It is essential to know that you, as an investor, cannot directly buy, sell or trade shares in the stock market. You have to have an account opened via brokers to engage in a stock market transaction, whether online or traditional.

When you initiate a sell or buy order on shares, your brokerage firm transfers the order to the stock exchange. The stock exchange then uses the Automatic Order Matching System to execute different orders.

But when you buy shares, they do not come to your Demat account immediately. Similarly, when you sell shares, the money earned from them does not immediately come into your trading account.

Let’s delve deeper to understand what happens in a stock market transaction and how the securities reach your account.

Clearing corporations

A clearing corporation is an organisation associated with an exchange to handle transactions’ confirmation, settlement, and delivery. Clearing corporations fulfil the primary obligation to ensure that transactions are made promptly and efficiently.

Examples of clearing corporations include India International Clearing Corporation (IFSC) Limited, Metropolitan Clearing Corporation of India Ltd., Indian Clearing Corporation Limited. Clearing corporations do not communicate with buyers and sellers on a stock market; they communicate with clearing members.

Clearing member

A Clearing member refers to a member of the clearing corporation. The clearing member clears and settles deals for a segment and is subject to predetermined terms, conditions and procedures.

All stock exchange firms are stock exchange members and are called trading members (trading corporations). Each trading corporation has to become a member of a clearing corporation compulsorily. As mentioned above, members of the clearing corporations are clearing members.

Journey of your stock investment: Transaction date and Settlement date

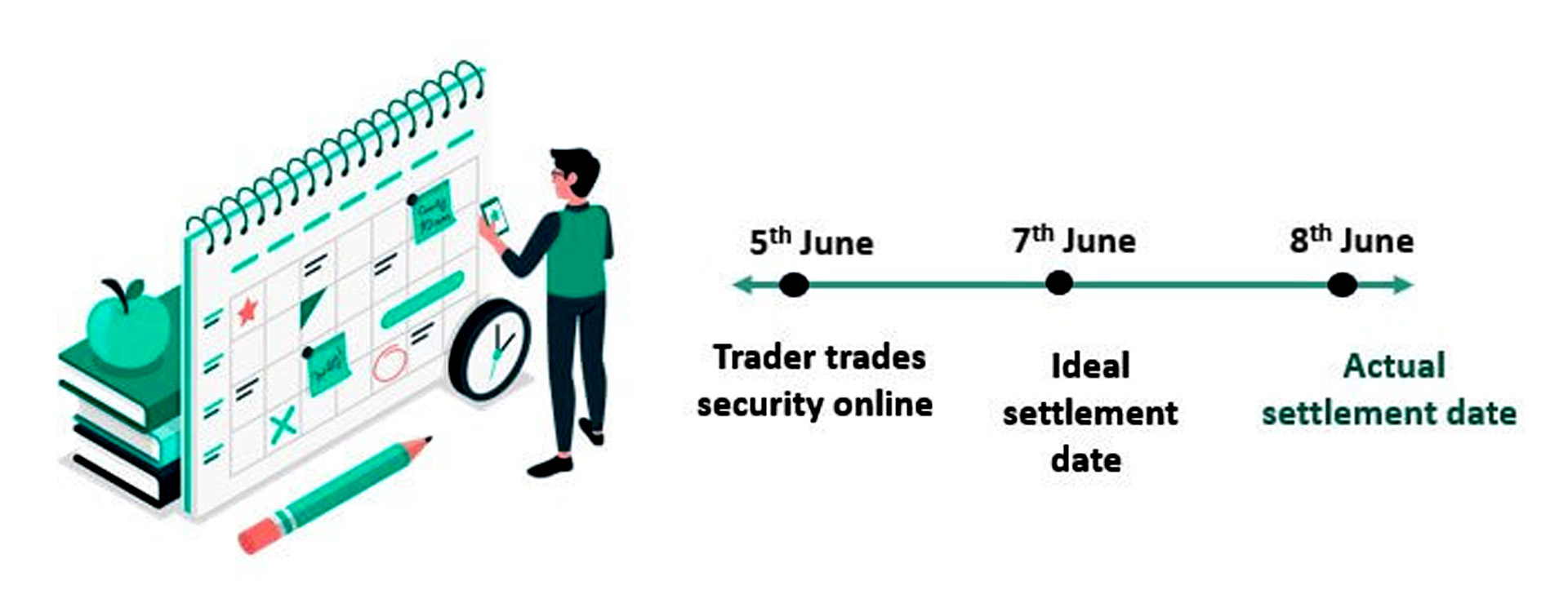

Whenever you buy a stock, bond or mutual fund, there are two critical dates in the process: a transaction date and a settlement date.

‘‘

As its name shows, the transaction date represents the date on which the transaction occurs.

For example, if you acquire 500 shares of a company’s stocks today, then today is the transaction date. However, the settlement date is a bit trickier to understand. Settlement date represents the time at which the ownership is transferred. The transfer of ownership does not always occur on the transaction date. It varies upon the type of securities you are trading in.

For example, treasury bills and bonds issued by the central government and the RBI are the only securities that can be transacted and settled on the same day.

What is the reason behind the delay in the actual settlement?

In the past, investors did security transactions manually rather than electronically. They had to wait for days to deliver the particular security they had invested in, which was in actual certificate form and would not pay until the reception.

Since delivery time could vary and the price could fluctuate, market regulators set a period in which parties must deliver securities and cash. Today, the settlement period is set at T+3, i.e. settlement must occur within three business days of the transaction.

Transaction date: What do T+1, T+2, T+3 mean?

If you buy or sell a security with a T+3 settlement on, say, Monday, assuming that there are no holidays during the week, the settlement date will be Thursday (not Wednesday). The “T”, or transaction date, is counted as a separate day.

The settlement date is the set ‘last’ date when the buyer must finish the cash transfer process to the seller of any financial entity (and vice versa). During the settlement period, the seller has the securities or assets of the buyer. On the settlement date, the seller releases the securities or investments to the buyer.

Generally, for bonds and stocks, the settlement date is two working days from the date of execution (T+2). It is (T+1) in the case of government securities and options. In the case of spotting foreign exchange, the settlement date is two business days after the transaction date.

Differences in settlement date

In life insurance policies, the date on which the policy gains are settled is the settlement date. The financial market determines the number of business days after completing a transaction for which the asset or securities must be delivered and paid for. The difference between the settlement date and transaction results from the time needed for the seller to provide.

As the delivery time differs and prices are susceptible to several factors, they may fluctuate. For this reason, the regulatory authorities have stipulated a guarantee period within which the interested parties must pay guaranteed money. Today’s trades are, thus, completed in less time using the latest technology.