Whenever we talk or discuss about business, we usually start with terminologies like the vision, the mission of the business, how they operate, what are the different levels involved and so on.

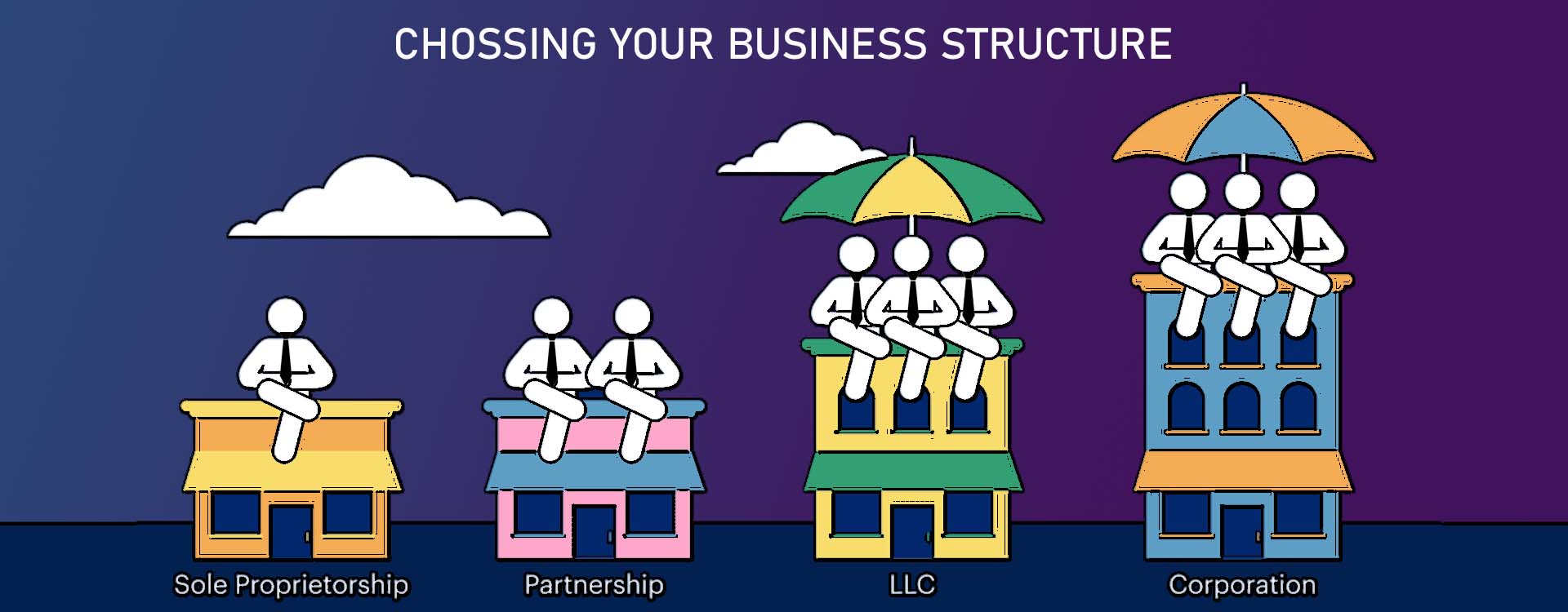

But before jumping into the land of starting a business or even owning one, we not only need to be aware of the above or even the geographic and political factors but also ask ourselves the main question, what are the different types of businesses?

The different types of businesses give an outline of a structure to the ownership world and without a structure, anything could be read like an open book ready to be disassembled like a rusty machine.

These businesses might be owned by a single person or a small group of people or even run by a large charitable organization with a notion to help. The point of differentiation is not just the amount of people but also the legalities that follow while being a part of them.

This legal and ownership structure of a business determines various factors- from the taxes that the business needs to pay to the profit distribution, the responsibilities that the owner or multiple owners have, ultimately determining the paperwork that the businesses have to go through to finally set up.

So, what are these different types of business ownership and how do you determine which is the right one for you?

‘‘

The different types of businesses give an outline of a structure to the ownership world and without a structure, anything could be read like an open book ready to be disassembled like a rusty machine.

Sole Proprietorship or Single Ownership

As the name suggests, the ownership of this kind of business falls in the hands of one single person, who is deemed as the sole or the final decision-making authority for the business. Here, the owner is the one responsible for all the assets and liabilities including both personal and professional ones.

With the profit or loss completely being handled by them, an advantage to being a sole proprietor is that these kinds of businesses are easy to set up since you’re the ultimate decision-maker but on the other hand you have to be responsible for all the liabilities and debts at any given point of time. Looking at the positives, the expenses to start a single ownership business is majorly minimal in the beginning and it is easier and flexible for the owner to operate.

Now, this does not mean that they should work alone. Like any other organization, they can always employ people to expand their businesses but any responsibilities from hiring to firing to giving profit to bearing the debt, to raising funds, everything falls on the head of the owner.

Examples of sole proprietorship or enterprises run by a single owner could be a small shop to sell handmade goods or an auto repair shop, a working plant to provide goods carved from wood, etc.

Given the above examples, the single ownership businesses have their fair share of ups and downs but given the advantages such as minimum legal restrictions, enjoying all the profit and also managing the raw materials and manufacturing methods to yourself, these assurances give a good deal of motivation and incentive to flourish.

