’s interest towards ecommerce start-ups has occurred in bursts. It first looked like he was holding back or disinterested especially when big players were already in the game. But he suddenly seems to have discovered the right opportunity to arrive on the scene and acquire promising start-ups without mercy when other investors had backtracked.

Start-ups with a novel idea in e-commerce have a chance at becoming an investee by differentiating themselves. The Indian e-commerce sector is not a place for stretching your legs. It’s already saturated with unique and innovative products and services. To be a worthy contender, start-ups need to sharpen their focus beyond the limits towards targeting consumers.

The biggest development that has culminated from this deal is that struggling e-commerce start-ups in India who were feebly attempting to take on big league names with foreign investment will and are already flocking to Reliance.