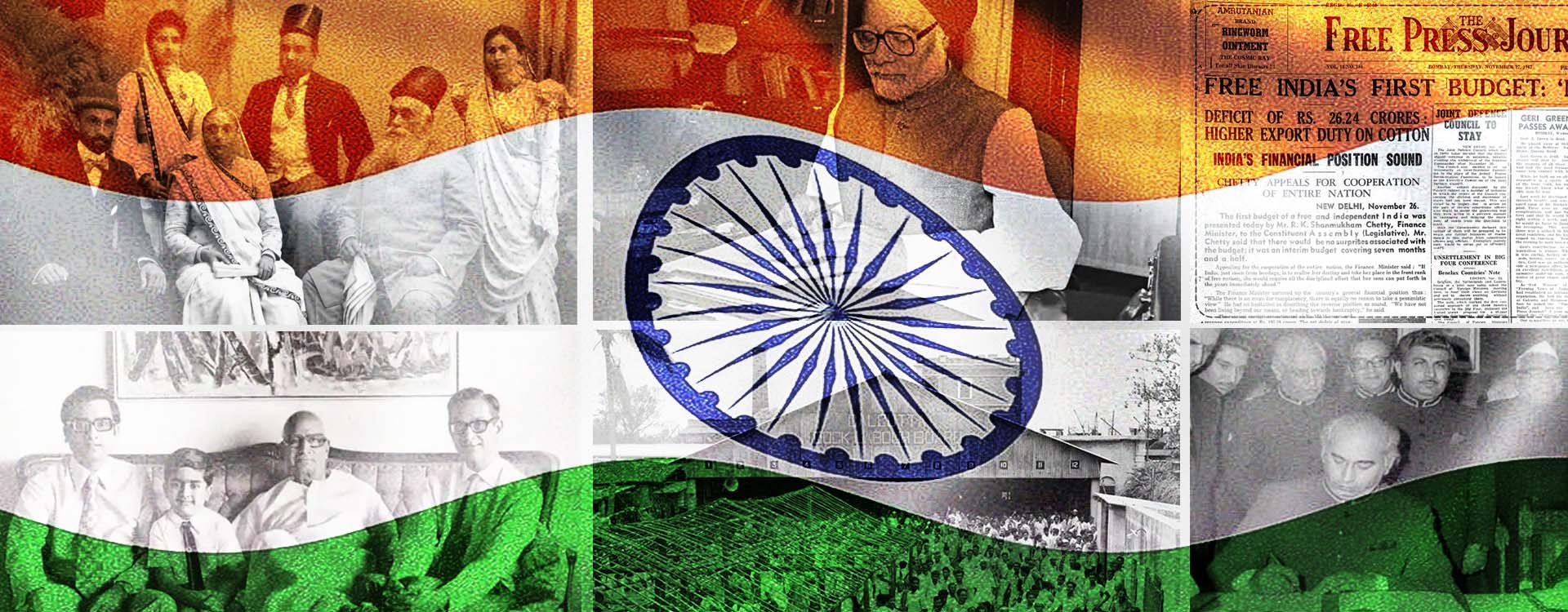

From the reassuring certainty of the five-year plans and liberalisation to the sweeping economic policies such as Make in India, Goods and Service Tax, Digital India and much more, the 75 years of independent India’s history have been marked by events that reveal a young nation in search of an effective development model.

As we celebrate Indian Independence from British colonial rule, let us delve into the history of Independent India’s business ecosystem and financial world and see which events shaped the course of our nation’s economy.

Highlights of business since Independence till date

Starting from 1947, the Central Legislative Assembly, a precursor to the contemporary Indian Parliament, enacted the Industrial Disputes Act to govern organised industrial labour. In 1949, the Reserve Bank of India – RBI- previously a shareholders’ bank, was nationalised and was made the central bank.

The year 1950 marked a genuinely Indian legislative era in which the Parliament made the laws. In 1950, the Planning Commission was constituted as a central planning body, and in 1951, the government presented the First Five-Year Plan. In this decade itself, in 1956, the Industrial Policy Resolution was passed by the Indian Parliament, marking the beginning of the Licence Raj.

