Total expenditures incurred in production include costs to purchase factor inputs including labour, land and capital that are needed in the manufacturing process of a product. Cost refers to the total cost incurred by a business to produce a specific quantity of a product or offer a service. The total cost of production includes both fixed and variable costs. These expenditures include any kind of factor inputs like raw materials, human resources, capital machines, etc. For instance, production costs for building a factory will include expenses like cement, sand, rocks, labour, machines, tractors, cranes and mass-producing will require proper land allocated legally to builders. In the case of companies that offer services, they will require costs of setting up an office, material costs of setting up the services, payment to people who deliver the services and costs of delivering the services.

‘‘

Variable costs, unlike fixed costs, depend on the quantity of product produced and change accordingly.

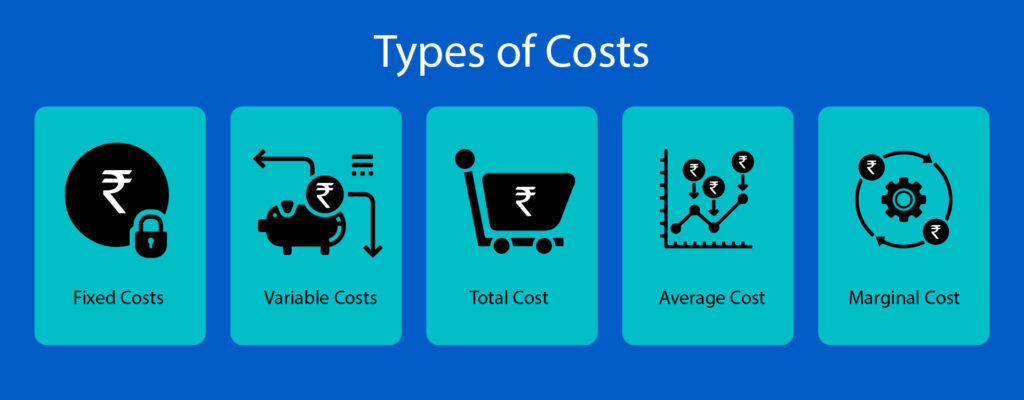

Types of Costs of Production

A business runs only if the revenue or benefits of running the business is more than the costs incurred. During the manufacturing process, a business will incur different types of costs depending on the product or service they offer:

Fixed costs

Fixed costs are costs that do not change with the amount of output produced. In other words, fixed costs remain constant even if the company produces zero output or maximum output. Fixed costs are fixed in the short term. They become variable after a period of time depending upon the business.

Variable costs

Variable costs are costs that change with the changes in the level of production. Variable costs increase with the increase in production and vice versa. If the production is zero, then no variable costs are incurred.

Total cost

Total cost as mentioned before includes both variable and fixed costs. It takes into account all the costs incurred in the production process.

Average cost

The average cost is defined as the total cost of production divided by the number of units produced. You can also calculate it by adding up the average variable costs and the average fixed costs. The average cost per unit should always be minimised by the business so they can increase profit margins without raising the costs of production.

Marginal cost

Marginal cost is the expenditure that is incurred in producing one additional unit of output. It represents the rise in total cost due to an increase in production by one unit. Marginal cost can also be defined as the increase in variable cost due to an additional unit of the product being manufactured. If marginal costs are more than the marginal revenue, the firm won’t go ahead with the production.

More About Variable Cost

Variable costs, unlike fixed costs, depend on the quantity of product produced and change accordingly. Variable costs are sometimes called unit-level costs as they vary with the number of units produced. You can predict fixed costs at the beginning of the year but you cannot predict variable costs as they depend on production levels.

For instance, in our construction builder example, the cost of land and cranes and machines are fixed costs, utility bills are also fixed costs. These costs will be incurred irrespective of how long it takes to build the house/factory and how many units are built within that area to be sold. Wages, cement, electricity, sand, water on the other hand are variable costs. With the increase in production, you will need more workers and more raw materials and your variable cost would increase accordingly.

Variable costs are the sum of marginal costs over all units produced. They can also be considered normal costs. Direct costs are costs that can easily be associated with a particular cost object. But remember that not all variable costs are direct costs like variable manufacturing overhead costs are variable costs that are indirect costs.

