The low-income workforce in India is a very self-reliant, hard-working lot who face rejection when availing credit and applying for loans. Banks have categorised them with low creditworthiness when the fact is that most of them are highly credit worthy with real financial needs. GalaxyCard is a fintech start-up that’s catering to this segment.

What is GalaxyCard?

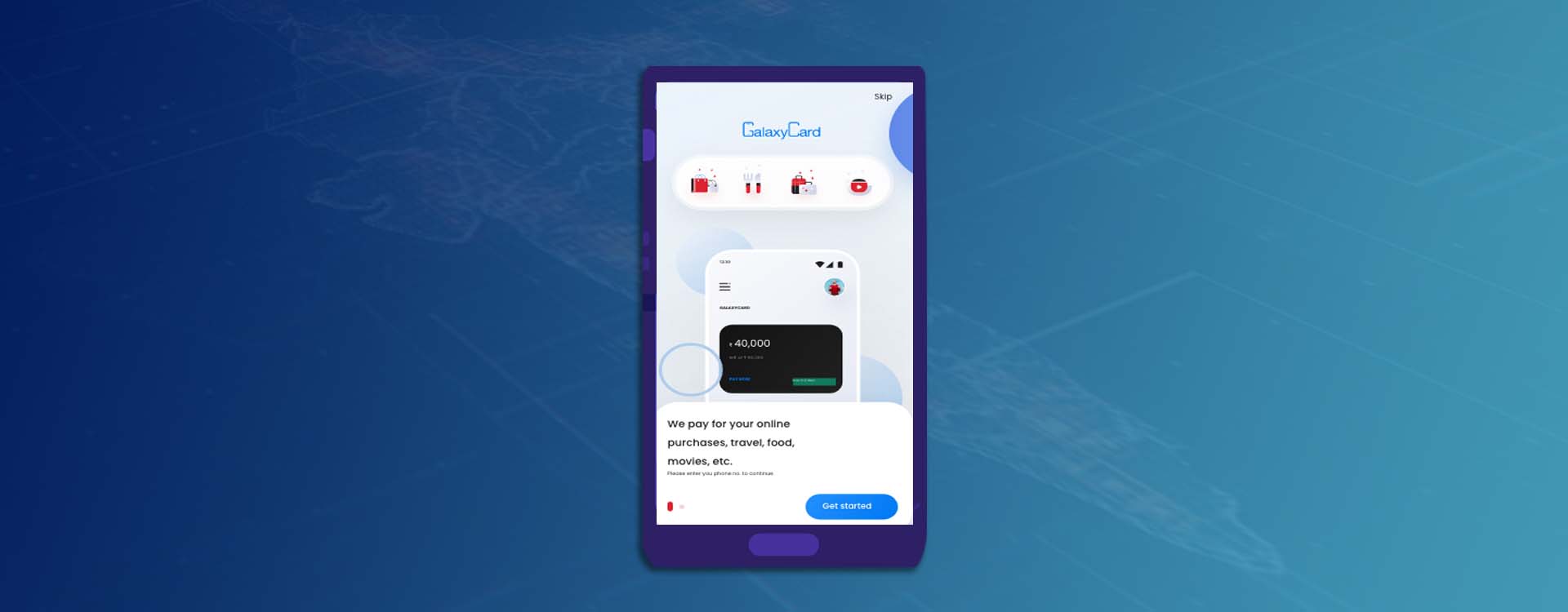

GalaxyCard is one of the top Fintech companies in India that is offering instantly approved credit cards in India. Their eponymous product, the GalaxyCard is a digital credit card with easy accessibility for consumers. Based in Gurugram, the start-up was founded in 2018 and stands out in the fintech space owing to their full-digitised mobile-based credit card.

Everything you need to know about the GalaxyCard

Features

The Galaxy Card can be instantly made available to consumers in a record time of under 3 minutes. This app-based card can be used to make online purchases, payments for utility bills, phone recharges, and can even be swiped at roadside stalls.

How to avail the card

To avail the card, consumers need to only download the GalaxyCard app, and make a free online registration for processing. The application process is purely digital requiring three basic documentation, the PAN Card, Aadhar Card, and Bank Statements.

Benefits for consumers

Consumers can enjoy zero annual, joining, and interest charges. The GalaxyCard targets consumers with income below INR 30,000 per month and is aimed at enabling access for credit to them. Unlike the traditional lending process, customers will find that there is no elaborative paperwork or long processing durations involved while availing the GalaxyCard.

The Fintech’s expansion plans – 600 towns and counting

The fintech start-up has acquired a massive consumer base comprising 600 towns in India. They are harbouring ambitious expansion plans to cater to a wider audience, and they will be adding more types of cards to suit different customer categories and financial needs to achieve this. The company will soon be scaling up their business and expanding their team. GalaxyCard aims to become the largest provider of digital cards in India.

Customer acquisition strategy – How they covered more than 600 towns

Since its inception, GalaxyCard has managed to cover close to 700 towns in India and their acquisition strategy is growing their customer base by 50% every month. They also have plans to increase this number by 5X within the next 4 months. GalaxyCard has adopted an aggressive customer acquisition strategy right from the start to establish itself as a key player in the market.

‘‘

Based in Gurugram, GalaxyCard was founded in 2018 and stands out in the fintech space owing to its fully digital mobile based credit card.

What’s in it for me?

In the fintech sector, the blue-collar worker segment is one of the most underserved but has a very massive potential. The potential of this segment is over 200 Mn people. Indians with lower income are still largely neglected by financial institutions. Fintech start-ups have a golden opportunity waiting to be explored here. Low-income workers who often face rejection by banks while availing credit can be targeted by fintech start-ups in the credit card space.

Target Tier II cities since the market gap here is huge and the opportunity awaiting fintech startups is robust. Other lucrative markets to explore include students seeking financial products and credit for their educational expenses. By solving core problems of customers in these segments, you can scale up faster. The blue-collar worker segment consists of drivers, security guards, small shop owners, semi-skilled labourers, daily wage earners, gig-economy workers, and the youth who are creditworthy. By building a scalable fintech model for these consumers, you can expect smooth growth in business and low friction with the customers.