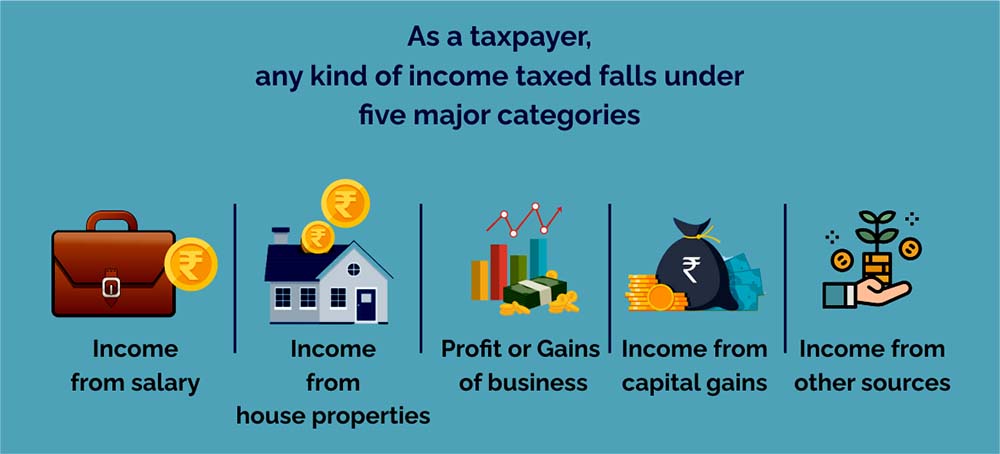

Before jumping on to what a speculative business means, let’s try and understand our income tax provision. If you’re a serviceman/servicewoman or a businessman/businesswoman doing that 9 to 5 or putting your all to grow that business and earning your bread and butter through that organisation then the income that you earn has a liability of undergoing the cycle of taxing which is processed by the government. As a taxpayer, any kind of income taxed falls under five major categories.

5 Heads of Income

- Income from Salary– The salary that you earn at the end of every month is taxed at a certain tax bracket depending on the level of income you earn.

- Income from house properties– If you have a single or few houses in your name then be ready to not only shell out the monthly EMI or instalment but also a certain level of money for the tax slab. After all, you’re going to reap the benefits of the house as an asset and every asset holds a major value in the eyes of the government.

- Profits or gains of business– There’s an unprecedented amount of income that you earn from running a business and with certain guidelines from the government of the country you operate that business in, your business income is liable to be taxed at the end of every financial year

- Income from capital gains– This defines the tax that is operated on all the income that you earn from the investment you have done at various places including mutual funds, share markets or even bitcoins.

- Income from other sources– Finally there might be an income that you might be earning from running an Instagram page and getting good deals or consulting a business apart from your daily job. As with any other income, this side hustle of yours also falls under the bracket of getting taxed.

‘‘

India’s income tax provision does not define what speculative business is but rather it defines what a speculative transaction is.

Now when we are through with the five different kinds of tax categories, it’s time to recall tax filing of which of the categories has been the easiest and which has accounted for a major brain as well as paperwork. When it comes to the classification of income from your business or profession, it is much easier for you to get the required paperwork for this category as compared to defining the income from capital gains.

Some say that the income earned on the capital gains must rely on the amount of investment and frequency of transactions or gains per transaction. And if the transactions fall under the category of business, then it’s further categorised into 2 different classifications of being speculative and non-speculative.

Understanding a speculative transaction

India’s income tax provision does not define what speculative business is but rather it defines what a speculative transaction is. According to Section 43(5) of the Income-tax Act, the term speculative transaction implies a transaction in which the contract which includes the purchase or sale of any commodity like stocks and shares is settled periodically or eventually settled otherwise than the actual delivery or transfer of the commodities or scripts.

Simplifying the above words, let’s take an example of Intra-day trading. Intra-day trading refers to the trading of shares within the same day. So, considering this example, there is no delivery as the shares enter and exit from a given trading account on the same date without getting a chance to enter the DEMAT account.

As the delivery does not take place, the above transaction falls under the category of speculative transactions. To further simplify you could call a speculative income or transaction the one where the outcome does not depend on your hard work or skills or your experience and the practice that you have. It rather completely depends on your luck or chance factors.

Intra-day trading might be a sophisticated way to term the speculative transaction, but to further understand you could also deem the speculative transaction as the one which gives you an income from gambling or casinos or sometimes even a coin toss for that matter.

Just like any business, there are always exceptions to playing this game. So, for your ease, to deem any transaction as speculative, you need to have a clear understanding of what is and what is not included while considering a transaction speculative.

