Growth is an essential fuel to run a successful business. Of course, there are other things too that help a business to grow. And sometimes this growth is effectively brought in by channelising the organisation’s capital into various assets in a step-by-step manner, both internally and externally through merger. The internal growth of an organisation takes place through the acquisition of assets and after financing them from external sources or through the retention of earnings. While external growth can be brought through the acquisition of another company.

The term merger means amalgamation or combining of two or more business organizations to form a separate entity. This process leads to the dissolution of two or more entities, where both get absorbed into another undertaking, and as a result, the outcome becomes relatively bigger in size like assets, capital and human capacity. It is a strategy adopted by the company to maximise company’s growth by expanding its production and marketing operations, that results in synergy, increased customer base, reduced competition, introduction to a new market/product segment, etc. On the same side, the shareholders of the old company also get their part of ownership in the new company. Here, the surviving organisation acquires the assets, liabilities, personnel and much of the reputation of the fusing company.

However, a merger is fundamentally different from a statutory consolidation. As it involves a combination of two companies, whereby an entirely new corporation is formed. Both the old companies cease to exist, and the shares of their common stock are exchanged for shares in the new company. When two companies of about the same size combine, they usually consolidate. But when two companies differ significantly in size, then they usually merge. Though mergers are not common, they have a market effect, whenever they do occur.

‘‘

The perfect marriage between a man and a woman is considered to be a match made in heaven.” So is the commitment companies make in a merger.

Many psychologists and economists have explored metaphors for the logistical, emotional and financial realities for companies in a merger. Mergers and matrimony go hand in hand. Like a marriage vows, two companies make a permanent commitment to move forward together to build a new future. Similarly like a successful marriage, a successful merger makes a whole that is greater than the sum of its parts, and involves compromise on both sides to iron out details and communicate effectively. Likewise, the marriage analogy manifests itself in buzz phrases: “The perfect marriage between a man and a woman is considered to be a match made in heaven.” So is the commitment companies make in a merger. It is serious and an apt set of observations.

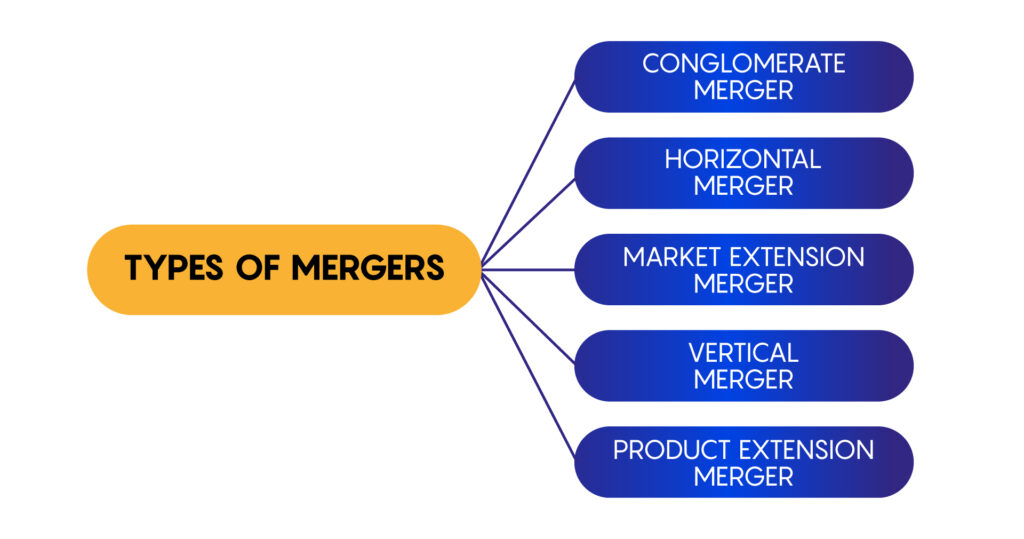

Types of Mergers

A conglomerate merger is between companies that are totally not related and operated in distinct markets. There are two types — pure conglomerate and mixed conglomerate. A pure conglomerate merger includes companies that have nothing in common between them. On the other hand, a mixed conglomerate merger involves companies that are looking for expansion in business, such as an extension of products to different geographical locations or development of new products. However, the biggest risk in a conglomerate merger is the immediate shift in business operations, as the two companies operate in completely different markets and offer unrelated products or services. For example, Walt Disney Company and the American Broadcasting Company underwent a conglomerate merger. Walt Disney Company is an entertainment company, while American Broadcasting company is a US commercial broadcast television network.

A horizontal merger refers to a business consolidation that occurs between entities that operate in the same industry. These are generally done to increase market share, further utilize economies of scale, and exploit merger synergies. Competition is usually higher among corporates operating in the same space. It means that the synergies and potential gains in market share are much more significant for entities merging. A horizontal merger often occurs because of more prominent companies trying to build more efficient economies of scale. A famous example of this type can be Hewlett-Packard (HP) and Compaq in 2011. The successful merger between these two companies created a global technology leader valued at over $87 billion.

