We keep coming across articles that talk about reduction or surge in a country’s trade deficit and how it impacts us across the globe. But what is Trade Deficit? How does our country’s deficit impact us? How does the United States trade deficit affect us

First, let’s begin by understanding what is a Balance of Trades. Balance of trade (BOT) is defined as the difference between the value of a country’s exports and the value of its imports for a given period. It is simply the total value of exports minus the total value of imports. BOT is used to measure a country’s relative economic strength. Countries that import more than what they export in terms of value have a Trade Deficit while on the other hand, countries that export more than what they import have a trade surplus. Usually, countries with trade deficits borrow money to pay for their goods and services while those with surpluses lend money to countries with deficits. As trade balances give an indirect measure of foreign investment in a country, it also reflects the country’s economic stability.

When Does a Trade Deficit Occur?

Trade deficits usually occur when a state does not produce everything and borrows from foreign states to pay for its imports. It can also occur if domestic companies produce goods overseas as the raw material used for production acts as exports and finished goods end up being imports. These imports are excluded while calculating an economy’s GDP even if the company is domestic.

Countries that experience a deficit are those that lack efficiency and capacity to produce their products due to lack of skill or resources or because they wish to practice specialization of goods. Trade balances indicate the exposure of the economy to the rest of the world.

To calculate the balance of trade, take an example of the United States. Suppose their total import value is $200 billion in goods and services during a given period and their export value is $160 billion. Then their trade balance during that period is – $40 billion or they have a trade deficit of $40 billion.

‘‘

Countries that experience a deficit are those that lack efficiency and capacity to produce their products due to lack of skill or resources or because they wish to practice specialization of goods.

What Does a Trade Deficit Signify?

Usually, economists subtract debit items (imports, foreign aid, domestic spending and investments abroad) from credit items (export, foreign spending and investments in the domestic country) to calculate trade deficit or surplus for a given period. According to the Reserve Bank of India, Indian Trade Balance recorded a deficit of 15.4 USD bn in Dec 2020 and a deficit of 9.9 USD bn in Nov 2020. The average deficit value is – 377.7 USD mn for India with an all-time high of 652.0 USD mn in Jun 2020 and an all-time low of – 20.2 USD bn in Oct 2012.

