You must have heard in the recent Union Budget allocation the mention of Fiscal Deficit or the financing of fiscal deficit and wondered what it means or how changes in fiscal deficit affect you as an entrepreneur or your company in an economy. Before we dig deeper into Fiscal Deficit, let’s understand what is a government deficit and how fiscal deficit forms a part of it.

Fiscal deficit as a way of measuring government deficit

Deficit is always defined as the amount by which the spending exceeds the earnings in a budget. The Government Deficit is the amount by which the government spending exceeds government revenue according to the budget set by the government. It shows the financial status of the economy. Government deficit can be measured via Revenue Deficit, Fiscal Deficit or Primary Deficit.

The revenue deficit is the surplus of government’s revenue expenditure over its revenue receipts. It reflects only current income and current expenses. Usually, governments resort to disinvestments as a corrective measure to reduce revenue deficit.

Fiscal deficit on the other hand is the difference between the government’s total expenditure and its total receipts excluding borrowing. The fiscal deficit is always financed by borrowing. Thus, it reflects the total borrowing necessities of the government whether it is from the public, RBI or foreign aids.

And primary deficit is the amount of money the government needs to borrow other than the interest payments on the formerly borrowed loans. It is the difference between fiscal deficit and the interest liabilities.

Difference Between Fiscal Deficit and Revenue Deficit

The fiscal deficit is the excess of Budget Expenditure over Budget Receipt other than borrowings while on the other hand, Revenue deficit is the surplus of Revenue Expenditure over Revenue Receipts. Fiscal Deficit reflects the total government borrowings during a fiscal year while Revenue deficit highlights the inefficiency of the government to reach its regular or recurring expenditure. Fiscal deficit is calculated as the difference between Budgetary deficit and borrowings while revenue deficit is measured by the difference between revenue expenditure and revenue receipts.

How is the fiscal deficit calculated?

An Economy’s fiscal balance is measured by the difference between government’s revenue and its expenditure in a given financial year. Fiscal deficit occurs when expenditure of the government exceeds its revenue in a year. It can be calculated both in absolute terms and as a percentage of the country’s gross domestic product (GDP). However, it includes only taxes and other revenues and excludes all kinds of borrowings used to counter the shortfall.

The mathematical formula is:

Total revenue generated – Total expenditure

Where the total revenue is = Revenue receipts + recovery of loans + other receipts of the government.

Revenue receipts of the government include Corporation Tax, Income Tax, Custom Duties, Union Excise Duties, GST and taxes of Union territories and Non-tax revenues like Interest Receipts, Dividends and Profits, External Grants, Other non-tax revenues and Receipts of union territories. On the other hand, expenditures of the government include Revenue Expenditure, Capital Expenditure, Interest Payments, Grants-in-aid for creation of capital assets. The Budget allocates funds for payments of salaries, pensions, infrastructure, development, health and education, science and technology, etc.

High deficits often occur when the government spends a lot on developmental works like construction of highways, ports, roads, airports that generate revenue for the government in future time periods. Fiscal debts occur when there are persistent large fiscal deficits over the years.

What causes Fiscal Deficit?

Governments spend their revenue for various handouts like infrastructural development, assistance to the vulnerable sections of the society, research and development, health and education extra. Excess spending on these as compared to revenue inflow leads to fiscal deficits. High fiscal deficits are beneficial for the economy if the borrowed money is used for the creation of productive assets like highways, roads, ports and airports which will help boost economic growth and result in a rise in employment.

What are the Implications of Fiscal Deficit?

- Increased foreign dependence: Government borrowings include borrowings from foreign countries. This often leads to increased economic and political interference from these countries.

- Debt trap: The first and foremost issues that Fiscal deficits create are debt traps. As we know, fiscal deficits lead to borrowing which causes problems like repayment of loans and payment of interest on these loans. With increase in government borrowing, the liability of repaying loans in future with added interest rises. Interest payments increase revenue expenditure which results in increased revenue deficits. This in turn, pushes the government to borrow more, again increasing the interest payments. This leads to a vicious circle and the economy ends up in a debt trap.

- Inflation: To finance fiscal deficits, governments mainly borrow from the central bank which lends money by printing more currency-notes (called deficit financing). This results in increased money circulation which often leads to inflation as prices and incomes hike.

- Expenditure wastage: High fiscal deficit results in the government undertaking unnecessary expenses which often go waste.

- Slows down future growth: The borrowings for fiscal deficit cannot entirely be used for growth and development as that part is used for payment of interests. This means that borrowings for fiscal deficit end up becoming a burden in the future in terms of repayment of the loan and interest rates. This slows down growth in the future periods.