‘‘

The task of calculating a speculative income and understanding the whereabouts of the business is no doubt risky and complex to fathom.

What cannot be termed as speculative business?

Hedging contract concerning raw materials or merchandise

If you’re a businessman/ businesswoman in possession of raw materials for manufacturing and merchandise to be sold, it is highly likely that with time, the value of the raw materials will fluctuate. So, to save the price fluctuation between the period at which you bought your raw materials and sold them, you get into a contract. This particular contract is for saving your goods and not a speculative transaction.

Hedging contract in the aspect of stocks and shares

In a similar fashion to the above example, there are a lot of price speculations which are expected when you hold a certain number of stocks and shares and to seal the loss incurred because of that with your dealer or investor you get in a contract. Reiterating the same, that this contract is not a part of the speculative transaction.

Forward Contract

Forward contract here refers to a situation in which a member enters into a forward market or stock exchange in the course of any transaction like jobbing (all transactions are squared off during the same day) or arbitrage (purchase of commodity or security in one market for immediate sale in another market) to guard against loss which may arise in the ordinary course of his/her business as such member. To ease the definition of a forward market, this typical market refers to an over-the-counter marketplace that sets the price of a financial instrument or asset for future delivery. This again is not deemed as a speculative transaction.

Trading in derivatives

As the name suggests, when your transaction is carried out electronically by the recognized brokers as defined per relevant statutes, the given transaction is supported by a time stamped contract note. This note indicates a unique client identity number and PAN (Permanent Account Number). The given transaction in respect of trading in derivatives are referred to in Securities Contracts (Regulation) Act, 1956 and carried out in recognized stock exchanges and not deemed as a speculative transaction.

Trading in commodity derivatives

Finally, a type of transaction that follows the same rules like the one given above and is very much eligible is carried out in respect of trading commodity derivatives in a recognized association. This association is chargeable to commodities transaction tax mentioned under Chapter VII of the Finance Act, 2013.

What happens when a speculative transaction takes place?

Taking a scenario where a taxpayer is involved with a lot of businesses along with a speculative one, the speculative business of this taxpayer will be deemed as a separate entity from any other business carried out by the taxpayer.

This helps in calculating the loss incurred by the speculative business or transaction. Section 73 of the Income Tax Act states that the losses from speculation business can only be set off against the profits of the speculative business which is quite unlike the loss from any other business which can be set off against the profits of other businesses.

Noting further points, the losses from a speculative business can be carried forward to a subsequent year, can only be set-off against the profit and gains of any speculative business in the respective subsequent year. For this given condition, it becomes imperative for any taxpayer to distinguish between the gains or losses from a speculative business to that of other businesses.

Another important thing to note is that the loss from the speculative business cannot be carried forward for a period greater than four assessment years beyond the year in which the loss was incurred. Also, if there is any expenditure and depreciation involved in the process of scientific research, if the depreciation or capital expenditure is carried forward in the speculative business then it is required to be set off first.

Can a single transaction constitute speculative business?

Well according to explanation 2 of section 28, a single transaction is insufficient unless there is a systematic or organised course of activity or conduct on the part of the assessee, it is clear that a single transaction is not possible. A single transaction done instead of actual delivery is not sufficient to stand by the explanation 2 of section 28 of the Income Tax Act, 1961 and there should be a plural set of speculative transactions. So, given the rules again, a single transaction cannot be deemed as a speculative transaction.

The takeaways

- If you have to calculate the turnover for a speculative transaction or business the simply add both the positives and the negative differences to get the final turnover

- As the income earned from a speculation gain is majorly through intra-day trading, Income from your speculation gains is taxed at the given normal rates.

- Speculative transaction or business no doubt involves very high risk, but if the luck is in your favour, it also gives an equal amount of great returns. All in all, the motive should be to gain the maximum advantage of the fluctuations that happen in the market.

- Always take care of what is and what is not included in a speculative transaction or business. Examples like hedging contracts or trading derivatives could be tricky as sometimes they confuse you as a speculative transaction, but keeping a note of these points and further educating yourself about the same helps in the long run.

The task of calculating a speculative income and understanding the whereabouts of the business is no doubt risky and complex to fathom. The taxpayer involved with all these transactions has to take care of several things and rules and regulations to distinguish their income from a normal to a speculative one. Ultimately it depends that no matter what the business, the time and money invested in is bringing you a good return and profit given all the legalities.

There will be many times where mistakes will be made and given rules and regulations will be misunderstood or misinterpreted depending on the type of business and gains involved. To avoid this, one thing has to be kept in mind, that any taxpayer should always be well versed with the clauses and continuously educate themselves with the given rules or consult someone who deals with these transactions daily to not fix themselves in unwanted tax transactions.