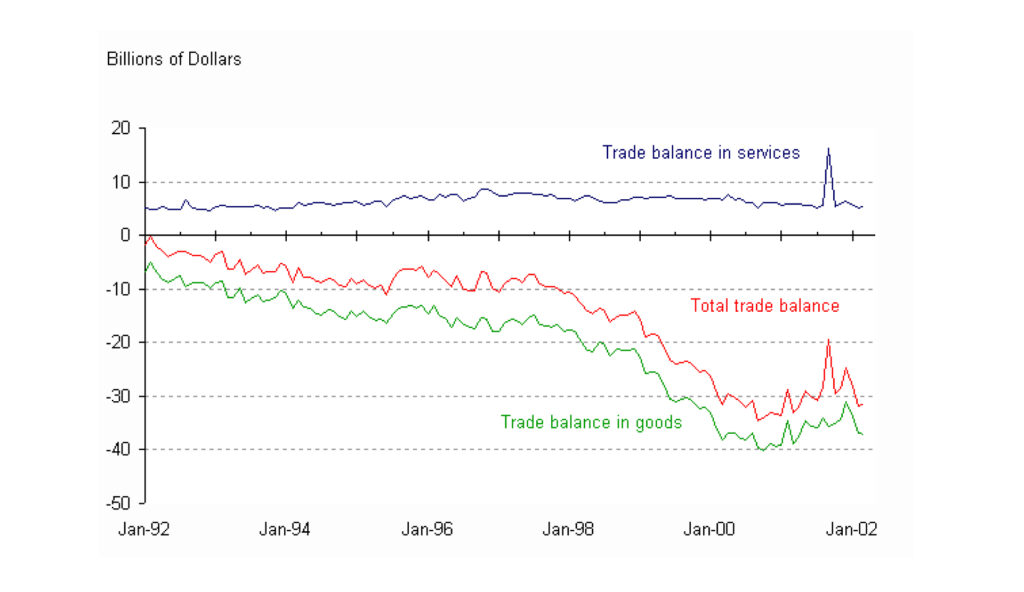

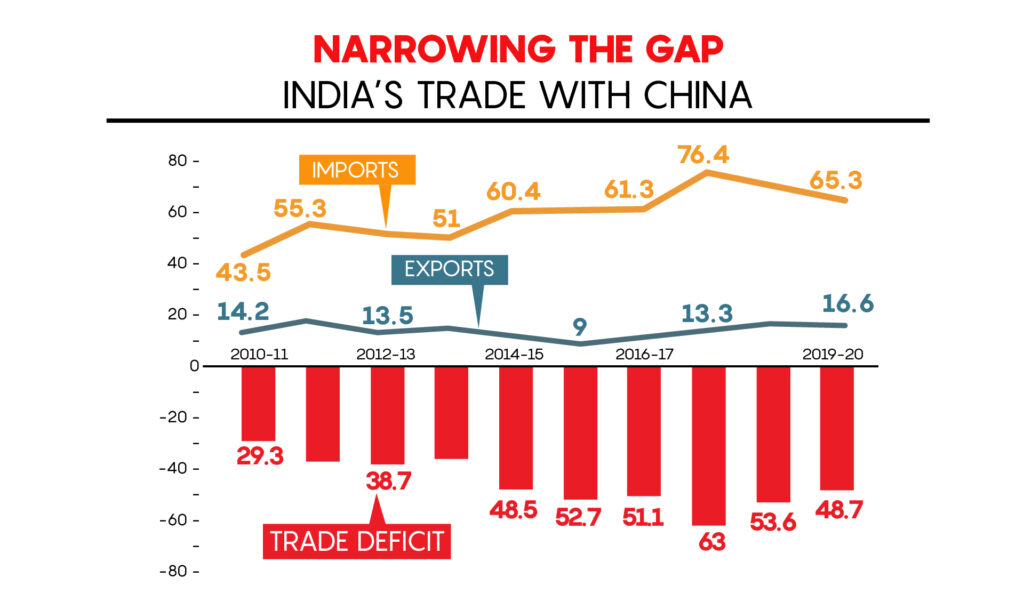

Around the world, the scenario is different for different countries. For instance, the United States has had a persistent trade deficit since the 1970s. While China’s trade surplus has spiked despite the pandemic reducing global trade. In 2019, Germany had the largest trade surplus followed by Japan and China. The United States had the largest trade deficit with the United Kingdom and Brazil right behind.

Trade Deficit and Economic Stability

A trade deficit is not necessarily a practical indicator of any economy’s stability. It should be observed relative to the business cycle and other indicators. During recessions, countries try to increase exports to induce jobs and demand while during booms, they import more to encourage price competition to control inflation.

Deficits can initially raise an economy’s standard of living as residents have access to a larger range of goods and services at more competitive prices. With lower prices, it keeps inflation in control. However, at later stages, it can lead to the outsourcing of jobs to foreign countries creating fewer jobs at home due to an increase in imports. At the same time, foreign companies increase hires to keep up with increased export demand. A trade deficit often makes domestic currency cheaper in a floating exchange rate system. This makes imports more expensive, pushing consumers to reduce consumption of imports while shifting to less expensive domestic goods. This increases the competition of exports in global markets and reduces the deficit by itself. However, deficits are also problematic in the long run. If a country persistently runs deficits, citizens of other countries acquire funds to buy capital in that nation.

Trade Deficit and Inflation

International trade is measured in U.S. dollars (United States of America). When a country runs a deficit, the demand for dollars to pay for imports is more than the supply of dollars for exports. This leads to a rise in the value of the dollar against domestic currency. This reduction in value pushes importers to increase the market price of products they produce as the cost of imported material increases. Due to the increase in the price of goods, workers demand an increase in wages and so on. The domino effect creates cascading triggers in all markets which leads to inflation in the economy.

Clearing a Trade Deficit

As we have already seen the disadvantages of a deficit, countries always try to reduce the deficit. One way to do so is by using deflationary policies like raising direct taxes or increasing monetary policy interest rates. Deflationary policies via a rise in taxes slow down consumption growth by reducing disposable income. This reduces demand for imports and also helps to lower inflation which then improves the price competitiveness of export industries. However, such policies contract planned capital investment which damages productivity and has the potential to worsen the trade deficit.

Another way to go about it is for the central bank to change monetary policy. It can also intervene in the currency markets to depreciate the exchange rate against major trade partners to make exports more competitive in foreign currencies.

A country can also use supply-side policies to increase productivity and make exports more competitive at the same time reducing dependency on imports. Supply-side policies theoretically have the best prospect of achieving a sustainable reduction of the deficit.

Trade Deficit and Exchange Rate

When imports exceed exports, a country’s currency demand in terms of international trade is lower. This makes the currency less valuable in international markets during deficits. Trade balances affect currency fluctuations in most cases. However, countries can try to make trade balances less influential by managing a portfolio of investments in foreign accounts. This controls the volatility and movement of the currency. Economies can also agree on a pegged currency rate to keep the exchange rate of their currency constant at a fixed rate.

As currency depreciates, exports from the country become more attractive as they become less expensive. The domestic country might start buying fewer dollars as imports become more expensive and foreigners buy more domestic goods as they are now cheaper. This gradually affects the balance of trade. The domestic country would then start exporting more and importing less, reducing the trade deficit.

Trade deficits become more dangerous with fixed exchange rates. As devaluation of the currency is impossible, trade deficits continue increasing unemployment significantly. A partial reason behind the European debt crisis was that some EU members were running persistent trade deficits with Germany. Exchange rates could no longer be adjusted between countries in the Euro zone leading to serious trade deficit problems.

Trade Deficit, Interest Rates and Investments

Higher interest rates potentially lead to a reduction in net exports. And negative net exports lead to a trade deficit. A higher interest rate means foreign investors induce more money into our domestic economy as it results in higher returns. They exchange their foreign currency for our domestic currency increasing demand for domestic currency. This raises the domestic currency’s value against foreign currency. This makes it cheaper for us to buy foreign goods and more expensive for foreigners to buy our goods. This means our imports go up and exports go down reducing net exports.

Deficits also occur if a country is a desirable destination for foreign investment. The U.S. dollar’s image as the world’s reserve currency induces a strong demand for U.S. dollars for which foreigners sell goods to Americans to obtain dollars. Several nations run cumulative trade surpluses with the U.S.

Conclusion:

Trade deficits are not that uncommon and many times not so dangerous. However, large trade deficits should always be avoided as they can lead to foreign dependency in terms of lending and borrowing. The final question remains whether a deficit is a blessing or a curse. Deficits can raise an economy’s standard of living with a larger range of goods and services at more competitive prices while keeping inflation in control. But it can also lead to outsourcing of jobs to foreign countries creating fewer jobs at home due increased imports. Trade deficits can thus be both a blessing and a curse, it depends on the business cycle, the country’s economic landscape and global markets