Partnerships

Moving on to the next type of ownership we have Partnerships. These kinds of businesses involve two or more people as the owners of the business. When the time for the owner comes to realize that the potential for their business is much more than they could handle and they might not be in a position to hold all the responsibilities and duties that come to handle a business, then comes the entry for a co-owner or co-owners depending on the decision and situation.

Now, these partnerships could be of two types:

General partnerships

Running on a similar idea of single ownership, where two or more people with the same vision and mission come together through a legal contract to grow a business. Every partner here can act as a sole owner and have full control of the business along with owning full rights to all the profits and debts sustained by the business. The incentive for success becomes high as large capital is invested from both sides and the firm can hold better talents and skills.

Along with that, if the business goes into loss, there’s more than one person to handle the situation and also attach tax advantages with the business. Examples of a general partnership could be retail trade organizations, small engineering firms, law firms, medical clinics, etc.

Limited Partnerships

A form of the partnership business, here although the partners share the profit generated from the business they can’t interfere with the management or decision making of the firm. As the word suggests, limited partners have their authority limited to the amount of investment made into the business.

Depending on the type of situation and legal contracts, these types of business are easier and also less costly so all the investors and lenders who were earlier hesitating to invest in the business have now an incentive to go ahead without much of a risk.

Joint-stock organization/Companies

There are two different types of Joint-stock organizations:

Private limited companies

The number of members for this type of business ranges from 2 to 50 excluding any employee or ex-employee shareholders. The money or capital is collected from private partners where all of them might not be active but these types of organizations restrict the right to transfer shares and avoid the public to get ownership on shares or debentures.

Although there isn’t a need for consent of directors in these types of businesses and also, they don’t need any certificate from a registrar for the initiation of business but they do require to hold a general meeting at certain periods to discuss its profit and loss generation.

They also need to send a certificate to the registrar of the companies along with the returns stating that they don’t have more than 50 shareholders on their account.

‘‘

With a democratic form of ownership, these organizations promote cooperation and mutual belief and understanding of self-help.

Public Limited Companies

Unlike private ownership, the money in here is collected through the public in small amounts of shares having a low face value. The public limited companies have to file with the registrar of Joint Stock Companies several documents. Some of them involve the consent of directors, list of directors, director’s contract etc. where they can start the business only once they receive the certificate.

These businesses are responsible for holding a statutory meeting and issuing a statutory report to all the members and also the registrar within a given time. With no restriction on the transfer of shares, the company is liable to get its account audited every year by the registered auditors’ and also hold a general meeting every year.

Since the shares are transferable, public limited companies have a huge potential to raise a good sum of money and also acquire the services of specialists. Some examples of a public limited company would be Steel mills and Fertilizer factories.

Cooperative Societies or Organizations

Containing a mix of features from both the large partnerships and some from corporations, here the members of the cooperative societies buy shares on their own and then the amalgamated profit gets distributed among its members. Each member of the society is given the right to vote only one time so that the concentration of power does not fall into few hands.

These kinds of organizations aim to provide goods and services to their members at a cost and therefore it is deemed as a kind of voluntary, democratic ownership which is usually formed by a couple of motivated members who believe in obtaining necessities of everyday life at rates lower than those of the market.

With a democratic form of ownership, these organizations promote cooperation and mutual belief and understanding of self-help. With no one man making huge profits, the monetary help for these businesses can be secured even from the government.

Examples of Cooperative Societies include Consumer cooperatives in retail trade or producer cooperatives for buying and selling items such as dairy products, grains, fruits, etc.

Public Sector Companies

There are three different ways of managing a public enterprise:

Either they are owned by the state, or they are managed by the state or they are both owned as well as managed by the state. Here enterprises fall into the hands of the government as they are the ones to control and produce the supply of goods and services which are required by the society.

These public sector companies open the doors for those industries which are in dire need of a huge amount of capital and don’t have enough resources to flourish under the umbrella of the private sector.

The consumers get the befit of greater, better and cheaper goods and also encourage the growth and nourishment of the under-developed regions of the country. Although there could be sometimes too much interference by the government and also delay in the decision-making process, at the end of the day necessities like raw materials, fuel, power and transport get made easily available to them.

Private Sector Companies

Last but not the least, private sector companies. As the name suggests, private sector companies are exactly the opposite of how the public sector companies operate. One of the points that stand out for them is that they do not indulge themselves in businesses where profit margins are low or where there is a huge risk involved.

Run by various businessmen from various sectors who possess an in-depth knowledge of the sector they come from, the profitability factor along with efficiency is always focused on very high levels along with a quick decision-making capability as compared to the public sector companies.

As there is minimal to no interference from the government, sometimes the situation leads to having a concentration of profits only in a few hands and also over-exploitation of the labour involved which results in an unbalanced growth of industries.

While looking at all these kinds of businesses, choosing the right one depends on certain factors, such as how much capital you have, how you want to handle the profit and loss management of your organization, what legalities and paperwork would be involved, so and so forth. It is indeed a tough and scary step for any entrepreneur.

There are equally compelling benefits and also hindrances that could be worrisome but the first and foremost step for any budding entrepreneur should be to educate themselves and weigh the pros and cons before stepping onto the world or business ownership. Ultimately, it requires a good amount of knowledge, confidence and support to take the first step and then eventually figure out what could be the right type of business to go for.