A market-extension merger is between companies that sell the same products or services but operate in different markets. The goal here is to gain access to a larger market and thus a bigger client or customer base. The main benefit of this type of merger is to give the companies that merge a larger market reach and client base as a result of its new capacity. The merger in 2002 of the American-based Eagle Bancshares Inc by the subsidiary of Royal Bank of Canada, RBC Centura Inc. This large acquisition saw the Canadian company gain access to Eagle Bancshare’s assets, which were worth $1.1 billion, as well as almost 90,000 accounts. Eagle Bancshares owned Tucker Federal Bank is one of the biggest banks in Atlanta with over 250 workers.

A vertical merger is between companies that operate along the same supply chain. It is the combination of companies along the production and distribution process of a business. The rationale behind a vertical merger includes higher quality control, better flow of information along the supply chain, and merger synergies.

A notable vertical merger happened between America Online and Time Warner in 2000. Each company had different operations in the supply chain – Time Warner supplied information through CNN and Time Magazine, while AOL distributed information through the internet.

A product extension merger refers to a situation where two businesses who operate in the same market and offer products or services which are not the same but are often co-consumed decide to come together. The benefit is that the companies are able to create a meta product from their individual products and access a larger market. Pooling resources ensures that their cost of operations is reduced and profits are increased. By employing a product-extension merger, the merged company is able to group their products together and gain access to more consumers. It is important to note that the products and services of both companies are not the same, but they are related. The key is that they utilize similar distribution channels and common, or related, production processions or supply chains. Mobilink Telecom Inc. and Broadcom underwent a product-extension merger. The two companies both operate in the electronics industry and the resulting merger allowed the companies to combine technologies and enable the combination of Mobilink’s 2G and 2.5G technologies with Broadcom’s 802.11, Bluetooth, and DSP products. Therefore, the two companies are able to sell products that complement each other.

Merging a Small Business

Combining forces with another business can be a daunting task for either a CEO of a large multinational or for a solopreneur. From making sure that the company cultures are compatible with each other, to sorting out the leadership structure of one’s new enterprise, it seems there is no end to the tasks that must be completed. Amalgamating two or more businesses into one business is a common way to improve the performance of each individual business by capitalizing on the benefits each company provides, and utilizing the common resources available to all companies after the merger. At the time of merging two or more businesses, there are several things that need to be considered before the merger process can take place.

‘‘

Amalgamating two or more businesses into one business is a common way to improve the performance of each individual business by capitalizing on the benefits each company provides, and utilizing the common resources available to all companies after the merger.

Before taking the merger process ahead, the structure of each firm needs to be examined properly to determine the best procedure for merging with the business. Always compare and analyse the corporate structures for better outcomes. Take into account the many perspectives while preparing the legal structure of the merger. After the structural details of the proposed merged organization are sorted out, the leadership structure of the future company needs to be established.

Acknowledging the branding of the new company takes center spot post-merger. Pay close attention to how one wants to market the new company. A careful analysis of the balance sheets of the merged companies must be undertaken well in advance, as this can make or break the merger deal. Before proceeding too far with the merger process, perform due diligence on the potential merger.

Importance of Merger

Synergies

Synergy refers to the greater combined value of merged firms than the sum of the values of individual units. It is something like one plus one more than two. It results from benefits other than those related to economies of scale. Operating economies are one of the various synergy benefits of merger or consolidation. The other instances, which may result in synergy benefits include, strong research and development facilities of one firm merged with better organised production facilities of another unit, enhanced managerial capabilities, the substantial financial resources of one being combined with profitable investment opportunities of the other, etc.

Diversification

Two or more companies operating in different lines can diversify their activities through amalgamation. Since different companies are already dealing in their respective lines there will be less risk in diversification. When a company tries to enter new lines of activities then it may face a number of problems in production, marketing etc. When some concerns are already operating in different lines, they must have crossed many obstacles and difficulties. Merger will bring together the experiences of different persons in varied activities. So, amalgamation will be the best way of diversification.

Increasing the Value

One of the main reasons for merger is the increase in value of the merged company. The value of the merged firm is greater than the sum of the independent values of the merged companies. Let’s say, if A Ltd. and B Ltd. merged and formed C Ltd., then the value of C Ltd. is expected to be greater than the sum of the independent values of A Ltd. and B Ltd.

Reducing Competition

The merger of two or more companies will reduce competition among them. The companies will be able to save their advertising expenses, and enable them to reduce their prices. The consumers will also benefit in the form of cheap or goods being made available to them.

Proper Financial Planning

The companies after merger can plan their resources in a proper way. The collective finances of merged companies will be more and their utilisation may be better than in the separate concerns. It is likely that one of the merging companies has a short gestation period, while the other has a longer gestation period. The profits of the company with a short gestation period will be utilised to finance the other company. When the company with a longer gestation period starts earning profits then it will improve financial position as a whole.

Economic Necessity

Economic necessity likely to force the merger of some units. If there are two sick units, the government may force their merger to improve the financial position and overall working. A sick unit may be required to merge with a healthy unit to ensure better utilisation of resources, improve returns and better management. Let’s say, from time to time the Indian government has merged Navratna Public Sector Enterprises.