‘‘

The First Five-Year Plan was based on the Harrod-Domar economic growth model and focused on the primary sector activities like agriculture, mining, fishing, forestry, dairy, etc., dependent on using natural resources.

The 1960s were the real test for the young nation of India. After independence, wars, poverty, illiteracy, and other serious problems were ailing the country. In 1965, the Green Revolution was initiated to combat India’s food crisis, and farmers were given high yielding seeds to produce wheat and essential crops for the masses. Further, in 1968, the Foreign Investment Board was established.

Fast forward two decades, in 1985, Prime Minister Rajiv Gandhi kicked off significant tax reforms with V.P. Singh as finance minister. In 1986, S&P BSE Sensex, India’s first equity index, was launched. And the following year, India’s first debit card was introduced by Citi Bank, the first ATM installed in Mumbai by HSBC.

Before and after liberalisation

The 1990s were a critical time for the Indian economy and the nation as a whole. As the closed economy showed signs of decadence, brokers and License Raj monopolies plagued the system. In 1991, the balance of payments crisis hit India. The critical situation meant that the Indian foreign exchange reserves could have marginally afforded three weeks’ worth of imports.

The pressure, in turn, paved the path for the liberalisation of the Indian economy. Thus, in 1991, Prime Minister P.V. Narasimha Rao and then Finance Minister Dr Manmohan Singh-led budget ushered in the era of liberalisation. This structural reform opened the Indian economy to participation from foreign entities in its industries, including state-owned enterprises.

In the new millennium, India also participated in the global tech boom. Many Indian companies like Infosys, Tech Mahindra, Wipro, among others, reaped the benefits of the tech boom. And start-ups like Shaadi.com, Make My Trip and others were born from the ‘dot.com‘ era.

In recent years, economic policies by PM Modi and his government are being made with the focus on making India a manufacturing hub of the world and campaigns like Make in India, Digital India, Start-up India, etc., are the key contributors towards that goal.

Start-up and India before Independence and now

India has always been an entrepreneurial country. Barely 300 years ago, India had a 25 per cent share of the global GDP. Colonisation kept the country away from the Industrial Revolution, reducing that share to 2 percent of global GDP in 1947.

‘‘

The Swadeshi Movement and the revival of domestic products and production processes helped restore the indigenous Indian Start-up ecosystem.

Modern entrepreneurs are trying to understand today’s youth’s everyday problems and solve them in the best possible way. Massive funding, consolidation activities, and a growing domestic market have altered the start-up culture in the last decade.

SMEs and India

The Small and Medium Enterprises (SMEs) segment has emerged as a crucial sector of the Indian economy, contributing significantly to exports, innovation, employment generation, and inclusive growth. SMEs are the backbone of the socio-economic development of India.

The joy of being an independent country and the benefits of being a republic

Freedom does incredible wonders, and it is rightly applicable to the Indian small business and start-up ecosystem. The economic liberalisation, technological advances, more accessible resources, knowledge pool, massive funding, emerging global standards, thriving domestic markets, and reduced communication gap over the years have boosted the Indian economy on the shoulders of small businesses.

This has been possible because of the liberty of decision making that let the Indian governments and stakeholders keep the Indian interest at the centre. Independence and freedom have allowed India to undergo a metamorphosis to re-make a nation after hundreds of years of oppression.

India’s start-up and small business bringing the Indian economy to the world map

The conducive economic environment that took decades to make has promoted entrepreneurs to take up new ventures and turn them into reality. Start-ups are heading the country’s economic growth even when the overall situation seems grim, and the pandemic is making matters worse.

SMEs and start-ups are employing youth and talent that otherwise goes wasted in an economic downturn like India currently faces. Indeed, the employment opportunities and emphasis on regional development encouraged by entrepreneurship have put the Indian economy on the world map – it has been possible due to small businesses and start-up’s initiations.