Financing a Deficit:

Fiscal debts are usually financed using two sources that have been mentioned above:

- Borrowings

- Governments finance fiscal deficit by borrowing from commercial banks, internal sources like the public, from external governments, and other external financial institutions or International Agencies like the International Monetary Fund or the World Bank.

- Deficit Financing or Printing New Currency

- Governments also borrow funds from their central bank against their securities to meet the fiscal deficit. For this, the central banks issue new currency. This process is known as Deficit Financing.

Government securities for example, treasury bonds are put on sale. When governments issue bonds, they sell them through banks. This usually reduces funds that can be lent or be invested in other businesses. This often reduces the capital stock in the economy and also affects interest rates. Government bonds are extremely safe investments. The interest rate paid on loans to the government therefore and risk-averse investments. This pushes other financial assets to increase the interest rates they pay to shift purchasers from investing in government bonds. This is often used by federal banks in open market operations to control interest rates in the economy while keeping their monetary policy constant.

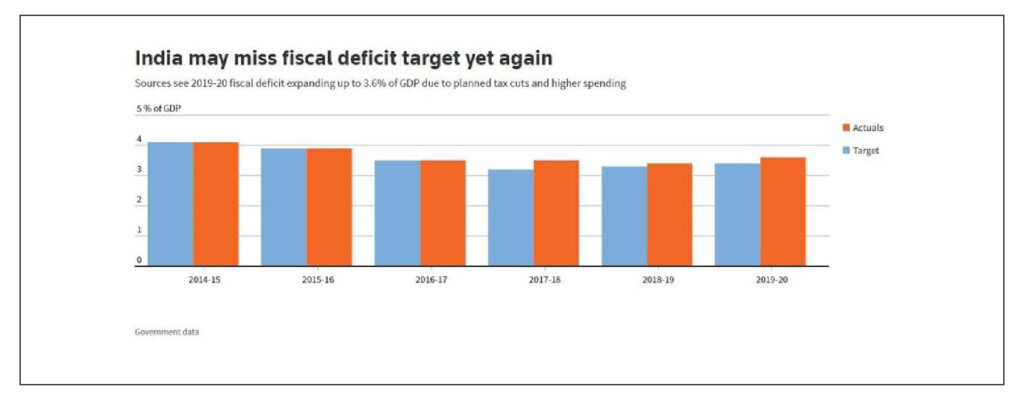

India’s Union Budget analysis: Fiscal Deficit

The budget estimated a central fiscal deficit of 9.5 per cent (10.2 including off-budget borrowing) of GDP in 2020-21, and 6.8 per cent (7 including off-budget) for 2021-22. The nominal deficit includes two components namely structural and cyclical deficit. The structural deficit is the amount that remains once we remove the revenue shortfall and expenditure increase due to sharp deviations in trend growth. During booms, the cyclical deficit is lower than the structural whereas during a slump, it is vice versa.

‘‘

The fiscal deficit is always financed by borrowing. Thus, it reflects the total borrowing necessities of the government whether it is from the public, RBI or foreign aids.

Disadvantages of Deficits

Budget deficits are always or mostly seen in a negative light. Several economists are of the view that deficits lead to crowding out of private borrowing, distort interest rates, scale non-competitive firms, and expand effects of people who do not participate directly in the market. But governments end up using deficits to expand on infrastructural development especially in the short run.

Deficits were originally meant to be run during recessions. And these deficits were to be corrected after the economy recovered from the recession. However, in reality, this is not the case. Increasing taxes and reducing government programs is not welcomed by the public even during booms. This often forces governments to run deficits persistently after each year without any attempt to correct it which finally leads to large public debts.

As governments increase borrowings to meet deficits, their liability of repaying loans in future with added interest spikes. Interest payments hike revenue expenditure further increasing revenue deficits. The government is forced to borrow more and the cycle leads to the economy ending up in a debt trap.

Deficits also lead to wastage of resources and funds. Deficit financing through money circulation also leads to inflation as the government mainly borrows from the central bank which prints more money. Borrowing for the fiscal deficit becomes a burden in the future in terms of repayment slowing down growth in the future and often increases foreign dependence which may lead to socio-economic interference.

Benefits of Fiscal Deficits

Many people do not view large government debt as something that negatively affects the economy. Leaders from both conservative and liberal administrations end up running large deficits in order to create tax cuts, stimulate spending for welfare, public goods, infrastructure, to finance wars and other public benefits. The public and businesses also end up believing that fiscal deficits are beneficial as they avail lower taxes as well as more government services.