Break-even Analysis and Variable Cost

Variable costs are very crucial when it comes to a company’s break-even analysis. Break-even analysis is used to determine the amount of revenue or the required units that must be sold in order to cover total costs. The break-even formula includes both fixed costs and variable costs and sales per unit:

Break-even Point in Units = Fixed Costs / (Sales Price per Unit – Variable Cost per Unit)

Consider the following example:

If a company is trying to determine the minimum units of goods that they need to sell in order to reach break-even every month. Assume that company sells only a single item: Pens. The fixed costs of running the company are Rs.15,000 and the variable costs of producing a single unit of pens are Rs.5 in raw materials and Rs.10 indirect labour. The company sells each pen at Rs.30 as a sales price. To determine the break-even point in units:

Break-even Point in Units = Rs.15,000 / (Rs.30 – Rs.15) = 1000

Therefore, for the company to break even, they would need to sell at least 1000 pens a month.

‘‘

If the variable costs increase at a rate that is more than the profits generated from new units produced, then expanding the business may not be the best decision to go about.

The formula for Variable Costs

The formula for calculating Total Variable Cost is extremely simple and is as follows:

Total Variable Cost = Total Quantity of Output x Variable Cost Per Unit of Output

As an entrepreneur, you must have a rough estimate of the total quantity of the output you are willing to produce and also the sale price of each unit of your product. By multiplying these two values, you can figure out the rough estimate of Variable costs you will need when you set out with your venture.

Fixed Costs become Variable over time

Fixed costs are not fixed permanently. They morphose into variable costs over time. They are fixed over months or years due to contractual obligations but after the contract is over, they can be varied. A company may have unpredictable expenses independent of production. For instance, land prices increase or decrease after a period of time, machines depreciate, technology evolves, etc and lead to changes in fixed costs. But there are no fixed costs in the long run. This is because all the short-run fixed inputs become variable in the long run.

Difference between Fixed Cost and Variable Cost

It is necessary to know how costs divide between variable and fixed costs. This helps in forecasting the earnings generated by various changes in unit sales and thus reflects the financial impact of marketing campaigns. By definition, costs that vary or change depending on the company’s production volume are variable while costs that do not change concerning production volume are fixed. In recent years, fixed costs gradually exceed variable costs for many companies. This is because automatic production increases the cost of equipment, including the depreciation and maintenance and also it becomes cumbersome to adjust human resources according to the actual work needs in the short term thus making labour a part of fixed costs.

When the level of production increases, total variable costs increase and when the production level decreases, total variable costs decrease. On the other hand, total fixed cost remains constant irrespective of the change in the level of production.

Example for Fixed vs. Variable Costs incurred by a builder

Depreciation of machine: Variable cost

Cost of shipping cement and other materials to construction sites: Variable cost

Cement used in manufacturing bread: Variable cost

Labour and construction engineer’s salary: Variable cost

Electricity used in manufacturing: Variable cost

Packing supplies for shipping products: Variable cost

Advertising costs: Fixed cost

Insurance: Fixed Cost

Variable Costs and Business Planning

Based on the market and product, many things are covered under fixed costs and variable costs distinctively. In business planning and management accounting, fixed costs, variable costs are different as compared to their usage in economics. In accounting, fixed costs broadly include almost all expenses that are not included in the cost of goods sold, and variable costs are those captured in costs of goods sold.

The distinction between fixed costs and variable costs is important when it comes to predicting the revenue earned via the changes in unit sales and thus important when it comes to calculating the financial impact of proposed marketing campaigns.

The level of variable cost is influenced by many factors, such as fixed cost, time period of project, uncertainties in production and discount rate. An analytical formula of variable cost as a function of these factors can be used to assess how different factors impact variable cost and total return in an investment.

Variable Costs and Growth Prospects

If there is a hike in production of a company in order to meet demand, their variable costs will increase. If the variable costs increase at a rate that is more than the profits generated from new units produced, then expanding the business may not be the best decision to go about. The company must pause and try to understand the reason why it is unable to achieve economies of scale according to which variable costs as a percentage of overall cost per unit decrease as the scale of production increases.